Dynamic Technology Lab Private Ltd bought a new stake in Confluent, Inc. (NASDAQ:CFLT - Free Report) during the third quarter, according to the company in its most recent disclosure with the SEC. The firm bought 124,401 shares of the company's stock, valued at approximately $2,535,000.

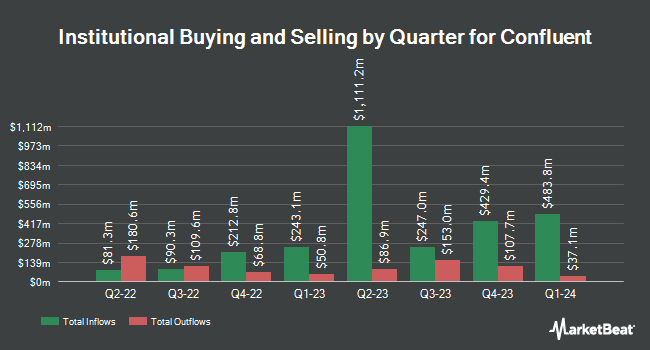

Other large investors have also recently modified their holdings of the company. Diversified Trust Co boosted its holdings in shares of Confluent by 110.3% in the 3rd quarter. Diversified Trust Co now owns 60,503 shares of the company's stock valued at $1,233,000 after purchasing an additional 31,729 shares in the last quarter. Sycomore Asset Management lifted its holdings in Confluent by 308.3% during the 2nd quarter. Sycomore Asset Management now owns 333,083 shares of the company's stock worth $9,176,000 after buying an additional 251,507 shares during the period. Pathway Capital Management LP acquired a new position in Confluent during the 3rd quarter worth about $918,000. Sei Investments Co. lifted its holdings in Confluent by 29.1% during the 2nd quarter. Sei Investments Co. now owns 305,537 shares of the company's stock worth $9,022,000 after buying an additional 68,880 shares during the period. Finally, Creative Planning lifted its holdings in Confluent by 109.9% during the 3rd quarter. Creative Planning now owns 94,939 shares of the company's stock worth $1,935,000 after buying an additional 49,699 shares during the period. Institutional investors and hedge funds own 78.09% of the company's stock.

Confluent Trading Up 2.9 %

NASDAQ:CFLT traded up $0.90 on Monday, hitting $32.42. The stock had a trading volume of 3,061,021 shares, compared to its average volume of 4,373,825. The company has a current ratio of 4.24, a quick ratio of 4.24 and a debt-to-equity ratio of 1.17. Confluent, Inc. has a 1 year low of $17.79 and a 1 year high of $35.07. The firm's fifty day simple moving average is $23.35 and its two-hundred day simple moving average is $24.57.

Confluent (NASDAQ:CFLT - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The company reported ($0.21) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.24) by $0.03. Confluent had a negative return on equity of 34.05% and a negative net margin of 38.35%. The business had revenue of $250.20 million for the quarter, compared to analysts' expectations of $243.98 million. Research analysts forecast that Confluent, Inc. will post -0.9 EPS for the current year.

Analyst Upgrades and Downgrades

CFLT has been the topic of several recent research reports. DA Davidson reaffirmed a "buy" rating and set a $30.00 target price on shares of Confluent in a report on Wednesday, September 18th. Mizuho lifted their price objective on Confluent from $29.00 to $31.00 and gave the stock an "outperform" rating in a research report on Thursday, October 31st. Bank of America lowered their price objective on Confluent from $32.00 to $26.00 and set an "underperform" rating for the company in a research report on Thursday, August 1st. Truist Financial reissued a "buy" rating and issued a $30.00 price target (down from $36.00) on shares of Confluent in a research note on Thursday, August 1st. Finally, JMP Securities reaffirmed a "market outperform" rating and set a $40.00 price objective on shares of Confluent in a research report on Tuesday, October 29th. One equities research analyst has rated the stock with a sell rating, seven have issued a hold rating, nineteen have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $30.88.

View Our Latest Report on Confluent

Insider Activity at Confluent

In other Confluent news, CAO Kong Phan sold 2,096 shares of the business's stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $28.23, for a total value of $59,170.08. Following the completion of the sale, the chief accounting officer now directly owns 190,680 shares of the company's stock, valued at $5,382,896.40. The trade was a 1.09 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, insider Erica Schultz sold 9,467 shares of the firm's stock in a transaction dated Wednesday, November 20th. The shares were sold at an average price of $28.23, for a total value of $267,253.41. Following the transaction, the insider now directly owns 678,016 shares in the company, valued at $19,140,391.68. This trade represents a 1.38 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 3,425,457 shares of company stock worth $93,622,927. Company insiders own 13.82% of the company's stock.

Confluent Company Profile

(

Free Report)

Confluent, Inc operates a data streaming platform in the United States and internationally. The company provides platforms that allow customers to connect their applications, systems, and data layers, such as Confluent Cloud, a managed cloud-native software-as-a-service; and Confluent Platform, an enterprise-grade self-managed software.

Further Reading

Before you consider Confluent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Confluent wasn't on the list.

While Confluent currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.