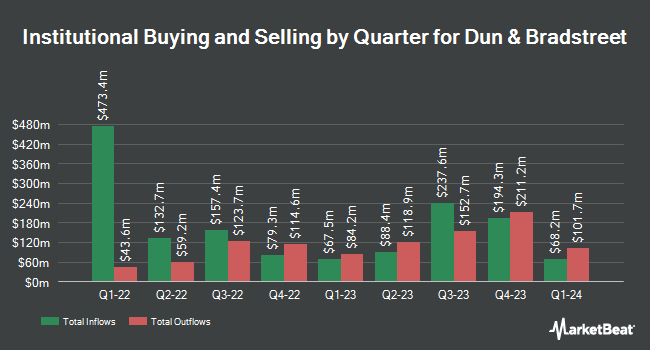

Clark Estates Inc. NY reduced its holdings in shares of Dun & Bradstreet Holdings, Inc. (NYSE:DNB - Free Report) by 12.4% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 2,260,100 shares of the business services provider's stock after selling 320,900 shares during the quarter. Dun & Bradstreet makes up 4.8% of Clark Estates Inc. NY's investment portfolio, making the stock its 2nd largest position. Clark Estates Inc. NY owned approximately 0.51% of Dun & Bradstreet worth $26,014,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds also recently modified their holdings of the business. Blue Trust Inc. increased its stake in shares of Dun & Bradstreet by 129.1% during the 2nd quarter. Blue Trust Inc. now owns 4,549 shares of the business services provider's stock worth $46,000 after purchasing an additional 2,563 shares in the last quarter. Canada Pension Plan Investment Board raised its holdings in shares of Dun & Bradstreet by 85.1% in the second quarter. Canada Pension Plan Investment Board now owns 8,700 shares of the business services provider's stock worth $81,000 after acquiring an additional 4,000 shares during the last quarter. KBC Group NV lifted its position in shares of Dun & Bradstreet by 33.9% in the third quarter. KBC Group NV now owns 9,878 shares of the business services provider's stock valued at $114,000 after acquiring an additional 2,499 shares in the last quarter. Xponance Inc. acquired a new stake in shares of Dun & Bradstreet during the second quarter valued at $100,000. Finally, CIBC Asset Management Inc purchased a new stake in Dun & Bradstreet during the 2nd quarter worth about $118,000. Hedge funds and other institutional investors own 86.68% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities research analysts have issued reports on the stock. Needham & Company LLC reaffirmed a "buy" rating and set a $17.00 price target on shares of Dun & Bradstreet in a research note on Friday, November 1st. The Goldman Sachs Group lifted their target price on shares of Dun & Bradstreet from $10.40 to $11.80 and gave the stock a "neutral" rating in a research note on Monday, August 5th. JPMorgan Chase & Co. increased their price target on Dun & Bradstreet from $11.00 to $13.00 and gave the stock a "neutral" rating in a research note on Monday, August 5th. Royal Bank of Canada dropped their target price on Dun & Bradstreet from $15.00 to $12.00 and set a "sector perform" rating for the company in a research note on Friday, August 2nd. Finally, StockNews.com upgraded Dun & Bradstreet from a "sell" rating to a "hold" rating in a research report on Wednesday, October 2nd. Five research analysts have rated the stock with a hold rating, two have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, Dun & Bradstreet has a consensus rating of "Moderate Buy" and an average price target of $13.83.

View Our Latest Report on Dun & Bradstreet

Dun & Bradstreet Trading Down 0.2 %

NYSE:DNB traded down $0.02 on Wednesday, hitting $12.71. 943,607 shares of the stock were exchanged, compared to its average volume of 3,362,471. The stock has a fifty day moving average of $11.66 and a 200-day moving average of $10.92. The stock has a market cap of $5.61 billion, a PE ratio of -159.00, a PEG ratio of 3.54 and a beta of 1.15. The company has a current ratio of 0.70, a quick ratio of 0.70 and a debt-to-equity ratio of 1.08. Dun & Bradstreet Holdings, Inc. has a fifty-two week low of $8.77 and a fifty-two week high of $12.94.

Dun & Bradstreet (NYSE:DNB - Get Free Report) last posted its quarterly earnings results on Thursday, October 31st. The business services provider reported $0.27 EPS for the quarter, meeting the consensus estimate of $0.27. Dun & Bradstreet had a negative net margin of 1.46% and a positive return on equity of 11.50%. The firm had revenue of $609.10 million for the quarter, compared to analyst estimates of $605.64 million. During the same quarter last year, the firm posted $0.23 earnings per share. Dun & Bradstreet's revenue for the quarter was up 3.5% compared to the same quarter last year. As a group, equities analysts expect that Dun & Bradstreet Holdings, Inc. will post 0.88 earnings per share for the current fiscal year.

Dun & Bradstreet Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Thursday, December 5th will be given a $0.05 dividend. This represents a $0.20 annualized dividend and a dividend yield of 1.57%. The ex-dividend date of this dividend is Thursday, December 5th. Dun & Bradstreet's payout ratio is -250.00%.

About Dun & Bradstreet

(

Free Report)

Dun & Bradstreet Holdings, Inc, together with its subsidiaries, provides business-to-business data and analytics in North America and internationally. It offers finance and risk solutions, including D&B Finance Analytics, an online application that offers clients real time access to its information, comprehensive monitoring, and portfolio analysis; D&B Direct, an application programming interface (API) that delivers risk and financial data directly into enterprise applications for real-time credit decision-making; D&B Small Business, a suite of tools that allows SMBs to monitor and build their business credit file; D&B Enterprise Risk Assessment Manager, a solution for managing and automating credit decisioning and reporting; and D&B Risk Analytics, a subscription-based online application that offers clients real-time access to complete and up-to-date global information to mitigate supply chain risk, regulatory risk, and ESG assessment, as well as other related risks; Risk Guardian, a subscription-based online application that offers real-time access to Northern Europe information, monitoring, and portfolio analysis; and D&B Beneficial Ownership that offers risk intelligence on ultimate beneficial ownership.

Featured Articles

Before you consider Dun & Bradstreet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dun & Bradstreet wasn't on the list.

While Dun & Bradstreet currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.