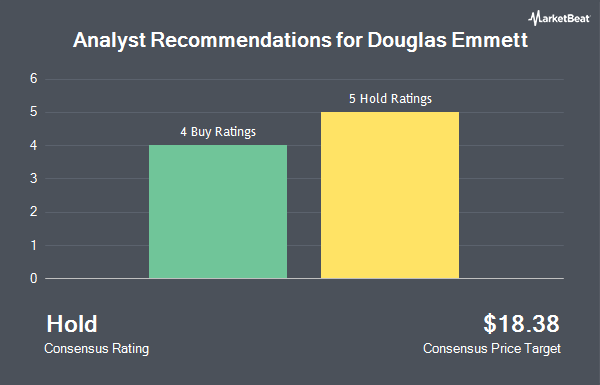

Douglas Emmett, Inc. (NYSE:DEI - Get Free Report) has been given a consensus rating of "Hold" by the seven research firms that are presently covering the stock, Marketbeat Ratings reports. Six equities research analysts have rated the stock with a hold rating and one has issued a buy rating on the company. The average 12-month price objective among brokerages that have issued a report on the stock in the last year is $16.71.

A number of brokerages have weighed in on DEI. Scotiabank upped their price objective on shares of Douglas Emmett from $14.00 to $16.00 and gave the stock a "sector perform" rating in a research report on Monday, August 26th. Citigroup raised their price objective on Douglas Emmett from $14.00 to $16.00 and gave the company a "neutral" rating in a report on Thursday, September 12th. Piper Sandler boosted their price objective on Douglas Emmett from $15.00 to $16.00 and gave the company a "neutral" rating in a research report on Monday, August 12th. JPMorgan Chase & Co. lifted their price target on shares of Douglas Emmett from $15.00 to $18.00 and gave the company a "neutral" rating in a research note on Monday, September 9th. Finally, Wells Fargo & Company increased their price objective on shares of Douglas Emmett from $15.00 to $17.00 and gave the company an "overweight" rating in a report on Wednesday, September 11th.

Check Out Our Latest Research Report on DEI

Douglas Emmett Stock Performance

Shares of DEI stock traded down $0.08 on Wednesday, hitting $18.08. The company had a trading volume of 1,689,902 shares, compared to its average volume of 1,655,728. Douglas Emmett has a twelve month low of $11.08 and a twelve month high of $19.59. The company has a quick ratio of 5.11, a current ratio of 4.09 and a debt-to-equity ratio of 1.51. The firm has a market cap of $3.03 billion, a P/E ratio of -180.90 and a beta of 1.10. The company has a 50-day moving average price of $17.64 and a 200-day moving average price of $15.49.

Douglas Emmett (NYSE:DEI - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The real estate investment trust reported $0.03 EPS for the quarter, missing the consensus estimate of $0.41 by ($0.38). The company had revenue of $250.75 million during the quarter, compared to analysts' expectations of $242.75 million. Douglas Emmett had a negative return on equity of 0.43% and a negative net margin of 1.68%. The company's revenue for the quarter was down 1.8% on a year-over-year basis. During the same quarter in the prior year, the company posted $0.45 EPS. As a group, equities research analysts predict that Douglas Emmett will post 1.7 earnings per share for the current fiscal year.

Douglas Emmett Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Wednesday, October 16th. Investors of record on Monday, September 30th were paid a dividend of $0.19 per share. The ex-dividend date of this dividend was Monday, September 30th. This represents a $0.76 annualized dividend and a yield of 4.20%. Douglas Emmett's dividend payout ratio is presently -760.00%.

Institutional Inflows and Outflows

A number of institutional investors have recently bought and sold shares of the business. Inspire Investing LLC boosted its holdings in Douglas Emmett by 3.4% in the 2nd quarter. Inspire Investing LLC now owns 26,491 shares of the real estate investment trust's stock valued at $353,000 after purchasing an additional 883 shares during the last quarter. Arizona State Retirement System increased its stake in Douglas Emmett by 2.2% during the second quarter. Arizona State Retirement System now owns 46,850 shares of the real estate investment trust's stock worth $624,000 after acquiring an additional 1,027 shares during the last quarter. GAMMA Investing LLC raised its position in Douglas Emmett by 44.6% in the third quarter. GAMMA Investing LLC now owns 3,811 shares of the real estate investment trust's stock valued at $67,000 after purchasing an additional 1,175 shares during the period. AQR Capital Management LLC lifted its stake in shares of Douglas Emmett by 3.9% in the 2nd quarter. AQR Capital Management LLC now owns 36,432 shares of the real estate investment trust's stock valued at $479,000 after purchasing an additional 1,377 shares during the last quarter. Finally, Raleigh Capital Management Inc. grew its holdings in shares of Douglas Emmett by 62.0% during the 3rd quarter. Raleigh Capital Management Inc. now owns 3,856 shares of the real estate investment trust's stock worth $68,000 after purchasing an additional 1,476 shares during the period. 97.37% of the stock is owned by hedge funds and other institutional investors.

Douglas Emmett Company Profile

(

Get Free ReportDouglas Emmett, Inc (DEI) is a fully integrated, self-administered and self-managed real estate investment trust (REIT), and one of the largest owners and operators of high-quality office and multifamily properties located in the premier coastal submarkets of Los Angeles and Honolulu. Douglas Emmett focuses on owning and acquiring a substantial share of top-tier office properties and premier multifamily communities in neighborhoods that possess significant supply constraints, high-end executive housing and key lifestyle amenities.

Read More

Before you consider Douglas Emmett, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Douglas Emmett wasn't on the list.

While Douglas Emmett currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.