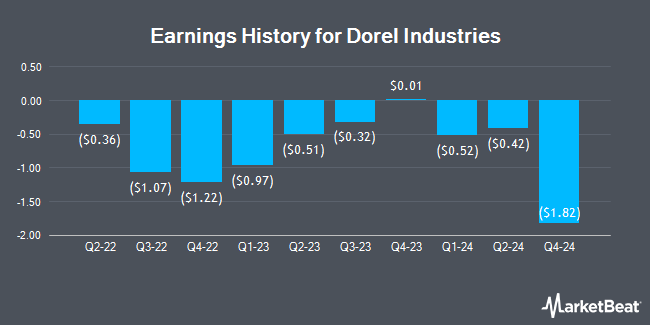

Dorel Industries (OTCMKTS:DIIBF - Get Free Report) is projected to post its quarterly earnings results before the market opens on Monday, March 10th. Analysts expect Dorel Industries to post earnings of ($0.24) per share and revenue of $352.00 million for the quarter.

Dorel Industries Price Performance

Dorel Industries stock traded up $0.04 during midday trading on Thursday, reaching $2.69. 1,624 shares of the company were exchanged, compared to its average volume of 6,721. The firm's 50-day simple moving average is $3.15 and its 200-day simple moving average is $3.61. Dorel Industries has a 1 year low of $2.36 and a 1 year high of $5.53. The company has a market capitalization of $87.66 million, a price-to-earnings ratio of -0.85 and a beta of 2.68. The company has a debt-to-equity ratio of 0.28, a quick ratio of 0.46 and a current ratio of 0.94.

Wall Street Analyst Weigh In

DIIBF has been the subject of a number of recent research reports. TD Securities downgraded shares of Dorel Industries from a "strong-buy" rating to a "hold" rating in a report on Monday, November 18th. BMO Capital Markets upgraded Dorel Industries to a "hold" rating in a report on Monday, November 18th.

View Our Latest Stock Analysis on DIIBF

Dorel Industries Company Profile

(

Get Free Report)

Dorel Industries Inc engages in the design, manufacture, sourcing, marketing, and distribution of home and juvenile products worldwide. The company operates through Dorel Home and Dorel Juvenile segments. The Dorel Home segment offers ready-to assemble furniture and home furnishings products, including metal folding furniture, futons, children's furniture, step stools, hand trucks, ladders, outdoor furniture, and other imported furniture items.

Featured Articles

Before you consider Dorel Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dorel Industries wasn't on the list.

While Dorel Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.