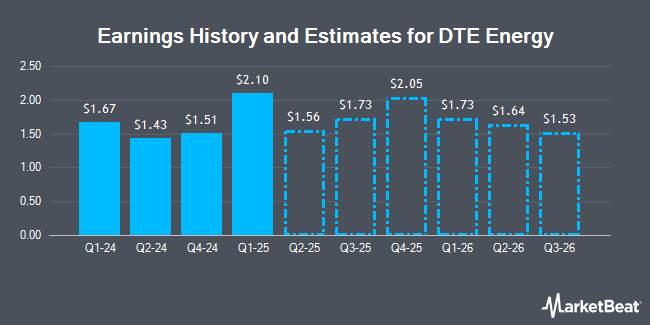

DTE Energy (NYSE:DTE - Get Free Report) issued an update on its FY 2024 earnings guidance on Friday morning. The company provided earnings per share (EPS) guidance of 6.540-6.830 for the period, compared to the consensus estimate of 6.740. The company issued revenue guidance of -.

DTE Energy Trading Down 1.6 %

Shares of NYSE DTE traded down $1.96 on Friday, reaching $119.05. 1,082,776 shares of the company traded hands, compared to its average volume of 872,446. DTE Energy has a fifty-two week low of $102.17 and a fifty-two week high of $131.66. The company has a current ratio of 0.83, a quick ratio of 0.62 and a debt-to-equity ratio of 1.76. The company has a 50 day moving average of $121.41 and a 200 day moving average of $121.48. The stock has a market capitalization of $24.66 billion, a PE ratio of 16.13, a P/E/G ratio of 2.23 and a beta of 0.68.

DTE Energy Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Monday, December 16th will be paid a dividend of $1.09 per share. This is an increase from DTE Energy's previous quarterly dividend of $1.02. This represents a $4.36 annualized dividend and a yield of 3.66%. The ex-dividend date is Monday, December 16th. DTE Energy's payout ratio is currently 59.08%.

Wall Street Analyst Weigh In

A number of brokerages recently weighed in on DTE. Jefferies Financial Group started coverage on shares of DTE Energy in a research report on Monday, October 21st. They set a "hold" rating and a $137.00 price target for the company. BMO Capital Markets upped their target price on DTE Energy from $135.00 to $140.00 and gave the stock a "market perform" rating in a research report on Friday, October 18th. Wells Fargo & Company raised their target price on DTE Energy from $133.00 to $145.00 and gave the company an "overweight" rating in a report on Friday, October 25th. Morgan Stanley decreased their price target on DTE Energy from $131.00 to $128.00 and set an "overweight" rating for the company in a report on Friday, November 22nd. Finally, Barclays boosted their target price on shares of DTE Energy from $128.00 to $137.00 and gave the stock an "overweight" rating in a research report on Monday, October 7th. Seven research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the stock. According to data from MarketBeat.com, DTE Energy presently has a consensus rating of "Moderate Buy" and a consensus price target of $134.31.

View Our Latest Stock Analysis on DTE Energy

DTE Energy Company Profile

(

Get Free Report)

DTE Energy Company engages in the utility operations. The company's Electric segment generates, purchases, distributes, and sells electricity to various residential, commercial, and industrial customers in southeastern Michigan. It generates electricity through coal-fired plants, hydroelectric pumped storage, and nuclear plants, as well as wind and solar assets.

Featured Stories

Before you consider DTE Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DTE Energy wasn't on the list.

While DTE Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.