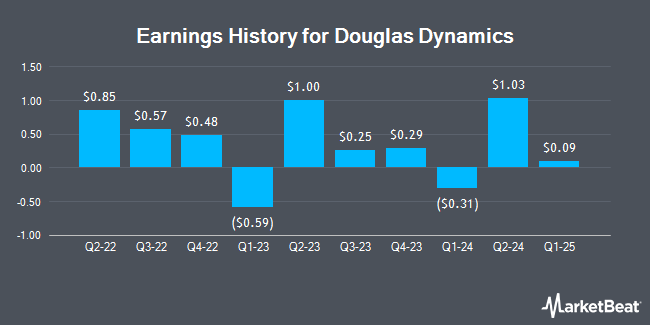

Douglas Dynamics (NYSE:PLOW - Get Free Report) is anticipated to issue its Q1 2025 quarterly earnings data after the market closes on Monday, May 5th. Analysts expect the company to announce earnings of ($0.16) per share and revenue of $107.80 million for the quarter.

Douglas Dynamics Trading Down 1.4 %

Shares of NYSE:PLOW opened at $23.88 on Monday. The business's 50-day moving average is $24.24 and its 200 day moving average is $24.78. The company has a debt-to-equity ratio of 0.56, a current ratio of 2.14 and a quick ratio of 1.13. Douglas Dynamics has a 1 year low of $21.30 and a 1 year high of $30.98. The firm has a market capitalization of $551.58 million, a P/E ratio of 10.38, a P/E/G ratio of 1.14 and a beta of 1.17.

Douglas Dynamics Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Monday, March 31st. Stockholders of record on Tuesday, March 18th were issued a dividend of $0.295 per share. The ex-dividend date was Tuesday, March 18th. This represents a $1.18 annualized dividend and a dividend yield of 4.94%. Douglas Dynamics's dividend payout ratio (DPR) is currently 50.43%.

Analysts Set New Price Targets

Several analysts have weighed in on PLOW shares. DA Davidson reissued a "buy" rating and set a $32.00 target price on shares of Douglas Dynamics in a research report on Tuesday, February 25th. StockNews.com raised Douglas Dynamics from a "hold" rating to a "buy" rating in a research report on Wednesday, February 26th.

Check Out Our Latest Stock Report on Douglas Dynamics

About Douglas Dynamics

(

Get Free Report)

Douglas Dynamics, Inc operates as a manufacturer and upfitter of commercial work truck attachments and equipment in North America. It operates through two segments, Work Truck Attachments and Work Truck Solutions. The Work Truck Attachments segment manufactures and sells snow and ice control attachments, including snowplows, and sand and salt spreaders for light trucks and heavy duty trucks, as well as various related parts and accessories.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Douglas Dynamics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Douglas Dynamics wasn't on the list.

While Douglas Dynamics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.