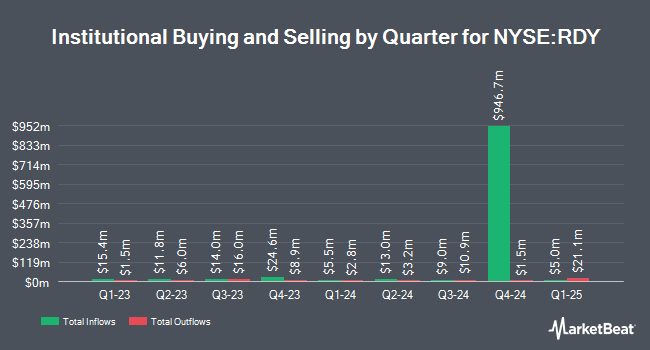

Mariner LLC boosted its holdings in shares of Dr. Reddy's Laboratories Limited (NYSE:RDY - Free Report) by 479.7% in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 138,375 shares of the company's stock after buying an additional 114,504 shares during the quarter. Mariner LLC's holdings in Dr. Reddy's Laboratories were worth $2,185,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also bought and sold shares of RDY. EverSource Wealth Advisors LLC increased its stake in shares of Dr. Reddy's Laboratories by 423.3% in the fourth quarter. EverSource Wealth Advisors LLC now owns 1,863 shares of the company's stock worth $29,000 after acquiring an additional 1,507 shares during the period. Glass Jacobson Investment Advisors llc raised its stake in shares of Dr. Reddy's Laboratories by 400.0% during the 4th quarter. Glass Jacobson Investment Advisors llc now owns 2,000 shares of the company's stock valued at $32,000 after buying an additional 1,600 shares during the last quarter. POM Investment Strategies LLC lifted its holdings in shares of Dr. Reddy's Laboratories by 400.0% in the 4th quarter. POM Investment Strategies LLC now owns 2,275 shares of the company's stock valued at $36,000 after buying an additional 1,820 shares during the period. Farther Finance Advisors LLC boosted its stake in shares of Dr. Reddy's Laboratories by 461.0% in the fourth quarter. Farther Finance Advisors LLC now owns 2,547 shares of the company's stock worth $40,000 after buying an additional 2,093 shares during the last quarter. Finally, Allworth Financial LP grew its holdings in Dr. Reddy's Laboratories by 447.8% during the fourth quarter. Allworth Financial LP now owns 2,728 shares of the company's stock worth $41,000 after acquiring an additional 2,230 shares during the period. 3.85% of the stock is currently owned by institutional investors and hedge funds.

Dr. Reddy's Laboratories Stock Performance

RDY stock traded down $0.19 during trading on Friday, hitting $13.81. 1,942,529 shares of the company traded hands, compared to its average volume of 1,469,416. The company has a debt-to-equity ratio of 0.02, a current ratio of 1.92 and a quick ratio of 1.38. Dr. Reddy's Laboratories Limited has a 1 year low of $12.26 and a 1 year high of $16.89. The stock's 50-day simple moving average is $13.17 and its 200 day simple moving average is $14.21. The company has a market cap of $11.53 billion, a PE ratio of 21.99 and a beta of 0.51.

Dr. Reddy's Laboratories (NYSE:RDY - Get Free Report) last released its quarterly earnings results on Thursday, January 23rd. The company reported $0.20 EPS for the quarter, beating the consensus estimate of $0.19 by $0.01. Dr. Reddy's Laboratories had a net margin of 17.25% and a return on equity of 17.87%. On average, equities analysts expect that Dr. Reddy's Laboratories Limited will post 0.8 earnings per share for the current fiscal year.

About Dr. Reddy's Laboratories

(

Free Report)

Dr. Reddy's Laboratories Limited, together with its subsidiaries, operates as an integrated pharmaceutical company worldwide. It operates through Global Generics, Pharmaceutical Services and Active Ingredients (PSAI), and Others segments. The company's Global Generics segment manufactures and markets prescription and over-the-counter finished pharmaceutical products that are marketed under a brand name or as a generic finished dosages with therapeutic equivalence to branded formulations, as well as engages in the biologics business.

Recommended Stories

Before you consider Dr. Reddy's Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dr. Reddy's Laboratories wasn't on the list.

While Dr. Reddy's Laboratories currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.