Wells Fargo & Company upgraded shares of Doximity (NASDAQ:DOCS - Free Report) from an underweight rating to an equal weight rating in a research report released on Friday, Marketbeat.com reports. Wells Fargo & Company currently has $41.00 price target on the stock, up from their prior price target of $19.00.

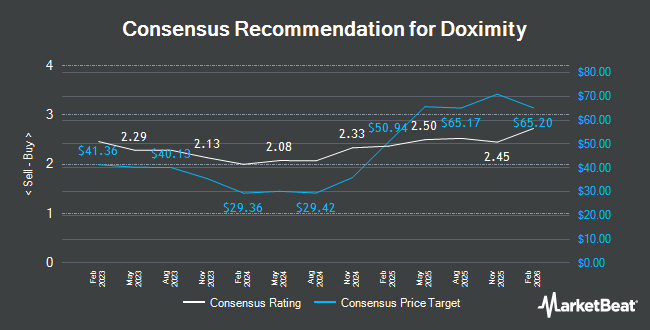

DOCS has been the subject of several other reports. Barclays raised shares of Doximity from an "equal weight" rating to an "overweight" rating and lifted their price target for the company from $35.00 to $52.00 in a report on Tuesday, October 15th. Bank of America boosted their target price on Doximity from $32.00 to $45.00 and gave the stock a "neutral" rating in a report on Monday, October 7th. Truist Financial reiterated a "hold" rating and issued a $35.00 price objective (up previously from $31.00) on shares of Doximity in a research report on Wednesday, August 14th. Baird R W upgraded Doximity to a "strong-buy" rating in a report on Tuesday, September 17th. Finally, Evercore ISI upped their price target on shares of Doximity from $34.00 to $45.00 and gave the stock an "in-line" rating in a research report on Tuesday, October 8th. One research analyst has rated the stock with a sell rating, eight have given a hold rating, seven have issued a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, Doximity presently has a consensus rating of "Hold" and a consensus target price of $42.43.

View Our Latest Report on Doximity

Doximity Trading Up 35.9 %

NASDAQ:DOCS traded up $15.57 during mid-day trading on Friday, hitting $58.99. The company's stock had a trading volume of 6,482,001 shares, compared to its average volume of 1,684,259. The stock has a fifty day moving average of $41.12 and a 200-day moving average of $32.82. The company has a market capitalization of $10.95 billion, a price-to-earnings ratio of 73.20, a P/E/G ratio of 5.03 and a beta of 1.30. Doximity has a fifty-two week low of $20.28 and a fifty-two week high of $60.90.

Doximity (NASDAQ:DOCS - Get Free Report) last announced its quarterly earnings results on Thursday, August 8th. The company reported $0.22 earnings per share for the quarter, beating analysts' consensus estimates of $0.16 by $0.06. The firm had revenue of $126.68 million for the quarter, compared to analysts' expectations of $119.88 million. Doximity had a return on equity of 19.26% and a net margin of 32.53%. On average, equities analysts anticipate that Doximity will post 0.8 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Doximity

Several institutional investors have recently modified their holdings of the stock. Blair William & Co. IL increased its stake in Doximity by 31.7% in the first quarter. Blair William & Co. IL now owns 90,600 shares of the company's stock valued at $2,438,000 after purchasing an additional 21,787 shares in the last quarter. Federated Hermes Inc. raised its stake in Doximity by 1,824.5% during the 2nd quarter. Federated Hermes Inc. now owns 279,634 shares of the company's stock worth $7,821,000 after buying an additional 265,104 shares during the period. AXA S.A. lifted its holdings in Doximity by 40.2% during the second quarter. AXA S.A. now owns 216,392 shares of the company's stock worth $6,052,000 after acquiring an additional 61,992 shares in the last quarter. Acadian Asset Management LLC grew its stake in Doximity by 128.7% in the first quarter. Acadian Asset Management LLC now owns 96,442 shares of the company's stock valued at $2,590,000 after acquiring an additional 54,281 shares during the period. Finally, Nisa Investment Advisors LLC raised its position in shares of Doximity by 15,714.3% during the second quarter. Nisa Investment Advisors LLC now owns 11,070 shares of the company's stock worth $310,000 after purchasing an additional 11,000 shares during the period. 87.19% of the stock is currently owned by institutional investors and hedge funds.

About Doximity

(

Get Free Report)

Doximity, Inc operates a cloud-based digital platform for medical professionals in the United States. The company's platform provides its members with tools built for medical professionals, enabling them to collaborate with their colleagues, coordinate patient care, conduct virtual patient visits, stay up to date with the latest medical news and research, and manage their careers.

Featured Stories

Before you consider Doximity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Doximity wasn't on the list.

While Doximity currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.