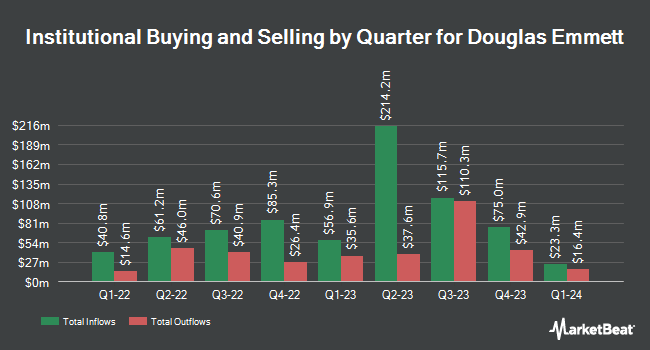

Victory Capital Management Inc. grew its position in shares of Douglas Emmett, Inc. (NYSE:DEI - Free Report) by 4,395.5% in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 1,578,205 shares of the real estate investment trust's stock after acquiring an additional 1,543,099 shares during the quarter. Victory Capital Management Inc. owned about 0.94% of Douglas Emmett worth $27,729,000 as of its most recent filing with the SEC.

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Massachusetts Financial Services Co. MA grew its stake in shares of Douglas Emmett by 2.1% in the 2nd quarter. Massachusetts Financial Services Co. MA now owns 8,090,198 shares of the real estate investment trust's stock worth $107,681,000 after purchasing an additional 165,425 shares during the last quarter. Dimensional Fund Advisors LP lifted its holdings in shares of Douglas Emmett by 8.1% during the second quarter. Dimensional Fund Advisors LP now owns 2,495,263 shares of the real estate investment trust's stock worth $33,212,000 after buying an additional 186,385 shares during the last quarter. Bank of New York Mellon Corp raised its position in shares of Douglas Emmett by 1.0% during the second quarter. Bank of New York Mellon Corp now owns 2,417,865 shares of the real estate investment trust's stock valued at $32,182,000 after buying an additional 24,272 shares during the last quarter. Rhumbline Advisers lifted its position in Douglas Emmett by 0.5% in the second quarter. Rhumbline Advisers now owns 559,680 shares of the real estate investment trust's stock worth $7,449,000 after purchasing an additional 3,048 shares during the period. Finally, CANADA LIFE ASSURANCE Co boosted its holdings in Douglas Emmett by 3.5% during the first quarter. CANADA LIFE ASSURANCE Co now owns 441,918 shares of the real estate investment trust's stock valued at $6,133,000 after purchasing an additional 14,783 shares in the last quarter. Institutional investors own 97.37% of the company's stock.

Douglas Emmett Stock Performance

Shares of DEI stock traded down $0.34 on Monday, hitting $18.05. 1,208,143 shares of the stock were exchanged, compared to its average volume of 1,658,176. The firm has a market capitalization of $3.02 billion, a PE ratio of -183.90 and a beta of 1.10. The firm's 50 day moving average is $17.79 and its two-hundred day moving average is $15.58. Douglas Emmett, Inc. has a one year low of $11.08 and a one year high of $19.59. The company has a current ratio of 4.09, a quick ratio of 5.11 and a debt-to-equity ratio of 1.51.

Douglas Emmett (NYSE:DEI - Get Free Report) last issued its earnings results on Monday, November 4th. The real estate investment trust reported $0.03 EPS for the quarter, missing analysts' consensus estimates of $0.41 by ($0.38). Douglas Emmett had a negative return on equity of 0.43% and a negative net margin of 1.68%. The business had revenue of $250.75 million during the quarter, compared to analysts' expectations of $242.75 million. During the same quarter in the previous year, the business earned $0.45 EPS. Douglas Emmett's revenue for the quarter was down 1.8% compared to the same quarter last year. Sell-side analysts expect that Douglas Emmett, Inc. will post 1.7 earnings per share for the current fiscal year.

Douglas Emmett Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Wednesday, October 16th. Investors of record on Monday, September 30th were paid a $0.19 dividend. This represents a $0.76 dividend on an annualized basis and a yield of 4.21%. The ex-dividend date of this dividend was Monday, September 30th. Douglas Emmett's payout ratio is -760.00%.

Wall Street Analyst Weigh In

A number of equities research analysts recently commented on DEI shares. JPMorgan Chase & Co. increased their price target on Douglas Emmett from $15.00 to $18.00 and gave the stock a "neutral" rating in a research report on Monday, September 9th. Wells Fargo & Company raised their price objective on Douglas Emmett from $15.00 to $17.00 and gave the stock an "overweight" rating in a research note on Wednesday, September 11th. Evercore ISI boosted their price target on Douglas Emmett from $16.00 to $19.00 and gave the company an "in-line" rating in a report on Thursday, November 7th. Citigroup increased their target price on shares of Douglas Emmett from $14.00 to $16.00 and gave the stock a "neutral" rating in a report on Thursday, September 12th. Finally, Scotiabank upgraded shares of Douglas Emmett from a "sector perform" rating to a "sector outperform" rating and increased their price target for the company from $16.00 to $21.00 in a research note on Thursday. Six research analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. Based on data from MarketBeat, Douglas Emmett currently has an average rating of "Hold" and a consensus target price of $17.43.

Get Our Latest Report on DEI

About Douglas Emmett

(

Free Report)

Douglas Emmett, Inc (DEI) is a fully integrated, self-administered and self-managed real estate investment trust (REIT), and one of the largest owners and operators of high-quality office and multifamily properties located in the premier coastal submarkets of Los Angeles and Honolulu. Douglas Emmett focuses on owning and acquiring a substantial share of top-tier office properties and premier multifamily communities in neighborhoods that possess significant supply constraints, high-end executive housing and key lifestyle amenities.

Read More

Before you consider Douglas Emmett, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Douglas Emmett wasn't on the list.

While Douglas Emmett currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.