Entropy Technologies LP trimmed its stake in D.R. Horton, Inc. (NYSE:DHI - Free Report) by 75.9% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 2,400 shares of the construction company's stock after selling 7,539 shares during the quarter. Entropy Technologies LP's holdings in D.R. Horton were worth $458,000 at the end of the most recent quarter.

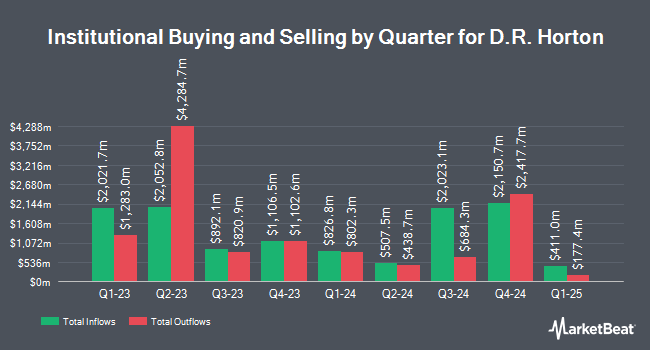

A number of other hedge funds have also modified their holdings of DHI. Blair William & Co. IL grew its holdings in shares of D.R. Horton by 0.6% in the 1st quarter. Blair William & Co. IL now owns 37,310 shares of the construction company's stock worth $6,139,000 after acquiring an additional 230 shares during the last quarter. Orion Portfolio Solutions LLC grew its holdings in shares of D.R. Horton by 9.2% in the 1st quarter. Orion Portfolio Solutions LLC now owns 26,461 shares of the construction company's stock worth $4,354,000 after acquiring an additional 2,237 shares during the last quarter. Intech Investment Management LLC acquired a new position in shares of D.R. Horton in the 1st quarter worth $1,205,000. Vanguard Group Inc. grew its holdings in shares of D.R. Horton by 7.6% during the first quarter. Vanguard Group Inc. now owns 34,856,397 shares of the construction company's stock valued at $5,735,620,000 after buying an additional 2,474,262 shares in the last quarter. Finally, Acadian Asset Management LLC grew its holdings in shares of D.R. Horton by 7.9% during the first quarter. Acadian Asset Management LLC now owns 251,271 shares of the construction company's stock valued at $41,334,000 after buying an additional 18,337 shares in the last quarter. 90.63% of the stock is currently owned by institutional investors and hedge funds.

D.R. Horton Stock Down 1.3 %

Shares of NYSE:DHI traded down $2.13 on Friday, reaching $161.61. The company had a trading volume of 2,507,253 shares, compared to its average volume of 2,517,690. D.R. Horton, Inc. has a twelve month low of $125.28 and a twelve month high of $199.85. The stock has a 50-day moving average price of $182.40 and a 200 day moving average price of $166.77. The stock has a market capitalization of $52.66 billion, a P/E ratio of 11.25, a P/E/G ratio of 0.56 and a beta of 1.74. The company has a quick ratio of 1.61, a current ratio of 7.32 and a debt-to-equity ratio of 0.23.

D.R. Horton (NYSE:DHI - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The construction company reported $3.92 earnings per share for the quarter, missing analysts' consensus estimates of $4.17 by ($0.25). D.R. Horton had a return on equity of 19.24% and a net margin of 12.93%. The company had revenue of $10 billion during the quarter, compared to analyst estimates of $10.22 billion. During the same period in the prior year, the firm earned $4.45 EPS. D.R. Horton's quarterly revenue was down 4.7% on a year-over-year basis. On average, equities analysts expect that D.R. Horton, Inc. will post 14.92 EPS for the current year.

D.R. Horton Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, November 19th. Investors of record on Tuesday, November 12th will be given a dividend of $0.40 per share. This represents a $1.60 annualized dividend and a dividend yield of 0.99%. The ex-dividend date of this dividend is Tuesday, November 12th. This is a boost from D.R. Horton's previous quarterly dividend of $0.30. D.R. Horton's payout ratio is currently 11.14%.

Wall Street Analyst Weigh In

DHI has been the topic of a number of research analyst reports. Wells Fargo & Company lowered their price target on D.R. Horton from $220.00 to $190.00 and set an "overweight" rating on the stock in a report on Wednesday, October 30th. UBS Group lowered their price target on D.R. Horton from $217.00 to $214.00 and set a "buy" rating on the stock in a report on Wednesday, October 30th. Barclays lowered their price target on D.R. Horton from $200.00 to $192.00 and set an "overweight" rating on the stock in a report on Thursday, October 31st. Evercore ISI lowered their price target on D.R. Horton from $218.00 to $204.00 and set an "outperform" rating on the stock in a report on Wednesday, October 30th. Finally, Citigroup reduced their price objective on D.R. Horton from $186.00 to $185.00 and set a "neutral" rating for the company in a research report on Wednesday, October 30th. One analyst has rated the stock with a sell rating, seven have assigned a hold rating and nine have issued a buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $185.87.

Read Our Latest Report on DHI

About D.R. Horton

(

Free Report)

D.R. Horton, Inc operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States. It engages in the acquisition and development of land; and construction and sale of residential homes in 118 markets across 33 states under the names of D.R.

Further Reading

Before you consider D.R. Horton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and D.R. Horton wasn't on the list.

While D.R. Horton currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.