Dynamic Technology Lab Private Ltd acquired a new position in US Foods Holding Corp. (NYSE:USFD - Free Report) in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm acquired 18,548 shares of the company's stock, valued at approximately $1,141,000.

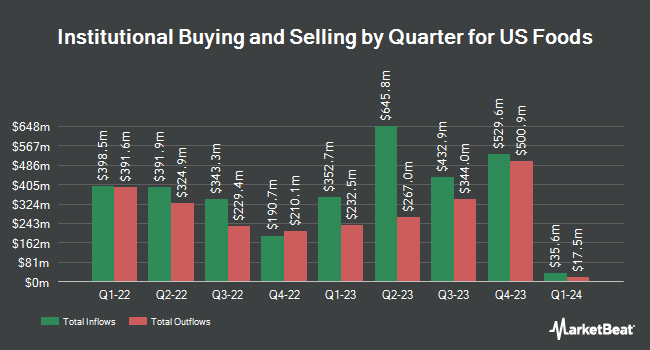

Other institutional investors and hedge funds also recently bought and sold shares of the company. O Shaughnessy Asset Management LLC boosted its holdings in US Foods by 29.3% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 7,946 shares of the company's stock valued at $429,000 after purchasing an additional 1,800 shares during the period. Advisors Asset Management Inc. boosted its holdings in US Foods by 55.7% in the 1st quarter. Advisors Asset Management Inc. now owns 10,122 shares of the company's stock valued at $546,000 after purchasing an additional 3,622 shares during the period. Price T Rowe Associates Inc. MD boosted its holdings in US Foods by 6.3% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 162,128 shares of the company's stock valued at $8,751,000 after purchasing an additional 9,652 shares during the period. Janus Henderson Group PLC boosted its holdings in US Foods by 46.3% in the 1st quarter. Janus Henderson Group PLC now owns 162,338 shares of the company's stock valued at $8,759,000 after purchasing an additional 51,402 shares during the period. Finally, Community Trust & Investment Co. boosted its holdings in US Foods by 0.3% in the 1st quarter. Community Trust & Investment Co. now owns 125,174 shares of the company's stock valued at $6,756,000 after purchasing an additional 427 shares during the period. 98.76% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

USFD has been the subject of several analyst reports. UBS Group raised their price target on shares of US Foods from $67.00 to $77.00 and gave the company a "buy" rating in a report on Friday, November 8th. Truist Financial raised their price objective on shares of US Foods from $66.00 to $74.00 and gave the company a "buy" rating in a research report on Friday, November 8th. Wells Fargo & Company raised their price objective on shares of US Foods from $66.00 to $75.00 and gave the company an "overweight" rating in a research report on Wednesday, September 18th. Barclays raised their price objective on shares of US Foods from $71.00 to $78.00 and gave the company an "overweight" rating in a research report on Friday, November 8th. Finally, StockNews.com upgraded shares of US Foods from a "buy" rating to a "strong-buy" rating in a research report on Thursday, October 10th. One investment analyst has rated the stock with a hold rating, ten have issued a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Buy" and a consensus target price of $71.09.

Check Out Our Latest Stock Analysis on USFD

US Foods Price Performance

USFD stock opened at $70.17 on Wednesday. The firm's 50-day moving average price is $63.09 and its two-hundred day moving average price is $57.48. US Foods Holding Corp. has a 12-month low of $42.96 and a 12-month high of $70.52. The stock has a market capitalization of $16.35 billion, a price-to-earnings ratio of 30.12, a PEG ratio of 1.15 and a beta of 1.66. The company has a current ratio of 1.19, a quick ratio of 0.72 and a debt-to-equity ratio of 1.01.

Insider Buying and Selling at US Foods

In other US Foods news, CFO Dirk J. Locascio sold 10,000 shares of the business's stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $57.95, for a total value of $579,500.00. Following the transaction, the chief financial officer now owns 88,563 shares in the company, valued at approximately $5,132,225.85. The trade was a 10.15 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 0.70% of the company's stock.

US Foods Profile

(

Free Report)

US Foods Holding Corp., together with its subsidiaries, engages in marketing, sale, and distribution of fresh, frozen, and dry food and non-food products to foodservice customers in the United States. The company's customers include independently owned single and multi-unit restaurants, regional concepts, national restaurant chains, hospitals, nursing homes, hotels and motels, country clubs, government and military organizations, colleges and universities, and retail locations.

Recommended Stories

Before you consider US Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and US Foods wasn't on the list.

While US Foods currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.