Dynamic Technology Lab Private Ltd trimmed its stake in Sunrun Inc. (NASDAQ:RUN - Free Report) by 48.6% during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 73,476 shares of the energy company's stock after selling 69,404 shares during the period. Dynamic Technology Lab Private Ltd's holdings in Sunrun were worth $679,000 as of its most recent SEC filing.

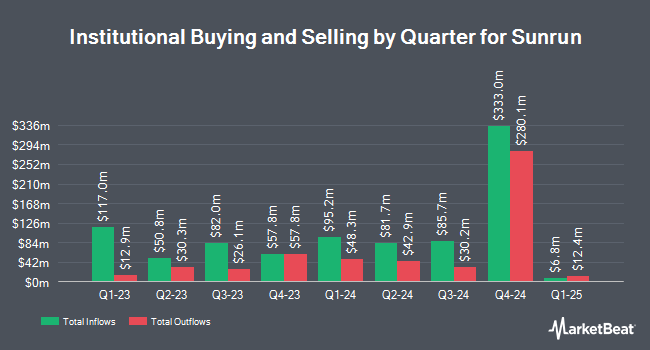

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in RUN. Newbridge Financial Services Group Inc. grew its position in Sunrun by 133.3% in the fourth quarter. Newbridge Financial Services Group Inc. now owns 3,500 shares of the energy company's stock valued at $32,000 after acquiring an additional 2,000 shares during the period. Wilmington Savings Fund Society FSB acquired a new stake in shares of Sunrun in the 3rd quarter valued at $44,000. Summit Securities Group LLC acquired a new stake in shares of Sunrun during the 4th quarter worth about $53,000. Union Bancaire Privee UBP SA bought a new position in Sunrun during the 4th quarter valued at about $56,000. Finally, Wealth Enhancement Advisory Services LLC acquired a new position in Sunrun in the fourth quarter valued at about $94,000. 91.69% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several analysts have recently weighed in on the stock. TD Cowen dropped their price objective on shares of Sunrun from $18.00 to $14.00 and set a "buy" rating for the company in a report on Friday, February 28th. StockNews.com raised Sunrun to a "sell" rating in a report on Friday, December 20th. UBS Group cut their price objective on Sunrun from $17.00 to $15.00 and set a "buy" rating for the company in a research report on Tuesday, March 4th. JPMorgan Chase & Co. decreased their target price on Sunrun from $22.00 to $18.00 and set an "overweight" rating on the stock in a report on Thursday, January 23rd. Finally, BNP Paribas raised Sunrun from a "neutral" rating to an "outperform" rating and set a $16.00 price target for the company in a report on Tuesday, January 7th. Two investment analysts have rated the stock with a sell rating, seven have issued a hold rating and thirteen have given a buy rating to the company's stock. According to data from MarketBeat, Sunrun has an average rating of "Moderate Buy" and an average target price of $17.20.

Get Our Latest Research Report on RUN

Insider Activity

In related news, CFO Danny Abajian sold 16,927 shares of the business's stock in a transaction that occurred on Monday, April 7th. The stock was sold at an average price of $6.74, for a total value of $114,087.98. Following the completion of the transaction, the chief financial officer now directly owns 231,279 shares in the company, valued at approximately $1,558,820.46. The trade was a 6.82 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Mary Powell sold 31,197 shares of the stock in a transaction on Monday, April 7th. The stock was sold at an average price of $6.74, for a total transaction of $210,267.78. Following the sale, the chief executive officer now directly owns 534,615 shares of the company's stock, valued at $3,603,305.10. This represents a 5.51 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 188,540 shares of company stock valued at $1,530,444 in the last ninety days. 3.77% of the stock is owned by insiders.

Sunrun Trading Up 4.3 %

Shares of NASDAQ:RUN traded up $0.26 during midday trading on Friday, hitting $6.29. The company had a trading volume of 8,182,374 shares, compared to its average volume of 10,763,659. The company has a current ratio of 1.47, a quick ratio of 1.15 and a debt-to-equity ratio of 1.92. Sunrun Inc. has a 12 month low of $5.45 and a 12 month high of $22.26. The stock has a market cap of $1.42 billion, a price-to-earnings ratio of -3.46 and a beta of 2.74. The firm has a fifty day simple moving average of $7.17 and a 200 day simple moving average of $10.18.

Sunrun Profile

(

Free Report)

Sunrun Inc designs, develops, installs, sells, owns, and maintains residential solar energy systems in the United States. It also sells solar energy systems and products, such as panels and racking; and solar leads generated to customers. In addition, the company offers battery storage along with solar energy systems; and sells services to commercial developers through multi-family and new homes.

Featured Articles

Before you consider Sunrun, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunrun wasn't on the list.

While Sunrun currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.