DXC Technology (NYSE:DXC - Free Report) had its target price hoisted by Susquehanna from $19.00 to $23.00 in a research note issued to investors on Friday,Benzinga reports. Susquehanna currently has a neutral rating on the stock.

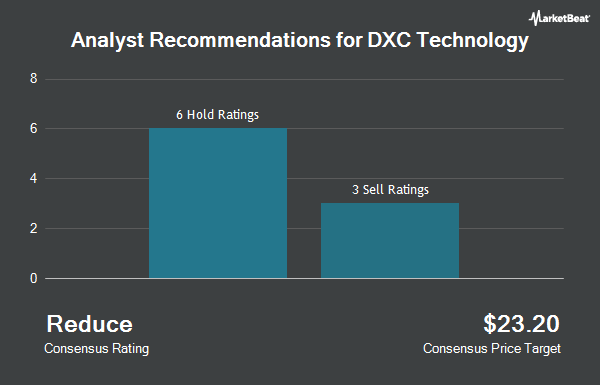

DXC has been the topic of several other reports. Royal Bank of Canada increased their price objective on shares of DXC Technology from $18.00 to $20.00 and gave the stock a "sector perform" rating in a report on Friday, August 9th. BMO Capital Markets boosted their price objective on shares of DXC Technology from $17.50 to $22.00 and gave the company a "market perform" rating in a research note on Friday, August 9th. Finally, JPMorgan Chase & Co. increased their target price on DXC Technology from $19.00 to $22.00 and gave the stock an "underweight" rating in a research report on Friday, September 6th. Two research analysts have rated the stock with a sell rating and seven have issued a hold rating to the company's stock. According to data from MarketBeat.com, DXC Technology presently has a consensus rating of "Hold" and a consensus price target of $20.56.

Read Our Latest Stock Report on DXC Technology

DXC Technology Price Performance

Shares of NYSE DXC traded down $0.94 during trading on Friday, reaching $21.64. The company had a trading volume of 5,957,731 shares, compared to its average volume of 2,139,021. The company has a current ratio of 1.21, a quick ratio of 1.21 and a debt-to-equity ratio of 1.21. The stock has a market capitalization of $3.91 billion, a PE ratio of 71.47, a price-to-earnings-growth ratio of 1.79 and a beta of 1.67. DXC Technology has a twelve month low of $14.78 and a twelve month high of $25.14. The stock has a 50-day moving average price of $20.66 and a two-hundred day moving average price of $19.41.

DXC Technology (NYSE:DXC - Get Free Report) last released its earnings results on Thursday, August 8th. The company reported $0.74 EPS for the quarter, topping the consensus estimate of $0.57 by $0.17. DXC Technology had a net margin of 0.60% and a return on equity of 19.20%. The firm had revenue of $3.24 billion during the quarter, compared to analysts' expectations of $3.14 billion. As a group, sell-side analysts predict that DXC Technology will post 2.89 earnings per share for the current year.

Insider Activity at DXC Technology

In other DXC Technology news, SVP Christopher Anthony Voci sold 2,500 shares of the stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $21.37, for a total value of $53,425.00. Following the completion of the sale, the senior vice president now owns 83,746 shares of the company's stock, valued at $1,789,652.02. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. In other news, EVP Mary E. Finch sold 31,047 shares of the business's stock in a transaction dated Monday, August 12th. The shares were sold at an average price of $19.36, for a total value of $601,069.92. Following the completion of the sale, the executive vice president now owns 325,665 shares of the company's stock, valued at approximately $6,304,874.40. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, SVP Christopher Anthony Voci sold 2,500 shares of DXC Technology stock in a transaction dated Friday, September 13th. The stock was sold at an average price of $21.37, for a total value of $53,425.00. Following the completion of the transaction, the senior vice president now owns 83,746 shares of the company's stock, valued at $1,789,652.02. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.54% of the stock is owned by insiders.

Institutional Investors Weigh In On DXC Technology

A number of institutional investors have recently made changes to their positions in the company. Prospera Private Wealth LLC bought a new position in shares of DXC Technology during the third quarter worth about $49,000. Quest Partners LLC acquired a new position in DXC Technology during the 3rd quarter valued at about $97,000. Gladius Capital Management LP grew its position in DXC Technology by 21.0% in the 3rd quarter. Gladius Capital Management LP now owns 47,552 shares of the company's stock worth $987,000 after purchasing an additional 8,269 shares during the last quarter. Natixis Advisors LLC increased its stake in shares of DXC Technology by 22.3% in the third quarter. Natixis Advisors LLC now owns 223,376 shares of the company's stock valued at $4,635,000 after purchasing an additional 40,771 shares during the period. Finally, Royce & Associates LP raised its holdings in shares of DXC Technology by 124.7% during the third quarter. Royce & Associates LP now owns 91,971 shares of the company's stock valued at $1,908,000 after buying an additional 51,041 shares during the last quarter. 96.20% of the stock is currently owned by institutional investors.

About DXC Technology

(

Get Free Report)

DXC Technology Company, together with its subsidiaries, provides information technology services and solutions in the United States, the United Kingdom, rest of Europe, Australia, and internationally. It operates in two segments, Global Business Services (GBS) and Global Infrastructure Services (GIS).

Recommended Stories

Before you consider DXC Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DXC Technology wasn't on the list.

While DXC Technology currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.