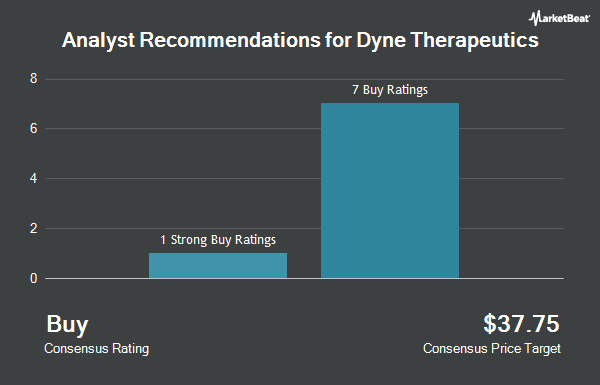

Dyne Therapeutics, Inc. (NASDAQ:DYN - Get Free Report) has been assigned a consensus recommendation of "Buy" from the eleven research firms that are presently covering the company, Marketbeat Ratings reports. One investment analyst has rated the stock with a hold rating, nine have issued a buy rating and one has assigned a strong buy rating to the company. The average 1 year price objective among analysts that have issued ratings on the stock in the last year is $50.82.

A number of equities analysts have weighed in on the company. Morgan Stanley upped their target price on Dyne Therapeutics from $48.00 to $52.00 and gave the stock an "overweight" rating in a research note on Wednesday, August 14th. Chardan Capital restated a "buy" rating and issued a $50.00 target price on shares of Dyne Therapeutics in a research note on Wednesday, November 13th. Guggenheim upped their target price on Dyne Therapeutics from $45.00 to $50.00 and gave the stock a "buy" rating in a research note on Thursday, August 15th. HC Wainwright reiterated a "buy" rating and set a $55.00 price objective on shares of Dyne Therapeutics in a research report on Wednesday, November 13th. Finally, StockNews.com lowered Dyne Therapeutics from a "hold" rating to a "sell" rating in a research report on Monday, September 16th.

View Our Latest Stock Report on Dyne Therapeutics

Dyne Therapeutics Price Performance

NASDAQ DYN traded down $1.70 during trading on Thursday, reaching $27.74. The company's stock had a trading volume of 631,635 shares, compared to its average volume of 1,463,396. The stock has a market capitalization of $2.82 billion, a PE ratio of -8.03 and a beta of 1.09. The firm has a fifty day moving average of $31.34 and a 200 day moving average of $35.44. Dyne Therapeutics has a one year low of $10.33 and a one year high of $47.45.

Dyne Therapeutics (NASDAQ:DYN - Get Free Report) last announced its earnings results on Tuesday, November 12th. The company reported ($0.96) earnings per share for the quarter, missing analysts' consensus estimates of ($0.71) by ($0.25). Research analysts expect that Dyne Therapeutics will post -3.45 earnings per share for the current fiscal year.

Insider Activity at Dyne Therapeutics

In related news, COO Susanna Gatti High sold 8,976 shares of the stock in a transaction dated Wednesday, September 18th. The stock was sold at an average price of $34.41, for a total transaction of $308,864.16. Following the completion of the sale, the chief operating officer now directly owns 131,636 shares in the company, valued at $4,529,594.76. This represents a 6.38 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Dirk Kersten sold 79,411 shares of the stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $36.45, for a total value of $2,894,530.95. Following the completion of the sale, the director now owns 234,127 shares of the company's stock, valued at approximately $8,533,929.15. This trade represents a 25.33 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 176,257 shares of company stock worth $6,193,718 in the last ninety days. 20.77% of the stock is owned by company insiders.

Institutional Investors Weigh In On Dyne Therapeutics

Institutional investors and hedge funds have recently bought and sold shares of the business. Nisa Investment Advisors LLC lifted its holdings in Dyne Therapeutics by 904.1% in the 2nd quarter. Nisa Investment Advisors LLC now owns 743 shares of the company's stock worth $26,000 after buying an additional 669 shares during the period. Quantbot Technologies LP purchased a new position in shares of Dyne Therapeutics in the 3rd quarter valued at approximately $34,000. Point72 DIFC Ltd purchased a new position in shares of Dyne Therapeutics in the 3rd quarter valued at approximately $36,000. US Bancorp DE lifted its stake in shares of Dyne Therapeutics by 776.9% in the 3rd quarter. US Bancorp DE now owns 1,368 shares of the company's stock valued at $49,000 after purchasing an additional 1,212 shares during the period. Finally, Values First Advisors Inc. purchased a new position in shares of Dyne Therapeutics in the 3rd quarter valued at approximately $62,000. Hedge funds and other institutional investors own 96.68% of the company's stock.

Dyne Therapeutics Company Profile

(

Get Free ReportDyne Therapeutics, Inc, a clinical-stage muscle disease company, operates as a biotechnology company that focuses on advancing therapeutics for genetically driven muscle diseases in the United States. It is developing a portfolio of muscle disease therapeutics, including programs in myotonic dystrophy type 1; duchenne muscular dystrophy; and facioscapulohumeral dystrophy, as well as rare skeletal muscle, and cardiac and metabolic muscle diseases using its FORCE platform that delivers disease-modifying therapeutics.

Featured Articles

Before you consider Dyne Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dyne Therapeutics wasn't on the list.

While Dyne Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.