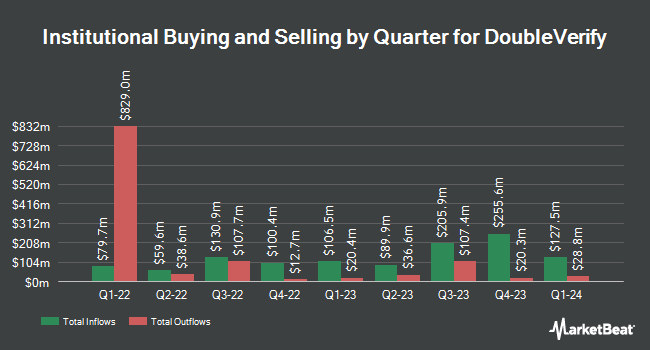

Quantbot Technologies LP raised its holdings in shares of DoubleVerify Holdings, Inc. (NYSE:DV - Free Report) by 32.9% in the third quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 238,870 shares of the company's stock after buying an additional 59,135 shares during the period. Quantbot Technologies LP owned about 0.14% of DoubleVerify worth $4,023,000 as of its most recent SEC filing.

Other large investors have also recently added to or reduced their stakes in the company. CWM LLC boosted its holdings in DoubleVerify by 212.5% during the second quarter. CWM LLC now owns 2,794 shares of the company's stock worth $54,000 after buying an additional 1,900 shares in the last quarter. Capital Performance Advisors LLP bought a new stake in DoubleVerify during the third quarter worth approximately $49,000. Fifth Third Bancorp boosted its stake in DoubleVerify by 72.3% in the 2nd quarter. Fifth Third Bancorp now owns 4,151 shares of the company's stock worth $81,000 after purchasing an additional 1,742 shares during the period. KBC Group NV boosted its stake in DoubleVerify by 35.8% in the 3rd quarter. KBC Group NV now owns 5,022 shares of the company's stock worth $85,000 after purchasing an additional 1,325 shares during the period. Finally, Parkside Financial Bank & Trust boosted its stake in DoubleVerify by 37.6% in the 2nd quarter. Parkside Financial Bank & Trust now owns 6,604 shares of the company's stock worth $129,000 after purchasing an additional 1,806 shares during the period. 97.29% of the stock is currently owned by institutional investors.

DoubleVerify Price Performance

Shares of DV opened at $20.50 on Wednesday. The company has a market capitalization of $3.47 billion, a PE ratio of 55.41, a price-to-earnings-growth ratio of 3.27 and a beta of 0.90. DoubleVerify Holdings, Inc. has a one year low of $16.11 and a one year high of $43.00. The company's fifty day moving average price is $17.88 and its 200 day moving average price is $18.72.

DoubleVerify announced that its Board of Directors has authorized a stock repurchase plan on Wednesday, November 6th that allows the company to buyback $200.00 million in outstanding shares. This buyback authorization allows the company to repurchase up to 6% of its stock through open market purchases. Stock buyback plans are generally an indication that the company's board believes its shares are undervalued.

Insiders Place Their Bets

In other DoubleVerify news, CFO Nicola T. Allais sold 1,764 shares of the firm's stock in a transaction on Friday, October 4th. The shares were sold at an average price of $16.92, for a total value of $29,846.88. Following the sale, the chief financial officer now directly owns 81,598 shares in the company, valued at $1,380,638.16. This trade represents a 2.12 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Insiders have sold 8,820 shares of company stock worth $155,444 in the last ninety days. Insiders own 3.00% of the company's stock.

Analyst Ratings Changes

DV has been the subject of a number of recent analyst reports. The Goldman Sachs Group decreased their price objective on shares of DoubleVerify from $28.00 to $25.00 and set a "buy" rating for the company in a research note on Monday, October 14th. Barclays decreased their price objective on shares of DoubleVerify from $27.00 to $23.00 and set an "overweight" rating for the company in a research note on Friday, October 11th. Morgan Stanley decreased their price objective on shares of DoubleVerify from $23.00 to $21.00 and set an "equal weight" rating for the company in a research note on Thursday, November 7th. Piper Sandler decreased their price objective on shares of DoubleVerify from $30.00 to $21.00 and set an "overweight" rating for the company in a research note on Wednesday, October 23rd. Finally, JMP Securities cut their target price on shares of DoubleVerify from $33.00 to $25.00 and set a "market outperform" rating for the company in a research report on Thursday, November 7th. Two research analysts have rated the stock with a sell rating, five have issued a hold rating and twelve have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $24.47.

Get Our Latest Stock Report on DoubleVerify

DoubleVerify Company Profile

(

Free Report)

DoubleVerify Holdings, Inc provides a software platform for digital media measurement, and data analytics in the United States and internationally. The company provides solutions to advertisers that enable advertisers to increase the effectiveness and quality and return on their digital advertising investments.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider DoubleVerify, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoubleVerify wasn't on the list.

While DoubleVerify currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.