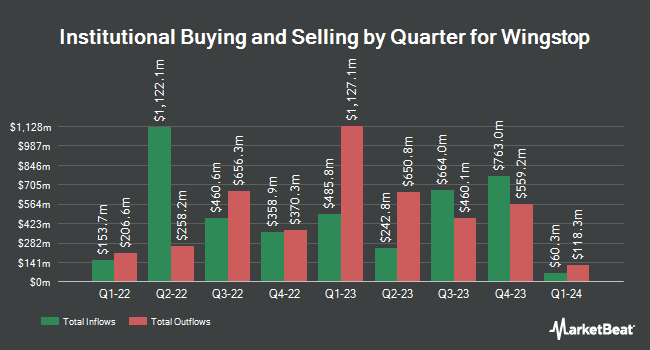

Dynamic Technology Lab Private Ltd reduced its position in Wingstop Inc. (NASDAQ:WING - Free Report) by 30.6% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 5,688 shares of the restaurant operator's stock after selling 2,504 shares during the period. Dynamic Technology Lab Private Ltd's holdings in Wingstop were worth $1,616,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also recently bought and sold shares of the company. EverSource Wealth Advisors LLC increased its position in shares of Wingstop by 521.4% in the fourth quarter. EverSource Wealth Advisors LLC now owns 87 shares of the restaurant operator's stock valued at $25,000 after buying an additional 73 shares in the last quarter. CBIZ Investment Advisory Services LLC increased its holdings in Wingstop by 62.5% during the 4th quarter. CBIZ Investment Advisory Services LLC now owns 91 shares of the restaurant operator's stock valued at $26,000 after acquiring an additional 35 shares in the last quarter. SBI Securities Co. Ltd. acquired a new position in Wingstop during the fourth quarter worth about $30,000. V Square Quantitative Management LLC lifted its holdings in shares of Wingstop by 34.9% in the fourth quarter. V Square Quantitative Management LLC now owns 143 shares of the restaurant operator's stock valued at $41,000 after purchasing an additional 37 shares in the last quarter. Finally, R Squared Ltd acquired a new stake in shares of Wingstop in the fourth quarter valued at approximately $71,000.

Analysts Set New Price Targets

WING has been the subject of several research reports. Northcoast Research downgraded Wingstop from a "buy" rating to a "neutral" rating in a research report on Friday, February 21st. Morgan Stanley cut their price target on Wingstop from $389.00 to $375.00 and set an "overweight" rating for the company in a report on Thursday, February 20th. Benchmark decreased their price objective on Wingstop from $340.00 to $325.00 and set a "buy" rating on the stock in a research note on Thursday, February 20th. Barclays cut their target price on shares of Wingstop from $359.00 to $315.00 and set an "overweight" rating for the company in a research note on Thursday, February 20th. Finally, Stifel Nicolaus decreased their price target on shares of Wingstop from $375.00 to $350.00 and set a "buy" rating on the stock in a research note on Friday, February 28th. Six analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $348.23.

View Our Latest Analysis on WING

Wingstop Stock Down 4.2 %

Shares of Wingstop stock traded down $10.24 during trading hours on Thursday, hitting $235.98. The company's stock had a trading volume of 331,051 shares, compared to its average volume of 571,071. The business has a fifty day moving average of $246.02 and a 200 day moving average of $300.92. Wingstop Inc. has a 1-year low of $205.60 and a 1-year high of $433.86. The company has a market capitalization of $6.58 billion, a PE ratio of 63.58, a P/E/G ratio of 2.27 and a beta of 2.02.

Wingstop Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, March 28th. Stockholders of record on Friday, March 7th were paid a $0.27 dividend. The ex-dividend date was Friday, March 7th. This represents a $1.08 annualized dividend and a dividend yield of 0.46%. Wingstop's dividend payout ratio (DPR) is presently 29.11%.

About Wingstop

(

Free Report)

Wingstop Inc, together with its subsidiaries, franchises and operates restaurants under the Wingstop brand. Its restaurants offer classic wings, boneless wings, tenders, and hand-sauced-and-tossed in various flavors, as well as chicken sandwiches with fries and hand-cut carrots and celery that are cooked-to-order.

Further Reading

Before you consider Wingstop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wingstop wasn't on the list.

While Wingstop currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.