Dorsey Wright & Associates bought a new stake in Coca-Cola Consolidated, Inc. (NASDAQ:COKE - Free Report) in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm bought 1,115 shares of the company's stock, valued at approximately $1,468,000.

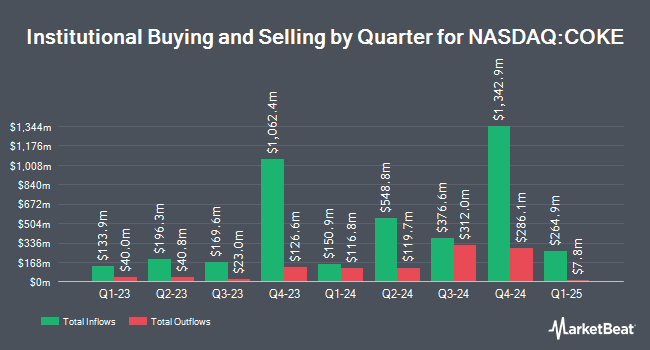

A number of other large investors have also modified their holdings of the stock. XTX Topco Ltd acquired a new stake in Coca-Cola Consolidated during the 3rd quarter valued at approximately $544,000. National Bank of Canada FI grew its stake in Coca-Cola Consolidated by 351.9% during the 3rd quarter. National Bank of Canada FI now owns 2,300 shares of the company's stock valued at $3,028,000 after purchasing an additional 1,791 shares in the last quarter. EP Wealth Advisors LLC acquired a new stake in Coca-Cola Consolidated during the 3rd quarter valued at approximately $806,000. Wellington Management Group LLP acquired a new stake in Coca-Cola Consolidated during the 3rd quarter valued at approximately $3,259,000. Finally, State Street Corp grew its stake in Coca-Cola Consolidated by 18.4% during the 3rd quarter. State Street Corp now owns 172,409 shares of the company's stock valued at $226,959,000 after purchasing an additional 26,752 shares in the last quarter. Institutional investors and hedge funds own 48.24% of the company's stock.

Coca-Cola Consolidated Stock Performance

NASDAQ:COKE traded down $26.84 during trading hours on Friday, reaching $1,290.72. 32,546 shares of the stock were exchanged, compared to its average volume of 33,043. The company has a quick ratio of 2.15, a current ratio of 2.47 and a debt-to-equity ratio of 1.39. The firm has a 50 day simple moving average of $1,257.54 and a 200-day simple moving average of $1,195.31. Coca-Cola Consolidated, Inc. has a 52 week low of $789.81 and a 52 week high of $1,376.84. The stock has a market capitalization of $11.31 billion, a P/E ratio of 22.46 and a beta of 0.88.

Coca-Cola Consolidated (NASDAQ:COKE - Get Free Report) last released its earnings results on Wednesday, October 30th. The company reported $18.81 EPS for the quarter. The company had revenue of $1.77 billion for the quarter. Coca-Cola Consolidated had a return on equity of 46.94% and a net margin of 7.81%.

About Coca-Cola Consolidated

(

Free Report)

Coca-Cola Consolidated, Inc, together with its subsidiaries, manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States. The company offers sparkling beverages; and still beverages, including energy products, as well as noncarbonated beverages comprising bottled water, ready to drink coffee and tea, enhanced water, juices, and sports drinks.

Read More

Before you consider Coca-Cola Consolidated, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola Consolidated wasn't on the list.

While Coca-Cola Consolidated currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.