Dynamic Technology Lab Private Ltd lessened its stake in Hudbay Minerals Inc. (NYSE:HBM - Free Report) TSE: HBM by 86.2% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 18,293 shares of the mining company's stock after selling 114,018 shares during the quarter. Dynamic Technology Lab Private Ltd's holdings in Hudbay Minerals were worth $168,000 as of its most recent SEC filing.

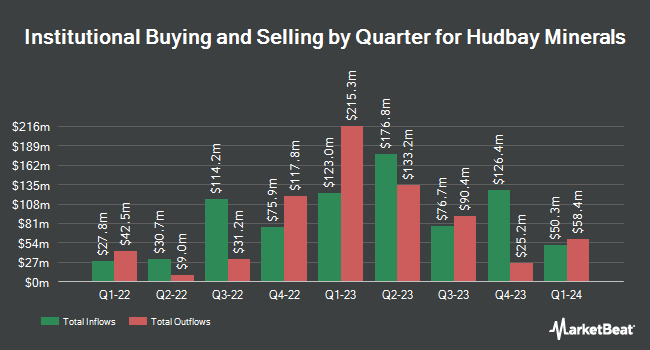

A number of other hedge funds have also recently modified their holdings of HBM. Prospera Private Wealth LLC acquired a new position in shares of Hudbay Minerals in the third quarter worth about $28,000. Exchange Traded Concepts LLC acquired a new position in Hudbay Minerals in the 3rd quarter worth about $53,000. Clear Harbor Asset Management LLC purchased a new position in Hudbay Minerals during the third quarter worth approximately $92,000. Ritholtz Wealth Management acquired a new stake in Hudbay Minerals in the second quarter valued at approximately $96,000. Finally, Armistice Capital LLC purchased a new stake in shares of Hudbay Minerals in the second quarter valued at approximately $97,000. Hedge funds and other institutional investors own 57.82% of the company's stock.

Wall Street Analyst Weigh In

HBM has been the topic of a number of recent analyst reports. StockNews.com upgraded Hudbay Minerals from a "hold" rating to a "buy" rating in a research report on Friday, November 15th. Jefferies Financial Group upgraded Hudbay Minerals from a "hold" rating to a "buy" rating in a report on Wednesday, August 14th. Five analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Buy" and a consensus price target of $11.17.

Check Out Our Latest Report on Hudbay Minerals

Hudbay Minerals Trading Up 2.2 %

NYSE:HBM traded up $0.19 on Tuesday, hitting $8.93. The stock had a trading volume of 2,141,859 shares, compared to its average volume of 3,090,327. The company has a fifty day moving average price of $9.13 and a two-hundred day moving average price of $8.68. Hudbay Minerals Inc. has a 1-year low of $4.51 and a 1-year high of $10.49. The company has a quick ratio of 1.47, a current ratio of 1.86 and a debt-to-equity ratio of 0.44. The stock has a market cap of $3.52 billion, a price-to-earnings ratio of 38.78 and a beta of 1.77.

Hudbay Minerals (NYSE:HBM - Get Free Report) TSE: HBM last released its quarterly earnings data on Wednesday, November 13th. The mining company reported $0.13 EPS for the quarter, beating analysts' consensus estimates of $0.04 by $0.09. The firm had revenue of $485.80 million for the quarter, compared to analysts' expectations of $454.47 million. Hudbay Minerals had a return on equity of 7.44% and a net margin of 4.23%. The firm's quarterly revenue was up 1.1% on a year-over-year basis. During the same period in the prior year, the firm posted $0.07 earnings per share. Equities research analysts expect that Hudbay Minerals Inc. will post 0.55 earnings per share for the current fiscal year.

Hudbay Minerals Profile

(

Free Report)

Hudbay Minerals Inc, a diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America. It produces copper concentrates containing gold, silver, and molybdenum; gold concentrates containing zinc; zinc concentrates; molybdenum concentrates; and silver/gold doré.

Further Reading

Before you consider Hudbay Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hudbay Minerals wasn't on the list.

While Hudbay Minerals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.