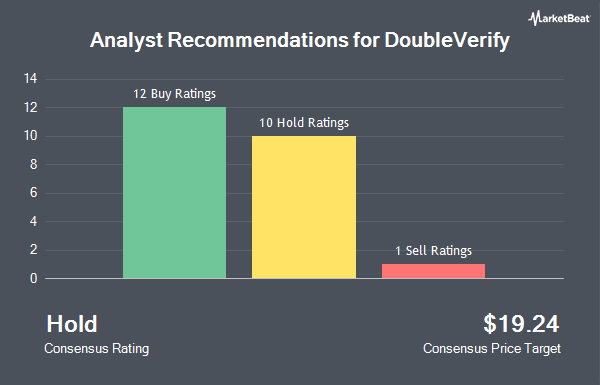

DoubleVerify Holdings, Inc. (NYSE:DV - Get Free Report) has received an average rating of "Moderate Buy" from the nineteen analysts that are currently covering the firm, MarketBeat.com reports. Two equities research analysts have rated the stock with a sell recommendation, five have given a hold recommendation and twelve have assigned a buy recommendation to the company. The average 12 month price objective among brokers that have issued a report on the stock in the last year is $24.47.

A number of research analysts have weighed in on the company. Truist Financial reduced their price target on DoubleVerify from $26.00 to $23.00 and set a "buy" rating on the stock in a research note on Thursday, November 7th. Wells Fargo & Company initiated coverage on DoubleVerify in a research note on Monday, October 28th. They issued an "underweight" rating and a $14.00 price target on the stock. Macquarie reaffirmed an "outperform" rating and set a $19.00 price objective on shares of DoubleVerify in a research note on Thursday, November 7th. Barclays cut their price objective on shares of DoubleVerify from $27.00 to $23.00 and set an "overweight" rating on the stock in a report on Friday, October 11th. Finally, Canaccord Genuity Group lowered their target price on shares of DoubleVerify from $36.00 to $30.00 and set a "buy" rating for the company in a report on Thursday, November 7th.

View Our Latest Analysis on DV

DoubleVerify Stock Up 0.2 %

Shares of NYSE:DV traded up $0.05 during trading on Tuesday, reaching $20.19. The stock had a trading volume of 763,904 shares, compared to its average volume of 2,376,781. DoubleVerify has a fifty-two week low of $16.11 and a fifty-two week high of $43.00. The business has a fifty day moving average price of $17.54 and a 200-day moving average price of $19.29. The stock has a market cap of $3.42 billion, a P/E ratio of 54.43, a PEG ratio of 2.45 and a beta of 0.90.

DoubleVerify declared that its board has approved a stock repurchase program on Wednesday, November 6th that authorizes the company to buyback $200.00 million in outstanding shares. This buyback authorization authorizes the company to purchase up to 6% of its shares through open market purchases. Shares buyback programs are often a sign that the company's board believes its stock is undervalued.

Insiders Place Their Bets

In related news, CFO Nicola T. Allais sold 1,764 shares of the firm's stock in a transaction on Wednesday, October 23rd. The shares were sold at an average price of $16.41, for a total transaction of $28,947.24. Following the completion of the sale, the chief financial officer now directly owns 81,598 shares of the company's stock, valued at approximately $1,339,023.18. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Insiders sold a total of 7,056 shares of company stock worth $119,634 in the last 90 days. 3.00% of the stock is owned by company insiders.

Institutional Trading of DoubleVerify

A number of hedge funds have recently made changes to their positions in DV. Capital Performance Advisors LLP bought a new stake in shares of DoubleVerify in the 3rd quarter valued at approximately $49,000. CWM LLC lifted its holdings in DoubleVerify by 212.5% in the second quarter. CWM LLC now owns 2,794 shares of the company's stock worth $54,000 after acquiring an additional 1,900 shares during the last quarter. Fifth Third Bancorp boosted its stake in DoubleVerify by 72.3% in the second quarter. Fifth Third Bancorp now owns 4,151 shares of the company's stock valued at $81,000 after acquiring an additional 1,742 shares during the period. KBC Group NV grew its holdings in shares of DoubleVerify by 35.8% during the third quarter. KBC Group NV now owns 5,022 shares of the company's stock valued at $85,000 after purchasing an additional 1,325 shares during the last quarter. Finally, Covestor Ltd grew its holdings in shares of DoubleVerify by 22.8% during the third quarter. Covestor Ltd now owns 6,643 shares of the company's stock valued at $112,000 after purchasing an additional 1,235 shares during the last quarter. Institutional investors and hedge funds own 97.29% of the company's stock.

About DoubleVerify

(

Get Free ReportDoubleVerify Holdings, Inc provides a software platform for digital media measurement, and data analytics in the United States and internationally. The company provides solutions to advertisers that enable advertisers to increase the effectiveness and quality and return on their digital advertising investments.

Read More

Before you consider DoubleVerify, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoubleVerify wasn't on the list.

While DoubleVerify currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.