Dynamic Technology Lab Private Ltd purchased a new stake in shares of Selective Insurance Group, Inc. (NASDAQ:SIGI - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the SEC. The firm purchased 4,845 shares of the insurance provider's stock, valued at approximately $453,000.

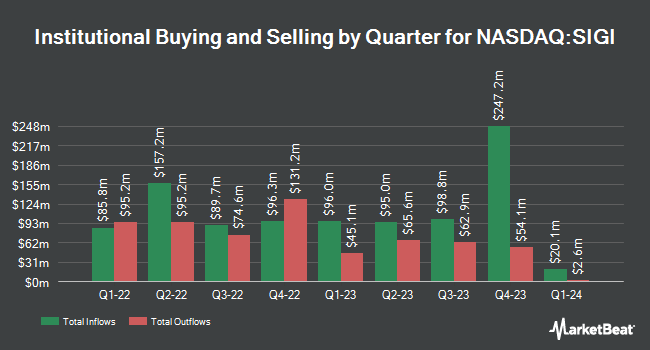

Other institutional investors and hedge funds have also recently modified their holdings of the company. State Street Corp raised its position in shares of Selective Insurance Group by 3.1% in the third quarter. State Street Corp now owns 2,401,897 shares of the insurance provider's stock valued at $224,097,000 after buying an additional 71,296 shares in the last quarter. Geode Capital Management LLC increased its stake in Selective Insurance Group by 1.7% in the third quarter. Geode Capital Management LLC now owns 1,586,527 shares of the insurance provider's stock valued at $148,048,000 after acquiring an additional 26,880 shares during the last quarter. Boston Trust Walden Corp raised its position in Selective Insurance Group by 8.7% during the fourth quarter. Boston Trust Walden Corp now owns 1,055,321 shares of the insurance provider's stock valued at $98,694,000 after purchasing an additional 84,341 shares in the last quarter. Norges Bank bought a new stake in Selective Insurance Group during the fourth quarter worth $93,409,000. Finally, Charles Schwab Investment Management Inc. boosted its holdings in shares of Selective Insurance Group by 1.9% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 884,230 shares of the insurance provider's stock valued at $82,693,000 after purchasing an additional 16,539 shares in the last quarter. 82.88% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on the stock. Morgan Stanley decreased their target price on shares of Selective Insurance Group from $95.00 to $87.00 and set an "equal weight" rating on the stock in a research note on Monday, February 3rd. JMP Securities restated a "market perform" rating on shares of Selective Insurance Group in a research report on Thursday, January 30th. Finally, Keefe, Bruyette & Woods reaffirmed a "market perform" rating and set a $93.00 price target (down previously from $116.00) on shares of Selective Insurance Group in a research report on Friday, February 7th. One analyst has rated the stock with a sell rating, five have given a hold rating and one has issued a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $95.17.

Check Out Our Latest Stock Analysis on SIGI

Selective Insurance Group Stock Performance

Shares of Selective Insurance Group stock traded up $1.17 during mid-day trading on Monday, hitting $87.80. 27,363 shares of the stock were exchanged, compared to its average volume of 383,379. Selective Insurance Group, Inc. has a 12 month low of $78.13 and a 12 month high of $104.67. The company has a 50-day simple moving average of $85.88 and a 200 day simple moving average of $91.54. The company has a market capitalization of $5.34 billion, a P/E ratio of 27.27 and a beta of 0.45. The company has a debt-to-equity ratio of 0.17, a quick ratio of 0.34 and a current ratio of 0.34.

Selective Insurance Group (NASDAQ:SIGI - Get Free Report) last announced its quarterly earnings data on Wednesday, January 29th. The insurance provider reported $1.62 EPS for the quarter, missing the consensus estimate of $1.99 by ($0.37). Selective Insurance Group had a return on equity of 7.33% and a net margin of 4.26%. Sell-side analysts anticipate that Selective Insurance Group, Inc. will post 7.62 earnings per share for the current fiscal year.

Selective Insurance Group Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, March 3rd. Investors of record on Friday, February 14th were issued a $0.38 dividend. This represents a $1.52 annualized dividend and a yield of 1.73%. The ex-dividend date of this dividend was Friday, February 14th. Selective Insurance Group's dividend payout ratio (DPR) is currently 47.20%.

Selective Insurance Group Profile

(

Free Report)

Selective Insurance Group, Inc, together with its subsidiaries, provides insurance products and services in the United States. The company operates through four segments: Standard Commercial Lines, Standard Personal Lines, E&S Lines, and Investments. It offers casualty insurance products that covers the financial consequences of employee injuries in the course of employment and bodily injury and/or property damage to a third party; property insurance products, which covers the accidental loss of an insured's real property, personal property, and/or earnings due to the property's loss; and flood insurance products.

See Also

Before you consider Selective Insurance Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Selective Insurance Group wasn't on the list.

While Selective Insurance Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.