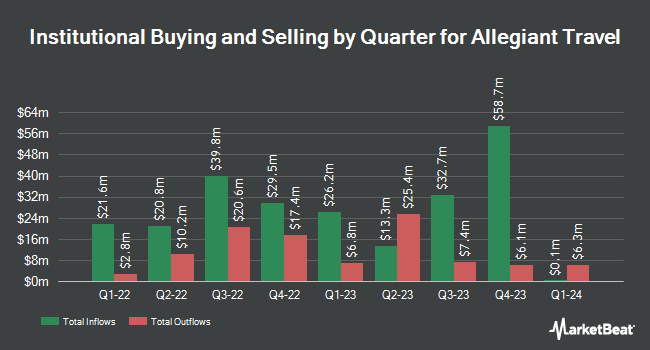

Drive Wealth Management LLC bought a new stake in Allegiant Travel (NASDAQ:ALGT - Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund bought 8,555 shares of the transportation company's stock, valued at approximately $471,000.

Other large investors have also recently made changes to their positions in the company. Signaturefd LLC lifted its stake in shares of Allegiant Travel by 149.2% in the third quarter. Signaturefd LLC now owns 456 shares of the transportation company's stock worth $25,000 after buying an additional 273 shares in the last quarter. Nisa Investment Advisors LLC lifted its position in Allegiant Travel by 136.9% in the 3rd quarter. Nisa Investment Advisors LLC now owns 526 shares of the transportation company's stock valued at $29,000 after acquiring an additional 304 shares in the last quarter. Innealta Capital LLC purchased a new stake in Allegiant Travel during the 2nd quarter valued at $34,000. CWM LLC increased its holdings in shares of Allegiant Travel by 275.1% in the 2nd quarter. CWM LLC now owns 1,268 shares of the transportation company's stock worth $64,000 after purchasing an additional 930 shares in the last quarter. Finally, NBC Securities Inc. raised its stake in shares of Allegiant Travel by 2,827.9% in the third quarter. NBC Securities Inc. now owns 1,259 shares of the transportation company's stock worth $69,000 after purchasing an additional 1,216 shares during the last quarter. 85.81% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

ALGT has been the subject of several research analyst reports. Barclays lifted their price objective on Allegiant Travel from $50.00 to $75.00 and gave the stock an "equal weight" rating in a report on Thursday. Wolfe Research cut shares of Allegiant Travel from a "strong-buy" rating to a "hold" rating in a report on Monday, November 4th. TD Cowen lifted their price objective on Allegiant Travel from $42.00 to $50.00 and gave the stock a "hold" rating in a report on Friday, November 1st. Susquehanna raised their price objective on Allegiant Travel from $55.00 to $60.00 and gave the stock a "neutral" rating in a research note on Monday, November 4th. Finally, Evercore ISI upped their price target on shares of Allegiant Travel from $60.00 to $65.00 and gave the company an "in-line" rating in a report on Thursday, October 3rd. One equities research analyst has rated the stock with a sell rating, eight have assigned a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat.com, Allegiant Travel currently has an average rating of "Hold" and a consensus price target of $70.11.

Check Out Our Latest Research Report on ALGT

Allegiant Travel Stock Down 4.5 %

Shares of ALGT traded down $3.49 during midday trading on Monday, reaching $74.20. 405,285 shares of the stock were exchanged, compared to its average volume of 372,184. The company has a current ratio of 0.75, a quick ratio of 0.72 and a debt-to-equity ratio of 1.36. The company's 50 day moving average is $57.95 and its two-hundred day moving average is $51.82. The company has a market capitalization of $1.36 billion, a P/E ratio of -51.79, a PEG ratio of 6.17 and a beta of 1.61. Allegiant Travel has a 52 week low of $36.08 and a 52 week high of $85.91.

Insiders Place Their Bets

In related news, COO Keny Frank Wilper sold 635 shares of the stock in a transaction that occurred on Wednesday, October 23rd. The shares were sold at an average price of $62.69, for a total transaction of $39,808.15. Following the completion of the sale, the chief operating officer now owns 16,353 shares of the company's stock, valued at $1,025,169.57. This represents a 3.74 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Gary Ellmer sold 1,000 shares of Allegiant Travel stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $45.00, for a total value of $45,000.00. Following the transaction, the director now owns 7,490 shares of the company's stock, valued at approximately $337,050. This represents a 11.78 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 1,931 shares of company stock worth $101,372 in the last three months. Corporate insiders own 15.80% of the company's stock.

About Allegiant Travel

(

Free Report)

Allegiant Travel Company, a leisure travel company, provides travel services and products to residents of under-served cities in the United States. The company offers scheduled air transportation on limited-frequency, nonstop flights between under-served cities and leisure destinations. As of February 1, 2024, it operated a fleet of 126 Airbus A320 series aircraft.

Read More

Before you consider Allegiant Travel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegiant Travel wasn't on the list.

While Allegiant Travel currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.