DRW Securities LLC purchased a new position in shares of Vertex, Inc. (NASDAQ:VERX - Free Report) during the third quarter, according to its most recent disclosure with the SEC. The institutional investor purchased 21,800 shares of the company's stock, valued at approximately $840,000.

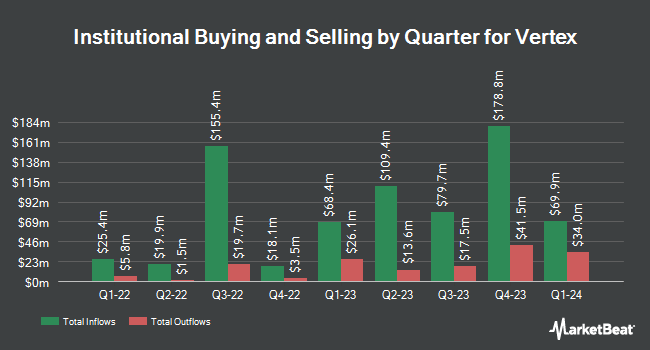

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. Vanguard Group Inc. grew its holdings in shares of Vertex by 4.2% during the first quarter. Vanguard Group Inc. now owns 5,791,215 shares of the company's stock valued at $183,929,000 after buying an additional 235,407 shares during the last quarter. Lazard Asset Management LLC purchased a new stake in shares of Vertex in the first quarter worth approximately $192,000. Bayesian Capital Management LP bought a new position in shares of Vertex in the first quarter valued at approximately $321,000. California State Teachers Retirement System boosted its position in shares of Vertex by 6.3% during the first quarter. California State Teachers Retirement System now owns 46,115 shares of the company's stock valued at $1,465,000 after buying an additional 2,719 shares during the last quarter. Finally, Comerica Bank grew its holdings in Vertex by 12.1% during the first quarter. Comerica Bank now owns 230,848 shares of the company's stock worth $7,332,000 after buying an additional 24,851 shares in the last quarter. Institutional investors own 59.10% of the company's stock.

Vertex Stock Performance

Shares of Vertex stock traded up $0.27 on Tuesday, hitting $55.15. 747,701 shares of the company's stock were exchanged, compared to its average volume of 790,404. Vertex, Inc. has a 1 year low of $23.31 and a 1 year high of $55.52. The company has a 50-day simple moving average of $43.46 and a 200-day simple moving average of $38.39. The company has a debt-to-equity ratio of 1.29, a quick ratio of 1.04 and a current ratio of 1.04. The stock has a market capitalization of $8.60 billion, a PE ratio of 306.39, a PEG ratio of 10.10 and a beta of 0.67.

Vertex (NASDAQ:VERX - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The company reported $0.16 earnings per share for the quarter, topping analysts' consensus estimates of $0.14 by $0.02. Vertex had a return on equity of 24.92% and a net margin of 4.73%. The firm had revenue of $170.40 million during the quarter, compared to analyst estimates of $165.70 million. During the same quarter in the prior year, the company posted $0.06 earnings per share. The business's quarterly revenue was up 17.5% compared to the same quarter last year. As a group, equities analysts anticipate that Vertex, Inc. will post 0.38 EPS for the current year.

Insider Activity

In other news, CEO David Destefano sold 159,107 shares of the stock in a transaction dated Thursday, November 14th. The stock was sold at an average price of $49.61, for a total value of $7,893,298.27. Following the transaction, the chief executive officer now directly owns 332,290 shares of the company's stock, valued at approximately $16,484,906.90. This represents a 32.38 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, major shareholder Jeffrey Westphal sold 2,485,000 shares of the firm's stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $48.90, for a total transaction of $121,516,500.00. Following the transaction, the insider now directly owns 7,895 shares of the company's stock, valued at $386,065.50. This represents a 99.68 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 4,171,822 shares of company stock valued at $191,086,808 in the last ninety days. Insiders own 44.58% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have weighed in on VERX shares. Needham & Company LLC raised their price objective on Vertex from $45.00 to $60.00 and gave the company a "buy" rating in a research note on Thursday, November 7th. Stifel Nicolaus boosted their target price on Vertex from $41.00 to $52.00 and gave the stock a "buy" rating in a research note on Thursday, November 7th. Morgan Stanley boosted their target price on shares of Vertex from $50.00 to $62.00 and gave the company an "overweight" rating in a research note on Wednesday, November 13th. Robert W. Baird upped their price objective on shares of Vertex from $43.00 to $57.00 and gave the company an "outperform" rating in a report on Thursday, November 7th. Finally, BMO Capital Markets lifted their target price on Vertex from $42.00 to $52.00 and gave the company a "market perform" rating in a report on Thursday, November 7th. Three equities research analysts have rated the stock with a hold rating, seven have issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $52.30.

Get Our Latest Report on VERX

Vertex Profile

(

Free Report)

Vertex, Inc, together with its subsidiaries, provides enterprise tax technology solutions for retail trade, wholesale trade, and manufacturing industries in the United States and internationally. The company offers tax determination; compliance and reporting, including workflow management tools, role-based security, and event logging; tax data management; document management; analytics and insights; pre-built integration that includes mapping data fields, and business logic and configurations; industry-specific solutions; and technology specific solutions, such as chain flow accelerator and SAP-specific tools.

Featured Stories

Before you consider Vertex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vertex wasn't on the list.

While Vertex currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.