Eagle Asset Management Inc. raised its position in shares of HubSpot, Inc. (NYSE:HUBS - Free Report) by 10.2% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 161,840 shares of the software maker's stock after acquiring an additional 14,984 shares during the quarter. Eagle Asset Management Inc. owned approximately 0.31% of HubSpot worth $86,034,000 as of its most recent SEC filing.

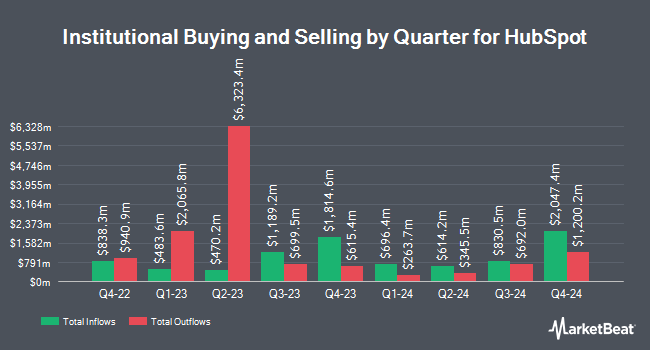

Other hedge funds and other institutional investors have also made changes to their positions in the company. International Assets Investment Management LLC purchased a new position in HubSpot in the 2nd quarter valued at $35,000. HM Payson & Co. lifted its stake in shares of HubSpot by 36.0% in the third quarter. HM Payson & Co. now owns 68 shares of the software maker's stock worth $36,000 after buying an additional 18 shares in the last quarter. Crewe Advisors LLC boosted its position in HubSpot by 525.0% during the second quarter. Crewe Advisors LLC now owns 75 shares of the software maker's stock worth $44,000 after acquiring an additional 63 shares during the last quarter. J.Safra Asset Management Corp grew its stake in HubSpot by 690.9% during the 2nd quarter. J.Safra Asset Management Corp now owns 87 shares of the software maker's stock valued at $51,000 after acquiring an additional 76 shares in the last quarter. Finally, Whittier Trust Co. of Nevada Inc. raised its holdings in HubSpot by 41.6% in the 2nd quarter. Whittier Trust Co. of Nevada Inc. now owns 109 shares of the software maker's stock valued at $64,000 after acquiring an additional 32 shares during the last quarter. Hedge funds and other institutional investors own 90.39% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have recently issued reports on HUBS shares. KeyCorp upgraded HubSpot from an "underweight" rating to a "sector weight" rating and set a $460.00 price target for the company in a research report on Thursday, August 8th. Barclays upped their target price on HubSpot from $500.00 to $650.00 and gave the company an "equal weight" rating in a report on Friday, November 8th. Wells Fargo & Company lifted their price target on HubSpot from $625.00 to $750.00 and gave the stock an "overweight" rating in a report on Thursday, November 7th. Stifel Nicolaus upped their price objective on shares of HubSpot from $600.00 to $625.00 and gave the company a "buy" rating in a report on Tuesday, October 8th. Finally, Needham & Company LLC restated a "buy" rating and set a $730.00 price objective on shares of HubSpot in a research report on Thursday, November 7th. Five investment analysts have rated the stock with a hold rating and eighteen have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $672.68.

Read Our Latest Report on HubSpot

Insider Activity at HubSpot

In related news, CFO Kathryn Bueker sold 4,381 shares of HubSpot stock in a transaction that occurred on Tuesday, November 12th. The shares were sold at an average price of $700.00, for a total value of $3,066,700.00. Following the completion of the transaction, the chief financial officer now owns 41,259 shares in the company, valued at $28,881,300. The trade was a 9.60 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CTO Dharmesh Shah sold 25,000 shares of the stock in a transaction that occurred on Tuesday, November 19th. The shares were sold at an average price of $672.62, for a total transaction of $16,815,500.00. Following the completion of the sale, the chief technology officer now directly owns 1,323,145 shares in the company, valued at approximately $889,973,789.90. This represents a 1.85 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 44,391 shares of company stock worth $29,101,488. Company insiders own 4.50% of the company's stock.

HubSpot Stock Up 2.4 %

NYSE:HUBS traded up $17.40 on Friday, reaching $737.40. 222,639 shares of the company's stock were exchanged, compared to its average volume of 591,820. The business has a fifty day moving average of $570.51 and a 200-day moving average of $551.07. HubSpot, Inc. has a 52-week low of $434.84 and a 52-week high of $737.91. The firm has a market capitalization of $38.07 billion, a price-to-earnings ratio of -2,660.15, a price-to-earnings-growth ratio of 82.97 and a beta of 1.63.

HubSpot (NYSE:HUBS - Get Free Report) last released its earnings results on Wednesday, November 6th. The software maker reported $2.18 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.91 by $0.27. The company had revenue of $669.72 million for the quarter, compared to analyst estimates of $646.97 million. HubSpot had a negative net margin of 0.56% and a negative return on equity of 1.16%. The firm's quarterly revenue was up 20.1% on a year-over-year basis. During the same period in the prior year, the business earned ($0.04) EPS. As a group, equities analysts anticipate that HubSpot, Inc. will post 0.4 earnings per share for the current year.

About HubSpot

(

Free Report)

HubSpot, Inc, together with its subsidiaries, provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific. The company's CRM platform includes Marketing Hub, a toolset for marketing automation and email, social media, SEO, and reporting and analytics; Sales Hub offers email templates and tracking, conversations and live chat, meeting and call scheduling, lead and website visit alerts, lead scoring, sales automation, pipeline management, quoting, forecasting, and reporting; Service Hub, a service software designed to help businesses manage, respond, and connect with customers; and Content Management Systems Hub enables businesses to create new and edit existing web content.

Featured Articles

Before you consider HubSpot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HubSpot wasn't on the list.

While HubSpot currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.