Dunelm Group (LON:DNLM - Get Free Report)'s stock had its "buy" rating reaffirmed by stock analysts at Berenberg Bank in a research note issued to investors on Thursday, MarketBeat Ratings reports. They currently have a GBX 1,430 ($18.25) target price on the stock. Berenberg Bank's price target would indicate a potential upside of 25.43% from the company's previous close.

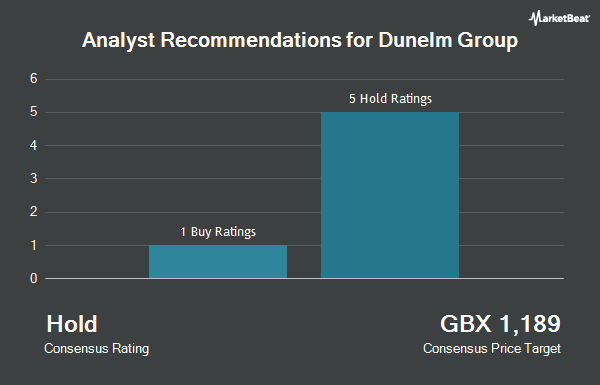

Several other equities analysts have also commented on the stock. Shore Capital restated a "not rated" rating on shares of Dunelm Group in a research report on Thursday, October 24th. JPMorgan Chase & Co. upped their target price on shares of Dunelm Group from GBX 1,140 ($14.55) to GBX 1,170 ($14.93) and gave the stock a "neutral" rating in a research report on Tuesday, September 24th. Canaccord Genuity Group restated a "buy" rating and issued a GBX 1,325 ($16.91) price target on shares of Dunelm Group in a research note on Thursday, October 24th. Finally, Deutsche Bank Aktiengesellschaft reiterated a "hold" rating and set a GBX 1,060 ($13.53) price objective on shares of Dunelm Group in a research report on Thursday, September 12th. Three analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. According to data from MarketBeat, Dunelm Group has a consensus rating of "Hold" and a consensus target price of GBX 1,237 ($15.78).

Read Our Latest Research Report on DNLM

Dunelm Group Stock Performance

DNLM traded up GBX 6.09 ($0.08) during trading on Thursday, reaching GBX 1,140.09 ($14.55). 194,682 shares of the company were exchanged, compared to its average volume of 346,448. Dunelm Group has a 52 week low of GBX 959 ($12.24) and a 52 week high of GBX 1,279 ($16.32). The company has a current ratio of 1.04, a quick ratio of 0.16 and a debt-to-equity ratio of 236.84. The firm has a 50 day moving average of GBX 1,156.38 and a 200 day moving average of GBX 1,155.79. The stock has a market cap of £2.31 billion, a P/E ratio of 1,532.43, a PEG ratio of -10.32 and a beta of 1.18.

Insider Activity

In other Dunelm Group news, insider Karen Witts bought 8,375 shares of the company's stock in a transaction that occurred on Thursday, October 31st. The shares were acquired at an average cost of GBX 1,126 ($14.37) per share, for a total transaction of £94,302.50 ($120,329.85). Also, insider Nick Wilkinson sold 28,236 shares of the stock in a transaction that occurred on Tuesday, October 29th. The shares were sold at an average price of GBX 1,161 ($14.81), for a total transaction of £327,819.96 ($418,297.77). Insiders own 34.28% of the company's stock.

Dunelm Group Company Profile

(

Get Free Report)

Dunelm Group plc retails homewares in the United Kingdom. The company offers furniture and beds products, which include bedroom, living room, dining room, and other furniture, as well as bed and mattresses, and sofas and armchairs; bedding products comprising bed linen, dorma, baby and kid's bedding, and duvets, pillows, and protectors; curtains and rugs; and venetian, roller, roman, vertical, and made to measure blinds.

See Also

Before you consider Dunelm Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dunelm Group wasn't on the list.

While Dunelm Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.