Duke Energy (NYSE:DUK - Get Free Report) had its price objective upped by investment analysts at UBS Group from $123.00 to $127.00 in a research report issued on Friday,Benzinga reports. The brokerage presently has a "neutral" rating on the utilities provider's stock. UBS Group's price target suggests a potential upside of 9.74% from the company's current price.

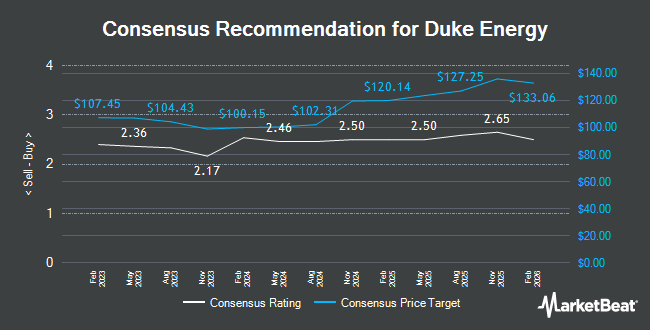

Several other research analysts have also recently weighed in on DUK. Guggenheim lifted their price target on shares of Duke Energy from $132.00 to $135.00 and gave the stock a "buy" rating in a research note on Wednesday, March 5th. BMO Capital Markets raised their price objective on shares of Duke Energy from $123.00 to $128.00 and gave the company an "outperform" rating in a research report on Tuesday, March 11th. Morgan Stanley upped their price target on Duke Energy from $123.00 to $128.00 and gave the stock an "equal weight" rating in a research note on Thursday, March 20th. JPMorgan Chase & Co. lifted their price target on Duke Energy from $114.00 to $121.00 and gave the stock a "neutral" rating in a research report on Tuesday, March 11th. Finally, Jefferies Financial Group upped their price objective on Duke Energy from $129.00 to $132.00 and gave the company a "buy" rating in a research report on Friday, February 21st. Seven investment analysts have rated the stock with a hold rating and eight have given a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $123.87.

Read Our Latest Stock Report on Duke Energy

Duke Energy Stock Down 2.1 %

Shares of DUK stock traded down $2.43 during midday trading on Friday, reaching $115.72. 670,504 shares of the stock were exchanged, compared to its average volume of 2,999,686. The firm has a market cap of $89.92 billion, a PE ratio of 20.31, a price-to-earnings-growth ratio of 2.79 and a beta of 0.48. The company's 50 day moving average is $114.39 and its two-hundred day moving average is $113.66. Duke Energy has a 1 year low of $92.75 and a 1 year high of $121.47. The company has a current ratio of 0.67, a quick ratio of 0.44 and a debt-to-equity ratio of 1.52.

Duke Energy (NYSE:DUK - Get Free Report) last announced its quarterly earnings results on Thursday, February 13th. The utilities provider reported $1.66 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.61 by $0.05. Duke Energy had a net margin of 14.90% and a return on equity of 9.50%. On average, equities research analysts predict that Duke Energy will post 6.33 EPS for the current year.

Hedge Funds Weigh In On Duke Energy

Several large investors have recently bought and sold shares of DUK. Bailard Inc. increased its position in Duke Energy by 10.9% in the 4th quarter. Bailard Inc. now owns 31,921 shares of the utilities provider's stock valued at $3,439,000 after acquiring an additional 3,139 shares during the period. KMG Fiduciary Partners LLC boosted its stake in shares of Duke Energy by 5.5% during the 4th quarter. KMG Fiduciary Partners LLC now owns 52,097 shares of the utilities provider's stock worth $5,613,000 after acquiring an additional 2,705 shares in the last quarter. Sequoia Financial Advisors LLC grew its holdings in shares of Duke Energy by 25.7% in the 4th quarter. Sequoia Financial Advisors LLC now owns 35,755 shares of the utilities provider's stock worth $3,852,000 after acquiring an additional 7,319 shares during the period. First Business Financial Services Inc. purchased a new stake in Duke Energy during the fourth quarter worth $384,000. Finally, Pines Wealth Management LLC acquired a new stake in Duke Energy in the fourth quarter valued at $1,032,000. Institutional investors and hedge funds own 65.31% of the company's stock.

About Duke Energy

(

Get Free Report)

Duke Energy Corporation, together with its subsidiaries, operates as an energy company in the United States. It operates through two segments: Electric Utilities and Infrastructure (EU&I), and Gas Utilities and Infrastructure (GU&I). The EU&I segment generates, transmits, distributes, and sells electricity in the Carolinas, Florida, and the Midwest.

Read More

Before you consider Duke Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Duke Energy wasn't on the list.

While Duke Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.