Needham & Company LLC restated their buy rating on shares of DoubleVerify (NYSE:DV - Free Report) in a report released on Wednesday,Benzinga reports. The firm currently has a $22.00 price objective on the stock.

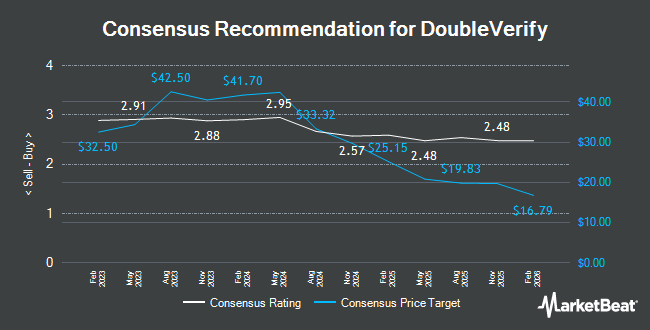

Several other equities research analysts have also commented on the stock. Stifel Nicolaus lowered their price target on shares of DoubleVerify from $25.00 to $22.00 and set a "buy" rating on the stock in a report on Monday, October 14th. Scotiabank assumed coverage on shares of DoubleVerify in a research note on Thursday, December 5th. They issued a "sector outperform" rating and a $24.00 price target on the stock. Canaccord Genuity Group lowered their target price on shares of DoubleVerify from $36.00 to $30.00 and set a "buy" rating on the stock in a research note on Thursday, November 7th. Morgan Stanley reduced their price target on DoubleVerify from $23.00 to $21.00 and set an "equal weight" rating on the stock in a report on Thursday, November 7th. Finally, Truist Financial dropped their target price on DoubleVerify from $26.00 to $23.00 and set a "buy" rating for the company in a research report on Thursday, November 7th. Two investment analysts have rated the stock with a sell rating, five have issued a hold rating and thirteen have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $24.06.

View Our Latest Stock Analysis on DoubleVerify

DoubleVerify Trading Up 1.5 %

DV traded up $0.30 during trading on Wednesday, hitting $20.77. 1,293,114 shares of the company traded hands, compared to its average volume of 2,310,467. The stock's 50-day simple moving average is $18.62 and its two-hundred day simple moving average is $18.84. DoubleVerify has a 1 year low of $16.11 and a 1 year high of $43.00. The company has a market cap of $3.51 billion, a PE ratio of 55.32, a P/E/G ratio of 3.28 and a beta of 0.97.

DoubleVerify declared that its board has approved a share buyback plan on Wednesday, November 6th that permits the company to repurchase $200.00 million in outstanding shares. This repurchase authorization permits the company to reacquire up to 6% of its shares through open market purchases. Shares repurchase plans are typically an indication that the company's leadership believes its stock is undervalued.

Insider Activity

In other news, CFO Nicola T. Allais sold 1,764 shares of the business's stock in a transaction on Friday, October 4th. The shares were sold at an average price of $16.92, for a total value of $29,846.88. Following the completion of the transaction, the chief financial officer now owns 81,598 shares of the company's stock, valued at $1,380,638.16. The trade was a 2.12 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Over the last three months, insiders sold 8,820 shares of company stock valued at $155,444. 3.00% of the stock is owned by company insiders.

Hedge Funds Weigh In On DoubleVerify

Several institutional investors and hedge funds have recently modified their holdings of DV. Neo Ivy Capital Management bought a new stake in DoubleVerify in the third quarter valued at $794,000. Ashford Capital Management Inc. grew its position in shares of DoubleVerify by 14.2% in the third quarter. Ashford Capital Management Inc. now owns 740,880 shares of the company's stock valued at $12,476,000 after purchasing an additional 92,020 shares in the last quarter. Geode Capital Management LLC boosted its stake in DoubleVerify by 0.5% in the 3rd quarter. Geode Capital Management LLC now owns 2,299,192 shares of the company's stock worth $38,729,000 after purchasing an additional 10,696 shares during the period. Disciplined Growth Investors Inc. MN purchased a new position in DoubleVerify during the third quarter valued at approximately $19,457,000. Finally, M&T Bank Corp purchased a new stake in shares of DoubleVerify in the 3rd quarter valued at about $384,000. 97.29% of the stock is currently owned by institutional investors and hedge funds.

About DoubleVerify

(

Get Free Report)

DoubleVerify Holdings, Inc provides a software platform for digital media measurement, and data analytics in the United States and internationally. The company provides solutions to advertisers that enable advertisers to increase the effectiveness and quality and return on their digital advertising investments.

Recommended Stories

Before you consider DoubleVerify, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoubleVerify wasn't on the list.

While DoubleVerify currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.