UBS Group initiated coverage on shares of Dover (NYSE:DOV - Free Report) in a research report sent to investors on Wednesday, Marketbeat reports. The firm issued a neutral rating and a $217.00 price objective on the industrial products company's stock.

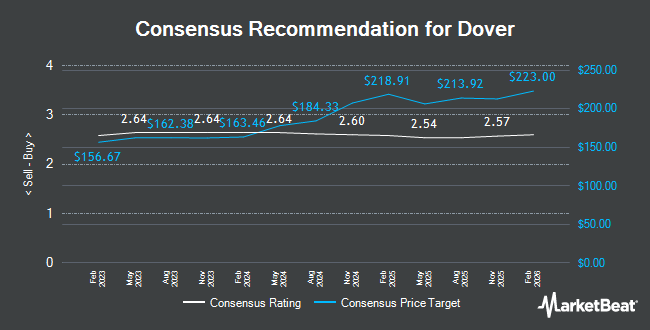

Other equities research analysts have also recently issued reports about the company. Wolfe Research upgraded Dover from a "peer perform" rating to an "outperform" rating and set a $227.00 price objective on the stock in a research note on Monday, October 28th. JPMorgan Chase & Co. increased their price objective on Dover from $210.00 to $212.00 and gave the company an "overweight" rating in a research note on Friday, October 25th. Oppenheimer reissued an "outperform" rating and set a $215.00 price objective (up previously from $210.00) on shares of Dover in a research note on Wednesday, October 16th. StockNews.com upgraded Dover from a "hold" rating to a "buy" rating in a report on Tuesday. Finally, Robert W. Baird reiterated an "outperform" rating and issued a $208.00 price objective on shares of Dover in a report on Monday, July 22nd. Four research analysts have rated the stock with a hold rating and eight have given a buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $208.40.

View Our Latest Report on DOV

Dover Stock Up 0.9 %

Shares of Dover stock traded up $1.91 on Wednesday, hitting $204.26. The company had a trading volume of 285,606 shares, compared to its average volume of 967,413. The firm has a market capitalization of $28.02 billion, a P/E ratio of 18.26, a P/E/G ratio of 2.72 and a beta of 1.22. The stock has a 50-day moving average of $189.92 and a 200-day moving average of $184.27. Dover has a twelve month low of $133.77 and a twelve month high of $204.93. The company has a debt-to-equity ratio of 0.53, a current ratio of 1.57 and a quick ratio of 1.06.

Dover Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Friday, November 29th will be given a dividend of $0.515 per share. This represents a $2.06 dividend on an annualized basis and a dividend yield of 1.01%. The ex-dividend date is Friday, November 29th. Dover's dividend payout ratio is currently 18.43%.

Insiders Place Their Bets

In other Dover news, SVP Ivonne M. Cabrera sold 1,220 shares of the company's stock in a transaction on Thursday, August 29th. The shares were sold at an average price of $185.00, for a total transaction of $225,700.00. Following the sale, the senior vice president now directly owns 47,060 shares of the company's stock, valued at approximately $8,706,100. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. In other Dover news, CEO Richard J. Tobin sold 25,004 shares of the business's stock in a transaction on Wednesday, August 21st. The stock was sold at an average price of $181.96, for a total value of $4,549,727.84. Following the sale, the chief executive officer now directly owns 182,928 shares in the company, valued at $33,285,578.88. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, SVP Ivonne M. Cabrera sold 1,220 shares of Dover stock in a transaction on Thursday, August 29th. The shares were sold at an average price of $185.00, for a total value of $225,700.00. Following the completion of the transaction, the senior vice president now owns 47,060 shares of the company's stock, valued at approximately $8,706,100. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 41,042 shares of company stock valued at $7,368,578. 1.30% of the stock is currently owned by insiders.

Hedge Funds Weigh In On Dover

Several hedge funds and other institutional investors have recently added to or reduced their stakes in DOV. FMR LLC lifted its stake in shares of Dover by 5.1% in the 3rd quarter. FMR LLC now owns 3,085,826 shares of the industrial products company's stock valued at $591,676,000 after acquiring an additional 149,378 shares during the last quarter. Price T Rowe Associates Inc. MD boosted its stake in Dover by 153.7% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 2,633,453 shares of the industrial products company's stock valued at $466,622,000 after purchasing an additional 1,595,611 shares during the last quarter. Dimensional Fund Advisors LP lifted its holdings in shares of Dover by 4.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 1,505,749 shares of the industrial products company's stock valued at $271,702,000 after buying an additional 60,912 shares during the period. Charles Schwab Investment Management Inc. lifted its holdings in shares of Dover by 1.2% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 811,340 shares of the industrial products company's stock valued at $155,566,000 after buying an additional 9,464 shares during the period. Finally, American Century Companies Inc. lifted its holdings in shares of Dover by 162.2% during the 2nd quarter. American Century Companies Inc. now owns 688,249 shares of the industrial products company's stock valued at $124,195,000 after buying an additional 425,768 shares during the period. 84.46% of the stock is currently owned by hedge funds and other institutional investors.

Dover Company Profile

(

Get Free Report)

Dover Corporation provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide. The company's Engineered Products segment provides various equipment, component, software, solution, and services that are used in vehicle aftermarket, waste handling, industrial automation, aerospace and defense, industrial winch and hoist, and fluid dispensing end-market.

Read More

Before you consider Dover, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dover wasn't on the list.

While Dover currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.