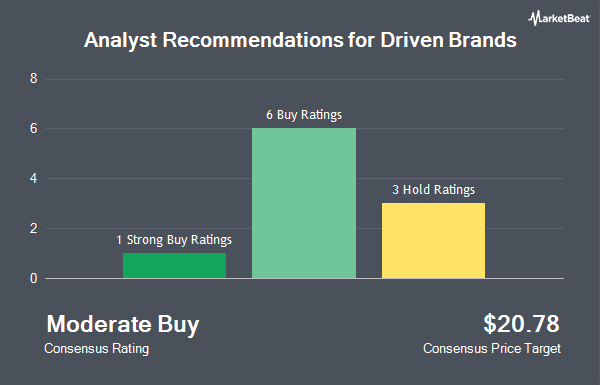

Shares of Driven Brands Holdings Inc. (NASDAQ:DRVN - Get Free Report) have been given a consensus recommendation of "Moderate Buy" by the twelve analysts that are presently covering the firm, MarketBeat Ratings reports. Four equities research analysts have rated the stock with a hold recommendation, seven have assigned a buy recommendation and one has issued a strong buy recommendation on the company. The average 1-year price target among brokerages that have updated their coverage on the stock in the last year is $17.86.

A number of brokerages recently issued reports on DRVN. The Goldman Sachs Group increased their price objective on Driven Brands from $14.00 to $16.00 and gave the stock a "neutral" rating in a report on Friday, August 2nd. Piper Sandler reissued an "overweight" rating and issued a $17.00 price objective (up from $14.00) on shares of Driven Brands in a report on Friday, August 2nd. BMO Capital Markets began coverage on Driven Brands in a report on Monday, July 22nd. They issued a "market perform" rating and a $14.00 price objective for the company. Canaccord Genuity Group increased their price objective on Driven Brands from $20.00 to $21.00 and gave the stock a "buy" rating in a report on Friday, November 1st. Finally, Royal Bank of Canada increased their price target on Driven Brands from $17.00 to $20.00 and gave the company an "outperform" rating in a research note on Friday, November 1st.

Read Our Latest Stock Analysis on DRVN

Driven Brands Stock Down 0.7 %

NASDAQ DRVN traded down $0.12 on Tuesday, hitting $16.36. 323,071 shares of the stock traded hands, compared to its average volume of 1,070,599. The stock has a 50-day moving average of $14.78 and a 200 day moving average of $13.35. Driven Brands has a twelve month low of $10.59 and a twelve month high of $16.93. The company has a market capitalization of $2.68 billion, a P/E ratio of 409.75, a price-to-earnings-growth ratio of 1.10 and a beta of 1.11. The company has a current ratio of 1.90, a quick ratio of 1.72 and a debt-to-equity ratio of 2.84.

Driven Brands (NASDAQ:DRVN - Get Free Report) last posted its earnings results on Thursday, October 31st. The company reported $0.26 EPS for the quarter, beating the consensus estimate of $0.22 by $0.04. The company had revenue of $591.70 million during the quarter, compared to analyst estimates of $598.49 million. Driven Brands had a return on equity of 14.86% and a net margin of 0.27%. The business's revenue was up 1.8% compared to the same quarter last year. During the same period in the prior year, the company earned $0.19 earnings per share. As a group, analysts expect that Driven Brands will post 0.86 earnings per share for the current fiscal year.

Institutional Trading of Driven Brands

Several hedge funds and other institutional investors have recently modified their holdings of DRVN. Allspring Global Investments Holdings LLC purchased a new stake in shares of Driven Brands during the first quarter worth $26,000. Innealta Capital LLC bought a new stake in shares of Driven Brands in the second quarter valued at about $86,000. nVerses Capital LLC bought a new position in Driven Brands during the third quarter worth about $86,000. Townsquare Capital LLC bought a new position in shares of Driven Brands in the third quarter valued at approximately $153,000. Finally, Bleakley Financial Group LLC bought a new position in shares of Driven Brands in the third quarter valued at approximately $171,000. 77.08% of the stock is currently owned by hedge funds and other institutional investors.

About Driven Brands

(

Get Free ReportDriven Brands Holdings Inc, together with its subsidiaries, provides automotive services to retail and commercial customers in the United States, Canada, and internationally. It offers various services, such as paint, collision, glass, repair, car wash, oil change, and maintenance services. The company also distributes automotive parts, including radiators, air conditioning components, and exhaust products to automotive repair shops, auto parts stores, body shops, and other auto repair outlets; windshields and glass accessories through a network of distribution centers; and consumable products, such as oil filters and wiper blades, as well as training services to repair and maintenance, and paint and collision shops.

Featured Articles

Before you consider Driven Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Driven Brands wasn't on the list.

While Driven Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.