Eagle Asset Management Inc. increased its holdings in Perella Weinberg Partners (NASDAQ:PWP - Free Report) by 32.1% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 756,540 shares of the company's stock after purchasing an additional 183,905 shares during the quarter. Eagle Asset Management Inc. owned 0.88% of Perella Weinberg Partners worth $14,609,000 at the end of the most recent reporting period.

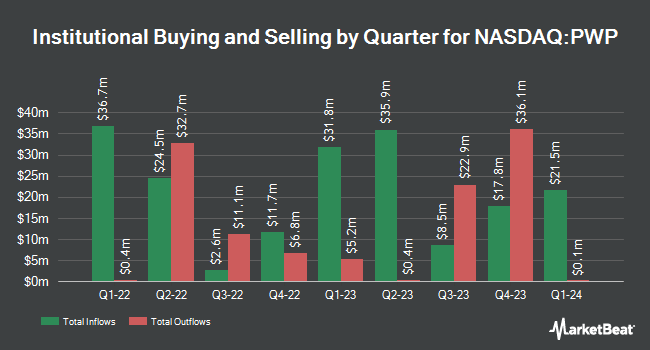

Several other institutional investors also recently bought and sold shares of PWP. Arizona State Retirement System grew its stake in Perella Weinberg Partners by 15.3% in the 2nd quarter. Arizona State Retirement System now owns 13,020 shares of the company's stock valued at $212,000 after acquiring an additional 1,724 shares during the period. Price T Rowe Associates Inc. MD raised its position in shares of Perella Weinberg Partners by 16.6% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 12,306 shares of the company's stock worth $174,000 after purchasing an additional 1,753 shares during the last quarter. Oppenheimer Asset Management Inc. lifted its stake in Perella Weinberg Partners by 17.9% in the 2nd quarter. Oppenheimer Asset Management Inc. now owns 16,709 shares of the company's stock valued at $272,000 after buying an additional 2,537 shares in the last quarter. California State Teachers Retirement System increased its stake in Perella Weinberg Partners by 6.0% during the 1st quarter. California State Teachers Retirement System now owns 45,448 shares of the company's stock worth $642,000 after buying an additional 2,560 shares in the last quarter. Finally, The Manufacturers Life Insurance Company raised its holdings in shares of Perella Weinberg Partners by 30.4% during the second quarter. The Manufacturers Life Insurance Company now owns 20,167 shares of the company's stock valued at $328,000 after acquiring an additional 4,697 shares during the last quarter. 41.07% of the stock is owned by institutional investors and hedge funds.

Perella Weinberg Partners Trading Down 0.5 %

PWP stock traded down $0.13 during mid-day trading on Friday, reaching $25.64. The company's stock had a trading volume of 481,546 shares, compared to its average volume of 614,571. The company's 50 day moving average is $21.56 and its two-hundred day moving average is $18.51. Perella Weinberg Partners has a fifty-two week low of $10.73 and a fifty-two week high of $26.62. The stock has a market cap of $2.26 billion, a PE ratio of -10.82 and a beta of 1.49.

Perella Weinberg Partners (NASDAQ:PWP - Get Free Report) last announced its quarterly earnings data on Friday, November 8th. The company reported $0.34 EPS for the quarter, topping analysts' consensus estimates of $0.20 by $0.14. Perella Weinberg Partners had a negative return on equity of 295.65% and a negative net margin of 11.09%. The firm had revenue of $278.20 million for the quarter, compared to the consensus estimate of $196.42 million. During the same quarter last year, the business posted $0.12 earnings per share. The firm's revenue was up 100.1% compared to the same quarter last year.

Perella Weinberg Partners Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Shareholders of record on Wednesday, December 4th will be given a $0.07 dividend. The ex-dividend date of this dividend is Wednesday, December 4th. This represents a $0.28 dividend on an annualized basis and a yield of 1.09%. Perella Weinberg Partners's dividend payout ratio is currently -11.81%.

Analyst Upgrades and Downgrades

Separately, JMP Securities increased their price objective on Perella Weinberg Partners from $22.00 to $26.00 and gave the company a "market outperform" rating in a research note on Wednesday, October 9th.

Read Our Latest Stock Analysis on Perella Weinberg Partners

Insider Activity

In other news, President Dietrich Becker sold 442,889 shares of Perella Weinberg Partners stock in a transaction on Tuesday, November 12th. The stock was sold at an average price of $24.48, for a total value of $10,841,922.72. Following the completion of the sale, the president now directly owns 379,140 shares of the company's stock, valued at approximately $9,281,347.20. The trade was a 53.88 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, CEO Andrew Bednar sold 300,579 shares of the stock in a transaction dated Tuesday, November 12th. The stock was sold at an average price of $24.48, for a total value of $7,358,173.92. Following the transaction, the chief executive officer now directly owns 566,386 shares in the company, valued at approximately $13,865,129.28. The trade was a 34.67 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 43.53% of the company's stock.

Perella Weinberg Partners Profile

(

Free Report)

Perella Weinberg Partners, an independent investment banking company, provides strategic and financial advice services in the United States and internationally. The company offers advisory services related to strategic and financial decisions, mergers and acquisition execution, shareholder and defense advisory, and financing and capital solutions advice with resources focused on restructuring, liability management, and capital markets advisory, as well as underwriting and research services primarily for the energy and related industries.

See Also

Before you consider Perella Weinberg Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Perella Weinberg Partners wasn't on the list.

While Perella Weinberg Partners currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.