Rosenblatt Securities reaffirmed their buy rating on shares of Dynatrace (NYSE:DT - Free Report) in a research report report published on Wednesday morning, Benzinga reports. The brokerage currently has a $65.00 price objective on the stock.

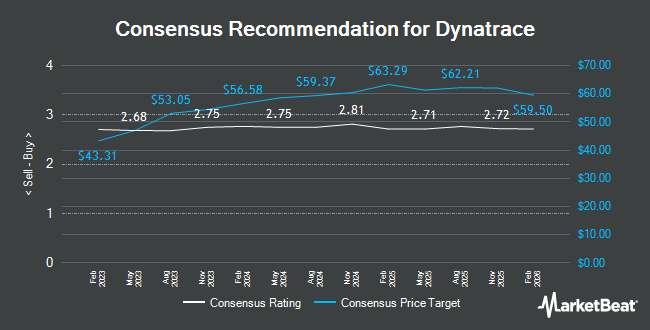

Other equities analysts have also recently issued research reports about the stock. BNP Paribas initiated coverage on shares of Dynatrace in a research note on Tuesday, October 8th. They set a "neutral" rating and a $52.00 target price on the stock. JPMorgan Chase & Co. lifted their target price on shares of Dynatrace from $55.00 to $60.00 and gave the stock an "overweight" rating in a research report on Wednesday, October 30th. BTIG Research raised their price target on shares of Dynatrace from $57.00 to $63.00 and gave the stock a "buy" rating in a report on Wednesday, October 23rd. BMO Capital Markets lifted their target price on shares of Dynatrace from $49.00 to $53.00 and gave the company an "outperform" rating in a research note on Thursday, August 8th. Finally, Wells Fargo & Company reduced their target price on shares of Dynatrace from $60.00 to $50.00 and set an "overweight" rating for the company in a research note on Tuesday, August 6th. Five equities research analysts have rated the stock with a hold rating and nineteen have issued a buy rating to the company's stock. Based on data from MarketBeat, Dynatrace currently has an average rating of "Moderate Buy" and an average target price of $60.46.

View Our Latest Report on Dynatrace

Dynatrace Stock Performance

NYSE:DT traded up $1.72 during mid-day trading on Wednesday, hitting $56.49. 5,258,275 shares of the company's stock traded hands, compared to its average volume of 3,316,461. The firm's 50 day simple moving average is $52.64 and its 200 day simple moving average is $48.23. The company has a market cap of $16.83 billion, a PE ratio of 108.25, a price-to-earnings-growth ratio of 7.94 and a beta of 1.06. Dynatrace has a 1 year low of $39.42 and a 1 year high of $61.41.

Dynatrace (NYSE:DT - Get Free Report) last released its quarterly earnings data on Wednesday, August 7th. The company reported $0.33 EPS for the quarter, topping analysts' consensus estimates of $0.29 by $0.04. Dynatrace had a return on equity of 9.77% and a net margin of 10.36%. The company had revenue of $399.20 million for the quarter, compared to the consensus estimate of $392.22 million. During the same period last year, the business posted $0.16 EPS. The company's quarterly revenue was up 19.9% compared to the same quarter last year. On average, research analysts expect that Dynatrace will post 0.71 earnings per share for the current fiscal year.

Insider Buying and Selling at Dynatrace

In other Dynatrace news, CEO Rick M. Mcconnell sold 50,000 shares of the firm's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $51.50, for a total value of $2,575,000.00. Following the sale, the chief executive officer now owns 650,587 shares of the company's stock, valued at $33,505,230.50. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. In other Dynatrace news, CEO Rick M. Mcconnell sold 50,000 shares of the business's stock in a transaction on Monday, September 16th. The stock was sold at an average price of $51.50, for a total value of $2,575,000.00. Following the sale, the chief executive officer now directly owns 650,587 shares of the company's stock, valued at approximately $33,505,230.50. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Stephen J. Lifshatz sold 5,000 shares of the business's stock in a transaction on Friday, October 11th. The stock was sold at an average price of $55.00, for a total value of $275,000.00. Following the completion of the sale, the director now directly owns 41,471 shares in the company, valued at $2,280,905. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 66,022 shares of company stock worth $3,397,904 in the last quarter. 0.59% of the stock is currently owned by company insiders.

Institutional Trading of Dynatrace

Several large investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. lifted its holdings in shares of Dynatrace by 6.4% in the first quarter. Vanguard Group Inc. now owns 27,945,251 shares of the company's stock worth $1,297,777,000 after buying an additional 1,680,971 shares in the last quarter. US Bancorp DE lifted its holdings in shares of Dynatrace by 89.7% in the first quarter. US Bancorp DE now owns 48,478 shares of the company's stock worth $2,251,000 after buying an additional 22,928 shares in the last quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. lifted its holdings in shares of Dynatrace by 640.8% in the first quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 182,355 shares of the company's stock worth $8,469,000 after buying an additional 157,739 shares in the last quarter. Diversify Advisory Services LLC purchased a new position in shares of Dynatrace in the second quarter worth $1,295,000. Finally, Assenagon Asset Management S.A. lifted its holdings in shares of Dynatrace by 1,146.0% in the second quarter. Assenagon Asset Management S.A. now owns 2,208,137 shares of the company's stock worth $98,792,000 after buying an additional 2,030,915 shares in the last quarter. 94.28% of the stock is currently owned by institutional investors.

About Dynatrace

(

Get Free Report)

Dynatrace, Inc provides a security platform for multicloud environments in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates Dynatrace, a security platform, which provides application and microservices monitoring, runtime application security, infrastructure monitoring, log management and analytics, digital experience monitoring, digital business analytics, and cloud automation.

See Also

Before you consider Dynatrace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dynatrace wasn't on the list.

While Dynatrace currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report