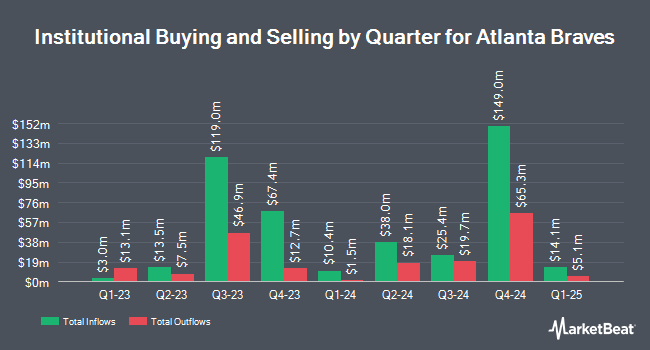

Eagle Asset Management Inc. lowered its stake in shares of Atlanta Braves Holdings, Inc. (NASDAQ:BATRK - Free Report) by 19.7% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 52,179 shares of the financial services provider's stock after selling 12,841 shares during the quarter. Eagle Asset Management Inc. owned about 0.10% of Atlanta Braves worth $2,121,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Vanguard Group Inc. grew its holdings in Atlanta Braves by 2.3% in the 1st quarter. Vanguard Group Inc. now owns 2,342,671 shares of the financial services provider's stock valued at $91,505,000 after buying an additional 53,272 shares during the last quarter. Price T Rowe Associates Inc. MD grew its stake in shares of Atlanta Braves by 14.5% in the first quarter. Price T Rowe Associates Inc. MD now owns 12,995 shares of the financial services provider's stock worth $508,000 after acquiring an additional 1,650 shares during the last quarter. Janus Henderson Group PLC increased its position in Atlanta Braves by 3.3% during the first quarter. Janus Henderson Group PLC now owns 661,845 shares of the financial services provider's stock worth $25,851,000 after acquiring an additional 21,053 shares during the period. California State Teachers Retirement System raised its stake in Atlanta Braves by 4.4% during the 1st quarter. California State Teachers Retirement System now owns 47,635 shares of the financial services provider's stock valued at $1,861,000 after purchasing an additional 2,004 shares during the last quarter. Finally, Delphi Management Inc. MA boosted its holdings in Atlanta Braves by 12.2% in the 1st quarter. Delphi Management Inc. MA now owns 46,843 shares of the financial services provider's stock valued at $1,830,000 after purchasing an additional 5,089 shares during the period. Institutional investors and hedge funds own 64.88% of the company's stock.

Analysts Set New Price Targets

Separately, Rosenblatt Securities lowered their price target on shares of Atlanta Braves from $54.00 to $53.00 and set a "buy" rating on the stock in a report on Wednesday, August 14th.

Get Our Latest Stock Analysis on Atlanta Braves

Atlanta Braves Stock Performance

Atlanta Braves stock traded down $0.17 during mid-day trading on Tuesday, reaching $40.08. The company's stock had a trading volume of 240,979 shares, compared to its average volume of 234,361. Atlanta Braves Holdings, Inc. has a 12 month low of $35.42 and a 12 month high of $44.42. The business's 50 day simple moving average is $40.23 and its 200 day simple moving average is $40.67. The company has a market capitalization of $2.04 billion, a price-to-earnings ratio of -54.90 and a beta of 0.70.

Atlanta Braves Profile

(

Free Report)

Atlanta Braves Holdings, Inc owns and operates the Atlanta Braves Major league baseball club. It also operates mixed-use development project, including retail, office, hotel, and entertainment projects. The company was incorporated in 2022 and is based in Englewood, Colorado.

Read More

Before you consider Atlanta Braves, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlanta Braves wasn't on the list.

While Atlanta Braves currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.