DRW Securities LLC acquired a new position in shares of DexCom, Inc. (NASDAQ:DXCM - Free Report) in the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund acquired 4,435 shares of the medical device company's stock, valued at approximately $345,000.

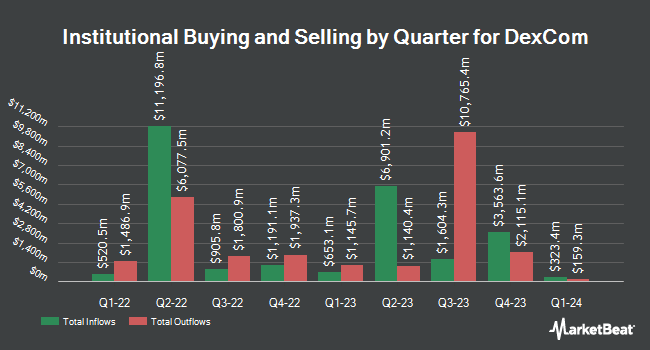

A number of other hedge funds also recently made changes to their positions in the stock. Geode Capital Management LLC grew its holdings in shares of DexCom by 2.2% during the 3rd quarter. Geode Capital Management LLC now owns 9,937,604 shares of the medical device company's stock valued at $664,056,000 after purchasing an additional 214,136 shares during the last quarter. Coldstream Capital Management Inc. boosted its holdings in DexCom by 45.3% during the 3rd quarter. Coldstream Capital Management Inc. now owns 11,253 shares of the medical device company's stock valued at $781,000 after acquiring an additional 3,508 shares during the period. Toronto Dominion Bank grew its position in DexCom by 3.1% during the 3rd quarter. Toronto Dominion Bank now owns 204,522 shares of the medical device company's stock worth $13,711,000 after acquiring an additional 6,227 shares during the last quarter. Virtu Financial LLC purchased a new position in DexCom in the 3rd quarter worth approximately $1,020,000. Finally, Pine Valley Investments Ltd Liability Co lifted its position in DexCom by 59.2% in the third quarter. Pine Valley Investments Ltd Liability Co now owns 5,679 shares of the medical device company's stock valued at $381,000 after purchasing an additional 2,111 shares during the last quarter. 97.75% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on the stock. Redburn Atlantic raised shares of DexCom from a "neutral" rating to a "buy" rating and lifted their target price for the stock from $85.00 to $115.00 in a research note on Monday, February 3rd. Robert W. Baird upgraded shares of DexCom from a "neutral" rating to an "outperform" rating and increased their target price for the stock from $86.00 to $104.00 in a report on Thursday, January 16th. Wells Fargo & Company reiterated an "overweight" rating on shares of DexCom in a report on Saturday, March 8th. Canaccord Genuity Group raised their target price on shares of DexCom from $99.00 to $103.00 and gave the stock a "buy" rating in a research report on Friday, February 14th. Finally, Mizuho began coverage on shares of DexCom in a research report on Thursday, April 10th. They set an "outperform" rating and a $85.00 price target on the stock. Five research analysts have rated the stock with a hold rating, thirteen have assigned a buy rating and three have issued a strong buy rating to the stock. According to MarketBeat, DexCom has an average rating of "Moderate Buy" and a consensus price target of $99.00.

Check Out Our Latest Analysis on DXCM

Insider Transactions at DexCom

In related news, EVP Jereme M. Sylvain sold 2,090 shares of DexCom stock in a transaction dated Wednesday, January 29th. The stock was sold at an average price of $86.91, for a total value of $181,641.90. Following the completion of the transaction, the executive vice president now owns 83,526 shares in the company, valued at approximately $7,259,244.66. This trade represents a 2.44 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, COO Jacob Steven Leach sold 2,634 shares of the firm's stock in a transaction that occurred on Wednesday, January 29th. The shares were sold at an average price of $86.91, for a total value of $228,920.94. Following the completion of the sale, the chief operating officer now directly owns 268,644 shares of the company's stock, valued at $23,347,850.04. The trade was a 0.97 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 105,009 shares of company stock valued at $8,044,178 in the last ninety days. Corporate insiders own 0.30% of the company's stock.

DexCom Price Performance

Shares of DexCom stock traded up $1.85 during trading hours on Tuesday, hitting $69.24. The company's stock had a trading volume of 3,439,581 shares, compared to its average volume of 4,194,899. The company has a market cap of $27.15 billion, a PE ratio of 48.42, a PEG ratio of 2.30 and a beta of 1.50. The company has a debt-to-equity ratio of 0.59, a quick ratio of 1.28 and a current ratio of 1.47. The business has a 50 day moving average price of $76.49 and a two-hundred day moving average price of $76.68. DexCom, Inc. has a 12-month low of $57.52 and a 12-month high of $139.24.

DexCom (NASDAQ:DXCM - Get Free Report) last posted its quarterly earnings results on Thursday, February 13th. The medical device company reported $0.45 EPS for the quarter, missing analysts' consensus estimates of $0.50 by ($0.05). DexCom had a return on equity of 30.14% and a net margin of 14.29%. Analysts expect that DexCom, Inc. will post 2.03 earnings per share for the current fiscal year.

DexCom Profile

(

Free Report)

DexCom, Inc, a medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally. The company provides its systems for use by people with diabetes, as well as for use by healthcare providers. Its products include Dexcom G6 and Dexcom G7, integrated CGM systems for diabetes management; Dexcom Share, a remote monitoring system; Dexcom Real-Time API, which enables authorized third-party software developers to integrate real-time CGM data into their digital health apps and devices; and Dexcom ONE, that is designed to replace finger stick blood glucose testing for diabetes treatment decisions.

Read More

Before you consider DexCom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DexCom wasn't on the list.

While DexCom currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.