Duncan Williams Asset Management LLC boosted its stake in Merck & Co., Inc. (NYSE:MRK - Free Report) by 66.0% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 7,656 shares of the company's stock after purchasing an additional 3,045 shares during the period. Duncan Williams Asset Management LLC's holdings in Merck & Co., Inc. were worth $762,000 at the end of the most recent quarter.

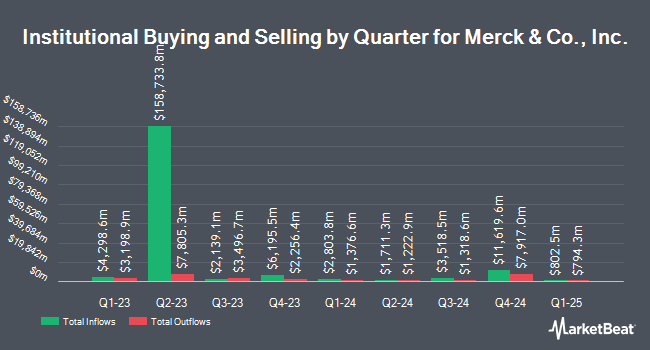

Several other institutional investors also recently modified their holdings of the stock. State Street Corp increased its holdings in Merck & Co., Inc. by 1.3% in the third quarter. State Street Corp now owns 119,026,412 shares of the company's stock valued at $13,606,360,000 after purchasing an additional 1,536,474 shares during the period. Wellington Management Group LLP increased its stake in shares of Merck & Co., Inc. by 4.6% in the third quarter. Wellington Management Group LLP now owns 75,809,383 shares of the company's stock valued at $8,608,914,000 after buying an additional 3,327,404 shares during the period. Geode Capital Management LLC raised its position in shares of Merck & Co., Inc. by 3.7% during the third quarter. Geode Capital Management LLC now owns 59,155,004 shares of the company's stock worth $6,696,060,000 after acquiring an additional 2,134,296 shares during the last quarter. Charles Schwab Investment Management Inc. raised its position in shares of Merck & Co., Inc. by 2.8% during the third quarter. Charles Schwab Investment Management Inc. now owns 18,807,293 shares of the company's stock worth $2,135,785,000 after acquiring an additional 514,060 shares during the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in shares of Merck & Co., Inc. by 1.8% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 17,756,021 shares of the company's stock worth $2,016,374,000 after acquiring an additional 309,656 shares during the period. 76.07% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

MRK has been the subject of a number of recent analyst reports. Truist Financial reissued a "hold" rating and set a $110.00 target price (down previously from $130.00) on shares of Merck & Co., Inc. in a research report on Wednesday, January 8th. HSBC raised shares of Merck & Co., Inc. from a "hold" rating to a "buy" rating and set a $130.00 target price for the company in a research note on Wednesday, December 4th. UBS Group cut their price target on shares of Merck & Co., Inc. from $125.00 to $120.00 and set a "buy" rating on the stock in a research report on Wednesday, January 8th. Wells Fargo & Company lowered their price objective on Merck & Co., Inc. from $125.00 to $110.00 and set an "equal weight" rating for the company in a research report on Friday, November 1st. Finally, Citigroup dropped their price objective on Merck & Co., Inc. from $140.00 to $130.00 and set a "buy" rating on the stock in a research note on Friday, October 25th. One investment analyst has rated the stock with a sell rating, eight have assigned a hold rating, nine have assigned a buy rating and four have issued a strong buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $123.00.

Get Our Latest Stock Report on Merck & Co., Inc.

Merck & Co., Inc. Stock Down 1.1 %

MRK traded down $1.09 during trading on Friday, hitting $95.54. 12,242,285 shares of the company's stock were exchanged, compared to its average volume of 8,030,870. Merck & Co., Inc. has a fifty-two week low of $94.48 and a fifty-two week high of $134.63. The stock has a market cap of $241.69 billion, a P/E ratio of 20.03, a PEG ratio of 1.13 and a beta of 0.39. The business's 50 day moving average is $99.80 and its two-hundred day moving average is $108.69. The company has a quick ratio of 1.15, a current ratio of 1.36 and a debt-to-equity ratio of 0.79.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last posted its earnings results on Thursday, October 31st. The company reported $1.57 earnings per share for the quarter, topping analysts' consensus estimates of $1.50 by $0.07. The company had revenue of $16.66 billion for the quarter, compared to analyst estimates of $16.47 billion. Merck & Co., Inc. had a net margin of 19.23% and a return on equity of 36.42%. The firm's revenue was up 4.4% compared to the same quarter last year. During the same quarter in the prior year, the business posted $2.13 EPS. As a group, equities analysts expect that Merck & Co., Inc. will post 7.67 earnings per share for the current fiscal year.

Merck & Co., Inc. Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Wednesday, January 8th. Investors of record on Monday, December 16th were given a dividend of $0.81 per share. This is a boost from Merck & Co., Inc.'s previous quarterly dividend of $0.77. The ex-dividend date was Monday, December 16th. This represents a $3.24 annualized dividend and a dividend yield of 3.39%. Merck & Co., Inc.'s payout ratio is presently 67.92%.

Merck & Co., Inc. Company Profile

(

Free Report)

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

Recommended Stories

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report