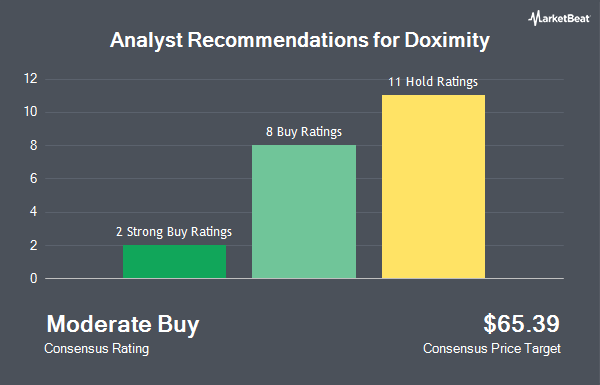

Doximity, Inc. (NASDAQ:DOCS - Get Free Report) has been given a consensus recommendation of "Moderate Buy" by the twenty-one ratings firms that are covering the firm, Marketbeat Ratings reports. Eleven investment analysts have rated the stock with a hold rating, eight have assigned a buy rating and two have issued a strong buy rating on the company. The average twelve-month price objective among brokers that have issued ratings on the stock in the last year is $64.22.

A number of analysts have recently commented on DOCS shares. The Goldman Sachs Group upped their target price on Doximity from $58.00 to $80.00 and gave the stock a "neutral" rating in a research note on Monday, February 10th. Needham & Company LLC raised their price objective on shares of Doximity from $65.00 to $82.00 and gave the stock a "buy" rating in a research note on Friday, February 7th. Bank of America lifted their target price on shares of Doximity from $54.00 to $57.00 and gave the company a "neutral" rating in a report on Monday, January 6th. Canaccord Genuity Group raised their price target on shares of Doximity from $60.00 to $71.00 and gave the company a "hold" rating in a research report on Friday, February 7th. Finally, Leerink Partners upgraded shares of Doximity from a "market perform" rating to an "outperform" rating and upped their price objective for the stock from $60.00 to $90.00 in a research report on Friday, February 7th.

View Our Latest Analysis on DOCS

Doximity Price Performance

NASDAQ:DOCS traded up $0.47 during mid-day trading on Friday, hitting $77.54. The company's stock had a trading volume of 713,137 shares, compared to its average volume of 2,334,293. The business's fifty day moving average is $58.36 and its two-hundred day moving average is $47.99. The stock has a market cap of $14.48 billion, a price-to-earnings ratio of 77.91, a PEG ratio of 4.61 and a beta of 1.39. Doximity has a 1 year low of $22.96 and a 1 year high of $85.21.

Insider Transactions at Doximity

In other news, Director Timothy S. Cabral sold 20,000 shares of the company's stock in a transaction that occurred on Monday, February 3rd. The stock was sold at an average price of $57.62, for a total value of $1,152,400.00. Following the completion of the sale, the director now directly owns 6,360 shares in the company, valued at $366,463.20. This represents a 75.87 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Insiders own 37.40% of the company's stock.

Hedge Funds Weigh In On Doximity

A number of institutional investors and hedge funds have recently added to or reduced their stakes in DOCS. Tidal Investments LLC acquired a new position in shares of Doximity during the 4th quarter valued at about $246,000. Teza Capital Management LLC purchased a new position in Doximity during the fourth quarter worth about $2,034,000. Strategic Global Advisors LLC acquired a new position in Doximity in the 4th quarter valued at about $1,506,000. Snowden Capital Advisors LLC purchased a new stake in shares of Doximity in the 4th quarter valued at approximately $248,000. Finally, Raiffeisen Bank International AG acquired a new stake in shares of Doximity during the 4th quarter worth approximately $179,000. Institutional investors and hedge funds own 87.19% of the company's stock.

About Doximity

(

Get Free ReportDoximity, Inc operates a cloud-based digital platform for medical professionals in the United States. The company's platform provides its members with tools built for medical professionals, enabling them to collaborate with their colleagues, coordinate patient care, conduct virtual patient visits, stay up to date with the latest medical news and research, and manage their careers.

Featured Stories

Before you consider Doximity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Doximity wasn't on the list.

While Doximity currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.