Douglas Lane & Associates LLC trimmed its position in shares of Ingersoll Rand Inc. (NYSE:IR - Free Report) by 3.3% during the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 882,126 shares of the industrial products company's stock after selling 30,277 shares during the period. Ingersoll Rand makes up approximately 1.1% of Douglas Lane & Associates LLC's investment portfolio, making the stock its 24th largest position. Douglas Lane & Associates LLC owned about 0.22% of Ingersoll Rand worth $79,797,000 at the end of the most recent reporting period.

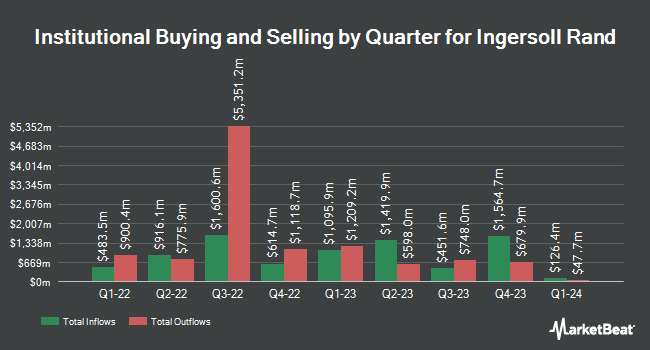

Several other hedge funds have also recently bought and sold shares of the company. Ashton Thomas Securities LLC acquired a new stake in Ingersoll Rand in the third quarter valued at about $34,000. Eastern Bank bought a new position in shares of Ingersoll Rand in the third quarter worth about $42,000. Kimelman & Baird LLC acquired a new stake in shares of Ingersoll Rand in the 2nd quarter valued at approximately $57,000. Princeton Global Asset Management LLC bought a new stake in shares of Ingersoll Rand during the 3rd quarter valued at approximately $65,000. Finally, Versant Capital Management Inc increased its position in Ingersoll Rand by 654.4% during the 4th quarter. Versant Capital Management Inc now owns 679 shares of the industrial products company's stock worth $61,000 after purchasing an additional 589 shares in the last quarter. 95.27% of the stock is owned by institutional investors.

Insider Transactions at Ingersoll Rand

In related news, CAO Michael J. Scheske sold 2,531 shares of the business's stock in a transaction on Tuesday, November 5th. The shares were sold at an average price of $97.44, for a total transaction of $246,620.64. Following the transaction, the chief accounting officer now owns 11,910 shares in the company, valued at $1,160,510.40. The trade was a 17.53 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Corporate insiders own 0.68% of the company's stock.

Ingersoll Rand Trading Up 0.0 %

Shares of NYSE:IR traded up $0.03 during trading on Wednesday, reaching $89.19. The stock had a trading volume of 2,441,270 shares, compared to its average volume of 2,558,054. Ingersoll Rand Inc. has a 52 week low of $74.58 and a 52 week high of $106.03. The company has a debt-to-equity ratio of 0.46, a quick ratio of 1.71 and a current ratio of 2.36. The firm's fifty day moving average is $98.80 and its 200 day moving average is $95.83. The stock has a market cap of $35.94 billion, a price-to-earnings ratio of 43.51, a P/E/G ratio of 3.84 and a beta of 1.44.

Ingersoll Rand Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, December 5th. Shareholders of record on Thursday, November 14th were issued a dividend of $0.02 per share. The ex-dividend date of this dividend was Thursday, November 14th. This represents a $0.08 dividend on an annualized basis and a yield of 0.09%. Ingersoll Rand's payout ratio is currently 3.90%.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on IR shares. Barclays cut their target price on shares of Ingersoll Rand from $120.00 to $115.00 and set an "overweight" rating on the stock in a research report on Wednesday. Robert W. Baird cut their price objective on Ingersoll Rand from $114.00 to $109.00 and set an "outperform" rating on the stock in a report on Monday, November 4th. Cfra boosted their price objective on Ingersoll Rand from $85.00 to $95.00 and gave the stock a "hold" rating in a research report on Friday, October 4th. The Goldman Sachs Group increased their target price on Ingersoll Rand from $109.00 to $121.00 and gave the company a "buy" rating in a research report on Thursday, December 12th. Finally, Citigroup boosted their price target on Ingersoll Rand from $112.00 to $119.00 and gave the stock a "buy" rating in a report on Monday, December 9th. Seven investment analysts have rated the stock with a hold rating and seven have given a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $106.83.

View Our Latest Stock Report on IR

Ingersoll Rand Company Profile

(

Free Report)

Ingersoll Rand Inc provides various mission-critical air, gas, liquid, and solid flow creation technologies services and solutions worldwide. It operates through two segments, Industrial Technologies and Services, and Precision and Science Technologies. The Industrial Technologies and Services segment designs, manufactures, markets, and services air and gas compression, vacuum, and blower products; fluid transfer equipment and loading systems; and power tools and lifting equipment, including associated aftermarket parts, consumables, air treatment equipment, controls, other accessories, and services under the under the Ingersoll Rand, Gardner Denver, Nash, CompAir, Elmo Rietschle brands, etc.

Read More

Before you consider Ingersoll Rand, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ingersoll Rand wasn't on the list.

While Ingersoll Rand currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.