Duff & Phelps Investment Management Co. purchased a new stake in SJW Group (NYSE:SJW - Free Report) during the third quarter, according to its most recent filing with the SEC. The firm purchased 27,408 shares of the utilities provider's stock, valued at approximately $1,593,000. Duff & Phelps Investment Management Co. owned 0.08% of SJW Group at the end of the most recent reporting period.

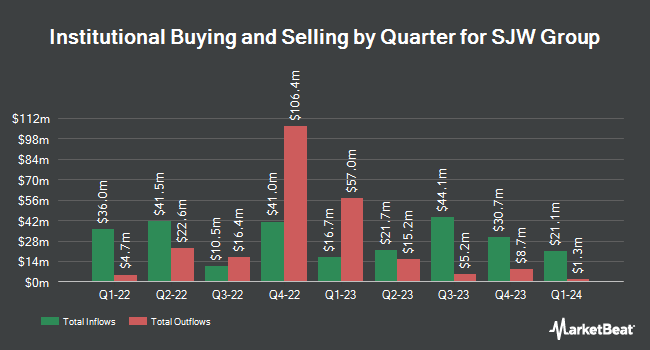

A number of other hedge funds and other institutional investors also recently made changes to their positions in SJW. Arizona State Retirement System increased its stake in SJW Group by 2.3% during the 2nd quarter. Arizona State Retirement System now owns 8,526 shares of the utilities provider's stock worth $462,000 after purchasing an additional 189 shares in the last quarter. Point72 DIFC Ltd increased its position in shares of SJW Group by 81.4% during the third quarter. Point72 DIFC Ltd now owns 704 shares of the utilities provider's stock worth $41,000 after acquiring an additional 316 shares in the last quarter. CWM LLC raised its holdings in shares of SJW Group by 184.2% during the second quarter. CWM LLC now owns 520 shares of the utilities provider's stock worth $28,000 after acquiring an additional 337 shares during the period. Louisiana State Employees Retirement System lifted its position in SJW Group by 2.8% in the 2nd quarter. Louisiana State Employees Retirement System now owns 14,800 shares of the utilities provider's stock valued at $802,000 after acquiring an additional 400 shares in the last quarter. Finally, US Bancorp DE boosted its stake in SJW Group by 53.8% in the 3rd quarter. US Bancorp DE now owns 1,255 shares of the utilities provider's stock worth $73,000 after purchasing an additional 439 shares during the period. 84.29% of the stock is owned by institutional investors.

SJW Group Stock Up 1.0 %

SJW stock traded up $0.54 during mid-day trading on Tuesday, reaching $53.68. The company had a trading volume of 176,096 shares, compared to its average volume of 190,388. The company has a market capitalization of $1.76 billion, a price-to-earnings ratio of 19.45, a PEG ratio of 3.18 and a beta of 0.62. SJW Group has a 52 week low of $51.17 and a 52 week high of $70.43. The stock has a 50 day simple moving average of $56.10 and a two-hundred day simple moving average of $56.70. The company has a debt-to-equity ratio of 1.25, a current ratio of 0.77 and a quick ratio of 0.77.

SJW Group Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Monday, December 2nd. Stockholders of record on Monday, November 4th were given a $0.40 dividend. This represents a $1.60 dividend on an annualized basis and a dividend yield of 2.98%. The ex-dividend date was Monday, November 4th. SJW Group's dividend payout ratio (DPR) is presently 57.97%.

Analysts Set New Price Targets

A number of brokerages recently issued reports on SJW. StockNews.com lowered SJW Group from a "hold" rating to a "sell" rating in a research report on Tuesday, October 29th. Wells Fargo & Company cut their price objective on shares of SJW Group from $63.00 to $61.00 and set an "equal weight" rating on the stock in a research report on Tuesday, October 29th. Finally, Bank of America assumed coverage on shares of SJW Group in a research report on Friday, September 20th. They issued a "neutral" rating and a $65.00 target price for the company.

Get Our Latest Stock Analysis on SJW Group

About SJW Group

(

Free Report)

SJW Group, through its subsidiaries, provides water utility and other related services in the United States. It operates in Water Utility Services and Real Estate Services segments. The company engages in the production, purchase, storage, purification, distribution, wholesale, and retail sale of water and wastewater services; and supplies groundwater from wells, surface water from watershed run-off and diversion, reclaimed water, and imported water purchased from the Santa Clara Valley Water District.

Featured Articles

Before you consider SJW Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SJW Group wasn't on the list.

While SJW Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.