Dynamic Technology Lab Private Ltd grew its position in shares of Axalta Coating Systems Ltd. (NYSE:AXTA - Free Report) by 68.4% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 36,191 shares of the specialty chemicals company's stock after acquiring an additional 14,704 shares during the quarter. Dynamic Technology Lab Private Ltd's holdings in Axalta Coating Systems were worth $1,310,000 at the end of the most recent reporting period.

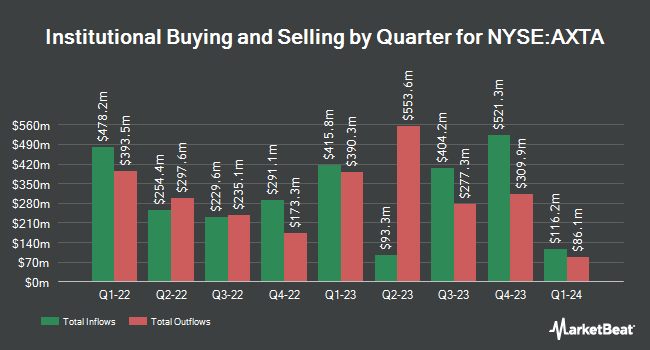

Other large investors have also recently bought and sold shares of the company. Plato Investment Management Ltd acquired a new position in Axalta Coating Systems during the 2nd quarter worth approximately $30,000. First Horizon Advisors Inc. boosted its holdings in shares of Axalta Coating Systems by 35.2% in the 3rd quarter. First Horizon Advisors Inc. now owns 1,021 shares of the specialty chemicals company's stock valued at $37,000 after buying an additional 266 shares during the last quarter. GAMMA Investing LLC boosted its holdings in shares of Axalta Coating Systems by 111.5% in the 2nd quarter. GAMMA Investing LLC now owns 1,417 shares of the specialty chemicals company's stock valued at $48,000 after buying an additional 747 shares during the last quarter. Capital Performance Advisors LLP acquired a new stake in shares of Axalta Coating Systems in the 3rd quarter valued at approximately $54,000. Finally, UMB Bank n.a. boosted its holdings in shares of Axalta Coating Systems by 90.2% in the 3rd quarter. UMB Bank n.a. now owns 1,546 shares of the specialty chemicals company's stock valued at $56,000 after buying an additional 733 shares during the last quarter. Institutional investors and hedge funds own 98.28% of the company's stock.

Analyst Ratings Changes

AXTA has been the subject of several recent analyst reports. Barclays increased their price objective on Axalta Coating Systems from $42.00 to $44.00 and gave the company an "overweight" rating in a report on Friday, November 1st. Mizuho increased their price objective on Axalta Coating Systems from $42.00 to $43.00 and gave the company an "outperform" rating in a report on Thursday, October 31st. Robert W. Baird increased their price objective on Axalta Coating Systems from $40.00 to $42.00 and gave the company an "outperform" rating in a report on Friday, August 2nd. Evercore ISI assumed coverage on Axalta Coating Systems in a report on Wednesday, November 13th. They set an "outperform" rating and a $47.00 price target for the company. Finally, JPMorgan Chase & Co. raised their price target on Axalta Coating Systems from $40.00 to $41.00 and gave the company an "overweight" rating in a report on Monday, August 5th. Two research analysts have rated the stock with a hold rating, eight have assigned a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, Axalta Coating Systems currently has a consensus rating of "Buy" and a consensus price target of $42.45.

Check Out Our Latest Stock Analysis on Axalta Coating Systems

Axalta Coating Systems Price Performance

NYSE:AXTA opened at $40.67 on Wednesday. Axalta Coating Systems Ltd. has a 52 week low of $30.40 and a 52 week high of $41.65. The company has a debt-to-equity ratio of 1.80, a quick ratio of 1.42 and a current ratio of 2.00. The firm's 50-day simple moving average is $37.52 and its 200 day simple moving average is $35.88. The firm has a market cap of $8.87 billion, a price-to-earnings ratio of 27.48, a P/E/G ratio of 0.89 and a beta of 1.43.

Axalta Coating Systems (NYSE:AXTA - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The specialty chemicals company reported $0.59 earnings per share for the quarter, beating analysts' consensus estimates of $0.51 by $0.08. The company had revenue of $1.32 billion during the quarter, compared to the consensus estimate of $1.32 billion. Axalta Coating Systems had a net margin of 6.22% and a return on equity of 24.92%. The firm's quarterly revenue was up .8% on a year-over-year basis. During the same period in the previous year, the business earned $0.45 earnings per share. As a group, sell-side analysts predict that Axalta Coating Systems Ltd. will post 2.16 earnings per share for the current year.

Axalta Coating Systems Profile

(

Free Report)

Axalta Coating Systems Ltd., through its subsidiaries, manufactures, markets, and distributes high-performance coatings systems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates through two segments, Performance Coatings and Mobility Coatings.

Featured Articles

Before you consider Axalta Coating Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axalta Coating Systems wasn't on the list.

While Axalta Coating Systems currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.