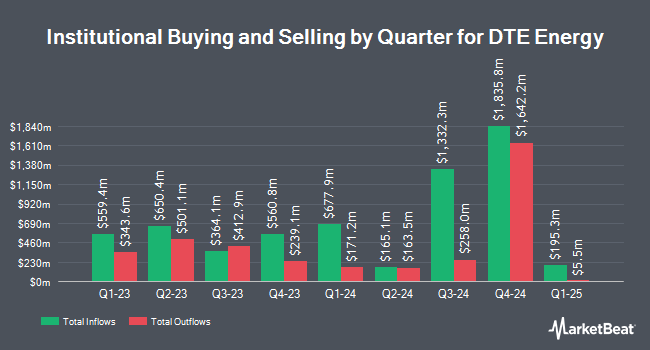

Janus Henderson Group PLC lifted its stake in DTE Energy (NYSE:DTE - Free Report) by 2.4% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 2,720,265 shares of the utilities provider's stock after purchasing an additional 64,880 shares during the period. Janus Henderson Group PLC owned 1.31% of DTE Energy worth $349,309,000 at the end of the most recent reporting period.

Several other hedge funds and other institutional investors have also recently modified their holdings of the stock. Farther Finance Advisors LLC increased its stake in shares of DTE Energy by 2.3% in the 3rd quarter. Farther Finance Advisors LLC now owns 3,588 shares of the utilities provider's stock worth $461,000 after purchasing an additional 81 shares in the last quarter. Signaturefd LLC raised its stake in shares of DTE Energy by 3.1% during the third quarter. Signaturefd LLC now owns 2,889 shares of the utilities provider's stock valued at $371,000 after acquiring an additional 86 shares in the last quarter. Aptus Capital Advisors LLC raised its stake in shares of DTE Energy by 3.7% during the second quarter. Aptus Capital Advisors LLC now owns 2,632 shares of the utilities provider's stock valued at $292,000 after acquiring an additional 94 shares in the last quarter. ASB Consultores LLC raised its stake in shares of DTE Energy by 4.9% during the second quarter. ASB Consultores LLC now owns 2,179 shares of the utilities provider's stock valued at $242,000 after acquiring an additional 101 shares in the last quarter. Finally, Centennial Wealth Advisory LLC raised its stake in shares of DTE Energy by 2.1% during the third quarter. Centennial Wealth Advisory LLC now owns 5,338 shares of the utilities provider's stock valued at $685,000 after acquiring an additional 110 shares in the last quarter. 76.06% of the stock is currently owned by hedge funds and other institutional investors.

DTE Energy Trading Down 0.6 %

Shares of DTE Energy stock traded down $0.72 during mid-day trading on Wednesday, hitting $122.26. The stock had a trading volume of 1,047,598 shares, compared to its average volume of 1,121,639. The firm has a 50-day moving average of $124.56 and a two-hundred day moving average of $120.16. DTE Energy has a 12-month low of $102.17 and a 12-month high of $131.66. The company has a quick ratio of 0.62, a current ratio of 0.83 and a debt-to-equity ratio of 1.76. The firm has a market cap of $25.32 billion, a P/E ratio of 16.57, a price-to-earnings-growth ratio of 2.28 and a beta of 0.68.

DTE Energy Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Monday, December 16th will be issued a $1.09 dividend. This is a positive change from DTE Energy's previous quarterly dividend of $1.02. This represents a $4.36 annualized dividend and a dividend yield of 3.57%. DTE Energy's dividend payout ratio is currently 55.28%.

Wall Street Analysts Forecast Growth

Several brokerages recently issued reports on DTE. StockNews.com raised shares of DTE Energy from a "sell" rating to a "hold" rating in a report on Tuesday, November 5th. BMO Capital Markets lifted their price objective on shares of DTE Energy from $135.00 to $140.00 and gave the company a "market perform" rating in a report on Friday, October 18th. Wells Fargo & Company lifted their price objective on shares of DTE Energy from $133.00 to $145.00 and gave the company an "overweight" rating in a report on Friday, October 25th. Mizuho lifted their price objective on shares of DTE Energy from $121.00 to $133.00 and gave the company an "outperform" rating in a report on Tuesday, September 10th. Finally, Jefferies Financial Group initiated coverage on shares of DTE Energy in a report on Monday, October 21st. They issued a "hold" rating and a $137.00 price target on the stock. Seven analysts have rated the stock with a hold rating and nine have assigned a buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $132.29.

Read Our Latest Stock Analysis on DTE

About DTE Energy

(

Free Report)

DTE Energy Company engages in the utility operations. The company's Electric segment generates, purchases, distributes, and sells electricity to various residential, commercial, and industrial customers in southeastern Michigan. It generates electricity through coal-fired plants, hydroelectric pumped storage, and nuclear plants, as well as wind and solar assets.

Read More

Before you consider DTE Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DTE Energy wasn't on the list.

While DTE Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.