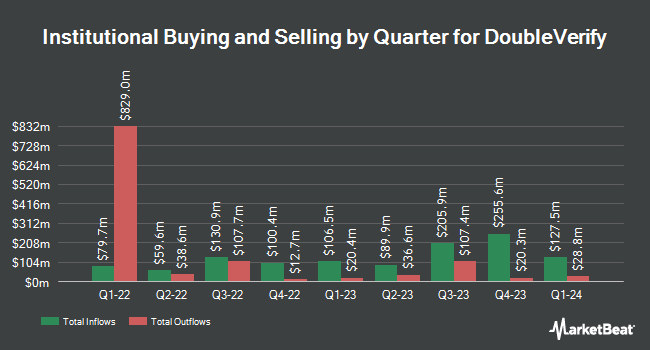

Verition Fund Management LLC increased its stake in shares of DoubleVerify Holdings, Inc. (NYSE:DV - Free Report) by 22.8% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 197,846 shares of the company's stock after buying an additional 36,746 shares during the quarter. Verition Fund Management LLC owned 0.12% of DoubleVerify worth $3,332,000 at the end of the most recent quarter.

Other institutional investors have also bought and sold shares of the company. Captrust Financial Advisors increased its stake in DoubleVerify by 61.3% in the 3rd quarter. Captrust Financial Advisors now owns 41,362 shares of the company's stock valued at $697,000 after buying an additional 15,714 shares during the last quarter. Capstone Investment Advisors LLC bought a new stake in DoubleVerify during the third quarter worth $268,000. FORA Capital LLC purchased a new position in DoubleVerify in the third quarter worth $307,000. Healthcare of Ontario Pension Plan Trust Fund bought a new position in DoubleVerify in the 3rd quarter valued at $1,345,000. Finally, Quantbot Technologies LP increased its position in shares of DoubleVerify by 32.9% during the 3rd quarter. Quantbot Technologies LP now owns 238,870 shares of the company's stock valued at $4,023,000 after purchasing an additional 59,135 shares during the last quarter. Institutional investors own 97.29% of the company's stock.

Insider Buying and Selling at DoubleVerify

In related news, CFO Nicola T. Allais sold 1,764 shares of DoubleVerify stock in a transaction on Friday, October 4th. The shares were sold at an average price of $16.92, for a total value of $29,846.88. Following the sale, the chief financial officer now owns 81,598 shares in the company, valued at $1,380,638.16. The trade was a 2.12 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Over the last quarter, insiders have sold 8,820 shares of company stock worth $155,444. 3.00% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

DV has been the topic of a number of research analyst reports. Needham & Company LLC reiterated a "buy" rating and issued a $33.00 target price on shares of DoubleVerify in a research note on Tuesday, September 17th. Barclays dropped their price objective on DoubleVerify from $27.00 to $23.00 and set an "overweight" rating on the stock in a research note on Friday, October 11th. BMO Capital Markets decreased their target price on DoubleVerify from $38.00 to $28.00 and set an "outperform" rating for the company in a research report on Friday, October 25th. Royal Bank of Canada dropped their price objective on shares of DoubleVerify from $27.00 to $22.00 and set an "outperform" rating on the stock in a report on Thursday, November 7th. Finally, Canaccord Genuity Group reduced their price objective on shares of DoubleVerify from $36.00 to $30.00 and set a "buy" rating for the company in a research note on Thursday, November 7th. Two analysts have rated the stock with a sell rating, five have issued a hold rating and thirteen have given a buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $24.44.

Read Our Latest Stock Report on DV

DoubleVerify Stock Down 1.8 %

Shares of DoubleVerify stock traded down $0.38 on Thursday, hitting $20.68. The stock had a trading volume of 532,208 shares, compared to its average volume of 2,326,099. The stock's 50-day simple moving average is $18.34 and its two-hundred day simple moving average is $18.79. DoubleVerify Holdings, Inc. has a one year low of $16.11 and a one year high of $43.00. The stock has a market cap of $3.50 billion, a price-to-earnings ratio of 56.92, a PEG ratio of 3.25 and a beta of 0.97.

DoubleVerify declared that its Board of Directors has initiated a stock repurchase plan on Wednesday, November 6th that authorizes the company to buyback $200.00 million in outstanding shares. This buyback authorization authorizes the company to reacquire up to 6% of its stock through open market purchases. Stock buyback plans are typically a sign that the company's board of directors believes its shares are undervalued.

About DoubleVerify

(

Free Report)

DoubleVerify Holdings, Inc provides a software platform for digital media measurement, and data analytics in the United States and internationally. The company provides solutions to advertisers that enable advertisers to increase the effectiveness and quality and return on their digital advertising investments.

Featured Articles

Before you consider DoubleVerify, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoubleVerify wasn't on the list.

While DoubleVerify currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.