Dorsey Wright & Associates purchased a new position in shares of Leidos Holdings, Inc. (NYSE:LDOS - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund purchased 26,827 shares of the aerospace company's stock, valued at approximately $4,373,000.

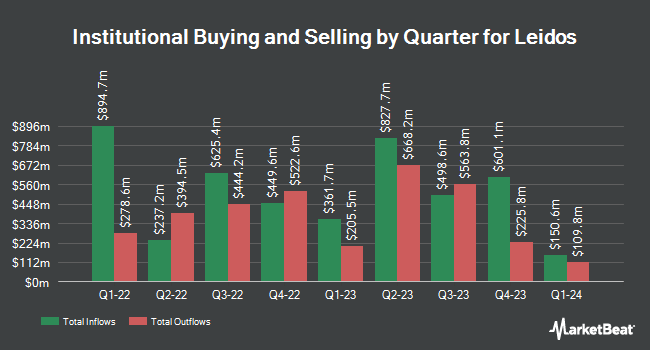

Other hedge funds have also recently added to or reduced their stakes in the company. CWM LLC increased its holdings in shares of Leidos by 8.4% in the second quarter. CWM LLC now owns 2,311 shares of the aerospace company's stock worth $337,000 after buying an additional 180 shares during the period. OLD National Bancorp IN increased its holdings in shares of Leidos by 30.5% in the second quarter. OLD National Bancorp IN now owns 2,688 shares of the aerospace company's stock worth $392,000 after buying an additional 628 shares during the period. SG Americas Securities LLC increased its holdings in shares of Leidos by 69.1% in the second quarter. SG Americas Securities LLC now owns 16,780 shares of the aerospace company's stock worth $2,448,000 after buying an additional 6,858 shares during the period. Czech National Bank increased its holdings in Leidos by 6.5% during the 2nd quarter. Czech National Bank now owns 25,766 shares of the aerospace company's stock valued at $3,759,000 after purchasing an additional 1,572 shares during the period. Finally, Artemis Investment Management LLP purchased a new position in Leidos during the 2nd quarter valued at about $6,075,000. Institutional investors own 76.12% of the company's stock.

Insider Buying and Selling at Leidos

In related news, Director Noel B. Geer acquired 2,000 shares of Leidos stock in a transaction dated Wednesday, November 20th. The stock was purchased at an average cost of $161.13 per share, for a total transaction of $322,260.00. Following the purchase, the director now directly owns 2,000 shares of the company's stock, valued at approximately $322,260. This trade represents a ∞ increase in their position. The purchase was disclosed in a filing with the SEC, which is accessible through this link. Also, Director Robert C. Kovarik, Jr. sold 1,047 shares of the company's stock in a transaction on Thursday, October 31st. The stock was sold at an average price of $184.94, for a total value of $193,632.18. Following the completion of the sale, the director now owns 6,408 shares of the company's stock, valued at $1,185,095.52. This trade represents a 14.04 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 0.96% of the company's stock.

Leidos Stock Down 0.4 %

LDOS stock traded down $0.61 during midday trading on Friday, hitting $163.15. The company's stock had a trading volume of 976,697 shares, compared to its average volume of 1,726,176. The company has a market cap of $21.77 billion, a PE ratio of 18.58, a P/E/G ratio of 1.11 and a beta of 0.64. Leidos Holdings, Inc. has a 12 month low of $105.52 and a 12 month high of $202.90. The company has a current ratio of 1.23, a quick ratio of 1.15 and a debt-to-equity ratio of 0.87. The firm's 50-day moving average is $171.81 and its 200-day moving average is $157.46.

Leidos (NYSE:LDOS - Get Free Report) last released its quarterly earnings data on Tuesday, October 29th. The aerospace company reported $2.93 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.96 by $0.97. The business had revenue of $4.19 billion for the quarter, compared to analysts' expectations of $4.06 billion. Leidos had a return on equity of 30.31% and a net margin of 7.37%. The firm's quarterly revenue was up 6.9% on a year-over-year basis. During the same period in the prior year, the firm posted $2.03 EPS. On average, equities research analysts forecast that Leidos Holdings, Inc. will post 10.04 earnings per share for the current fiscal year.

Leidos Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Monday, December 16th will be paid a dividend of $0.40 per share. The ex-dividend date of this dividend is Monday, December 16th. This is a positive change from Leidos's previous quarterly dividend of $0.38. This represents a $1.60 dividend on an annualized basis and a yield of 0.98%. Leidos's payout ratio is currently 18.22%.

Analyst Upgrades and Downgrades

A number of research analysts recently issued reports on LDOS shares. Citigroup boosted their price target on Leidos from $194.00 to $220.00 and gave the company a "buy" rating in a report on Wednesday, October 30th. TD Cowen boosted their price target on Leidos from $175.00 to $200.00 and gave the company a "buy" rating in a report on Wednesday, October 30th. Truist Financial reduced their price target on Leidos from $205.00 to $185.00 and set a "buy" rating on the stock in a report on Friday, November 22nd. Robert W. Baird boosted their price target on Leidos from $180.00 to $218.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. Finally, The Goldman Sachs Group lifted their price objective on Leidos from $205.00 to $228.00 and gave the company a "buy" rating in a research report on Wednesday, October 30th. Three research analysts have rated the stock with a hold rating, eleven have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $187.36.

Check Out Our Latest Research Report on Leidos

Leidos Profile

(

Free Report)

Leidos Holdings, Inc, together with its subsidiaries, provides services and solutions in the defense, intelligence, civil, and health markets in the United States and internationally. The company operates through Defense Solutions, Civil, and Health segments. The Defense Solutions segment offers national security solutions and systems for air, land, sea, space, and cyberspace for the U.S.

Featured Articles

Before you consider Leidos, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Leidos wasn't on the list.

While Leidos currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.