Dynamic Technology Lab Private Ltd purchased a new position in Talos Energy Inc. (NYSE:TALO - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund purchased 89,818 shares of the company's stock, valued at approximately $930,000.

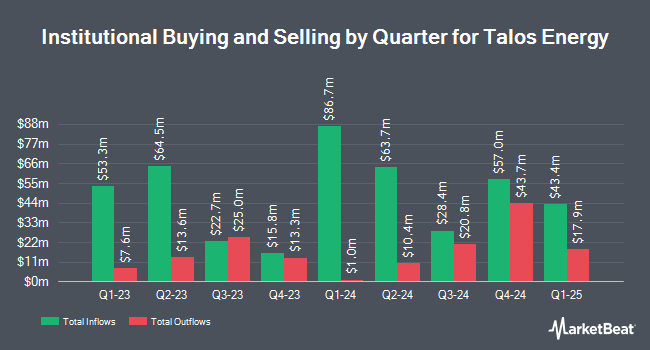

A number of other institutional investors also recently made changes to their positions in TALO. Vanguard Group Inc. increased its position in Talos Energy by 23.7% during the 1st quarter. Vanguard Group Inc. now owns 9,793,618 shares of the company's stock worth $136,425,000 after purchasing an additional 1,873,537 shares in the last quarter. American International Group Inc. raised its position in shares of Talos Energy by 27.2% in the first quarter. American International Group Inc. now owns 74,859 shares of the company's stock valued at $1,043,000 after buying an additional 16,008 shares during the last quarter. Price T Rowe Associates Inc. MD raised its position in shares of Talos Energy by 29.6% in the first quarter. Price T Rowe Associates Inc. MD now owns 54,431 shares of the company's stock valued at $759,000 after buying an additional 12,423 shares during the last quarter. California State Teachers Retirement System lifted its stake in shares of Talos Energy by 8.0% during the 1st quarter. California State Teachers Retirement System now owns 138,665 shares of the company's stock worth $1,932,000 after purchasing an additional 10,216 shares during the period. Finally, Comerica Bank lifted its position in Talos Energy by 21.3% during the first quarter. Comerica Bank now owns 56,754 shares of the company's stock worth $791,000 after buying an additional 9,968 shares during the period. 89.35% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

TALO has been the subject of several research reports. Benchmark reissued a "buy" rating and set a $20.00 price objective on shares of Talos Energy in a research note on Tuesday, November 12th. BMO Capital Markets dropped their price target on Talos Energy from $14.00 to $13.00 and set a "market perform" rating for the company in a research note on Friday, October 4th. Mizuho started coverage on Talos Energy in a research note on Thursday, September 19th. They issued an "outperform" rating and a $16.00 price objective on the stock. Citigroup boosted their target price on Talos Energy from $12.50 to $14.50 and gave the stock a "buy" rating in a report on Thursday, November 14th. Finally, KeyCorp cut their price target on shares of Talos Energy from $21.00 to $16.00 and set an "overweight" rating on the stock in a report on Wednesday, October 16th. One analyst has rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $17.06.

Check Out Our Latest Stock Analysis on TALO

Insiders Place Their Bets

In related news, insider Control Empresarial De Capital bought 100,000 shares of the firm's stock in a transaction on Friday, September 27th. The stock was bought at an average price of $10.31 per share, with a total value of $1,031,000.00. Following the purchase, the insider now directly owns 43,545,604 shares of the company's stock, valued at approximately $448,955,177.24. This represents a 0.23 % increase in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. In the last ninety days, insiders acquired 1,220,000 shares of company stock worth $13,135,560. 0.77% of the stock is currently owned by company insiders.

Talos Energy Stock Up 0.4 %

TALO opened at $11.20 on Thursday. The company has a debt-to-equity ratio of 0.47, a quick ratio of 0.97 and a current ratio of 0.97. The company has a market capitalization of $2.02 billion, a PE ratio of 20.74 and a beta of 1.92. The stock's fifty day moving average is $10.83 and its 200-day moving average is $11.24. Talos Energy Inc. has a one year low of $9.44 and a one year high of $14.77.

Talos Energy (NYSE:TALO - Get Free Report) last released its earnings results on Monday, November 11th. The company reported ($0.14) EPS for the quarter, missing the consensus estimate of ($0.07) by ($0.07). Talos Energy had a net margin of 3.95% and a negative return on equity of 1.98%. The business had revenue of $509.29 million for the quarter, compared to analyst estimates of $504.44 million. During the same period in the prior year, the company earned $0.14 earnings per share. The firm's revenue for the quarter was up 32.9% on a year-over-year basis. On average, equities analysts predict that Talos Energy Inc. will post -0.35 EPS for the current fiscal year.

Talos Energy Profile

(

Free Report)

Talos Energy Inc, through its subsidiaries, engages in the exploration and production of oil, natural gas, and natural gas liquids in the United States and Mexico. It also engages in the development of carbon capture and sequestration. Talos Energy Inc was founded in 2011 and is headquartered in Houston, Texas.

Featured Stories

Before you consider Talos Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Talos Energy wasn't on the list.

While Talos Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.