Dynamic Technology Lab Private Ltd purchased a new position in PagerDuty, Inc. (NYSE:PD - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor purchased 88,676 shares of the company's stock, valued at approximately $1,645,000. Dynamic Technology Lab Private Ltd owned approximately 0.10% of PagerDuty at the end of the most recent reporting period.

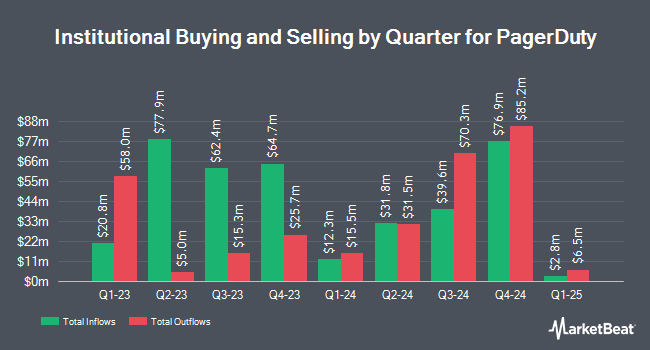

Several other institutional investors have also made changes to their positions in PD. Quarry LP increased its position in PagerDuty by 1,537.2% in the 2nd quarter. Quarry LP now owns 1,408 shares of the company's stock worth $32,000 after purchasing an additional 1,322 shares during the last quarter. First Horizon Advisors Inc. raised its position in PagerDuty by 28.0% during the second quarter. First Horizon Advisors Inc. now owns 2,323 shares of the company's stock valued at $53,000 after acquiring an additional 508 shares in the last quarter. Fred Alger Management LLC grew its position in PagerDuty by 170.6% in the second quarter. Fred Alger Management LLC now owns 2,503 shares of the company's stock worth $57,000 after acquiring an additional 1,578 shares in the last quarter. Cambridge Trust Co. acquired a new position in shares of PagerDuty during the 1st quarter worth $68,000. Finally, Headlands Technologies LLC bought a new position in shares of PagerDuty during the 2nd quarter valued at $114,000. 97.26% of the stock is currently owned by institutional investors and hedge funds.

PagerDuty Stock Performance

Shares of PagerDuty stock traded up $0.26 during midday trading on Tuesday, hitting $20.91. The company had a trading volume of 1,933,730 shares, compared to its average volume of 1,121,032. PagerDuty, Inc. has a 1-year low of $16.46 and a 1-year high of $26.70. The business's 50 day simple moving average is $18.68 and its two-hundred day simple moving average is $19.59. The stock has a market cap of $1.95 billion, a PE ratio of -23.49 and a beta of 1.07. The company has a debt-to-equity ratio of 2.38, a current ratio of 2.13 and a quick ratio of 2.13.

PagerDuty (NYSE:PD - Get Free Report) last posted its quarterly earnings results on Tuesday, September 3rd. The company reported $0.21 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.17 by $0.04. The company had revenue of $115.94 million for the quarter, compared to analyst estimates of $116.52 million. PagerDuty had a negative net margin of 18.58% and a negative return on equity of 25.83%. During the same period last year, the business posted ($0.18) EPS. The business's quarterly revenue was up 7.7% on a year-over-year basis. As a group, equities analysts predict that PagerDuty, Inc. will post -0.37 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of equities research analysts recently issued reports on the stock. Morgan Stanley decreased their price objective on shares of PagerDuty from $24.00 to $19.00 and set an "equal weight" rating for the company in a report on Wednesday, September 4th. Craig Hallum decreased their price target on PagerDuty from $30.00 to $26.00 and set a "buy" rating for the company in a research note on Wednesday, September 4th. Bank of America cut their price objective on PagerDuty from $28.00 to $23.00 and set a "buy" rating on the stock in a research note on Wednesday, September 4th. TD Cowen decreased their target price on PagerDuty from $23.00 to $19.00 and set a "hold" rating for the company in a research report on Wednesday, September 4th. Finally, The Goldman Sachs Group lowered their price target on PagerDuty from $24.00 to $21.00 and set a "neutral" rating on the stock in a report on Wednesday, September 4th. Six equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus price target of $21.82.

View Our Latest Research Report on PD

Insider Buying and Selling at PagerDuty

In other news, CAO Mitra Rezvan sold 2,942 shares of the firm's stock in a transaction dated Wednesday, October 9th. The shares were sold at an average price of $18.06, for a total transaction of $53,132.52. Following the completion of the transaction, the chief accounting officer now directly owns 108,449 shares of the company's stock, valued at approximately $1,958,588.94. This trade represents a 2.64 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Jennifer Tejada sold 18,750 shares of the company's stock in a transaction dated Tuesday, November 12th. The shares were sold at an average price of $20.04, for a total transaction of $375,750.00. Following the completion of the sale, the chief executive officer now directly owns 907,631 shares in the company, valued at approximately $18,188,925.24. The trade was a 2.02 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 87,396 shares of company stock valued at $1,733,561 in the last quarter. Corporate insiders own 7.60% of the company's stock.

PagerDuty Company Profile

(

Free Report)

PagerDuty, Inc engages in the operation of a digital operations management platform in the United States and internationally. The company's digital operations management platform collects data and digital signals from virtually any software-enabled system or device and leverage machine learning to correlate, process, and predict opportunities and issues.

Read More

Before you consider PagerDuty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PagerDuty wasn't on the list.

While PagerDuty currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.