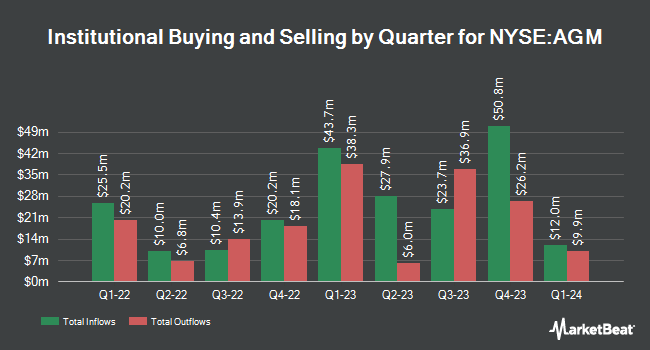

Eagle Asset Management Inc. reduced its position in Federal Agricultural Mortgage Co. (NYSE:AGM - Free Report) by 16.5% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 63,599 shares of the credit services provider's stock after selling 12,541 shares during the quarter. Eagle Asset Management Inc. owned approximately 0.58% of Federal Agricultural Mortgage worth $13,211,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Atria Investments Inc lifted its holdings in Federal Agricultural Mortgage by 0.7% in the 3rd quarter. Atria Investments Inc now owns 8,735 shares of the credit services provider's stock worth $1,637,000 after purchasing an additional 57 shares in the last quarter. Victory Capital Management Inc. lifted its holdings in shares of Federal Agricultural Mortgage by 1.8% in the third quarter. Victory Capital Management Inc. now owns 3,864 shares of the credit services provider's stock worth $724,000 after buying an additional 70 shares in the last quarter. US Bancorp DE boosted its position in shares of Federal Agricultural Mortgage by 7.3% during the third quarter. US Bancorp DE now owns 1,106 shares of the credit services provider's stock worth $207,000 after acquiring an additional 75 shares during the last quarter. Moors & Cabot Inc. grew its stake in Federal Agricultural Mortgage by 7.8% during the third quarter. Moors & Cabot Inc. now owns 1,266 shares of the credit services provider's stock valued at $237,000 after acquiring an additional 92 shares in the last quarter. Finally, nVerses Capital LLC increased its holdings in Federal Agricultural Mortgage by 50.0% in the 3rd quarter. nVerses Capital LLC now owns 300 shares of the credit services provider's stock valued at $56,000 after acquiring an additional 100 shares during the last quarter. 68.03% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In other Federal Agricultural Mortgage news, Director Mitchell A. Johnson sold 1,000 shares of the company's stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $208.00, for a total value of $208,000.00. Following the transaction, the director now owns 14,060 shares of the company's stock, valued at $2,924,480. This represents a 6.64 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, Director Sara Louise Faivre-Davis sold 685 shares of Federal Agricultural Mortgage stock in a transaction on Wednesday, September 4th. The stock was sold at an average price of $188.93, for a total value of $129,417.05. Following the sale, the director now owns 4,595 shares of the company's stock, valued at approximately $868,133.35. This trade represents a 12.97 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 7,467 shares of company stock valued at $1,455,622. 2.58% of the stock is currently owned by company insiders.

Analyst Upgrades and Downgrades

Separately, Keefe, Bruyette & Woods reaffirmed a "market perform" rating and issued a $215.00 target price on shares of Federal Agricultural Mortgage in a report on Tuesday, August 6th.

View Our Latest Analysis on Federal Agricultural Mortgage

Federal Agricultural Mortgage Price Performance

AGM traded up $1.25 during trading hours on Friday, hitting $205.09. The company's stock had a trading volume of 55,476 shares, compared to its average volume of 54,001. The stock has a market cap of $2.23 billion, a price-to-earnings ratio of 13.19, a P/E/G ratio of 1.84 and a beta of 1.04. The business's 50-day moving average price is $191.02 and its 200-day moving average price is $187.51. The company has a current ratio of 0.49, a quick ratio of 0.49 and a debt-to-equity ratio of 1.58. Federal Agricultural Mortgage Co. has a 12 month low of $161.72 and a 12 month high of $217.60.

Federal Agricultural Mortgage (NYSE:AGM - Get Free Report) last announced its quarterly earnings results on Monday, November 4th. The credit services provider reported $4.10 EPS for the quarter, missing analysts' consensus estimates of $4.14 by ($0.04). The business had revenue of $411.40 million during the quarter, compared to the consensus estimate of $92.15 million. Federal Agricultural Mortgage had a net margin of 12.59% and a return on equity of 20.14%. During the same period in the previous year, the business posted $4.13 EPS. Sell-side analysts expect that Federal Agricultural Mortgage Co. will post 15.85 earnings per share for the current fiscal year.

Federal Agricultural Mortgage Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Monday, December 16th will be given a dividend of $1.40 per share. This represents a $5.60 dividend on an annualized basis and a yield of 2.73%. The ex-dividend date is Monday, December 16th. Federal Agricultural Mortgage's dividend payout ratio (DPR) is 36.01%.

About Federal Agricultural Mortgage

(

Free Report)

Federal Agricultural Mortgage Corporation provides a secondary market for various loans made to borrowers in the United States. It operates through four segments: Corporate AgFinance, Farm & Ranch, Rural Utilities, and Renewable Energy. The company's Agricultural Finance line of business engages in purchasing and retaining eligible loans and securities; guaranteeing the payment of principal and interest on securities that represent interests in or obligations secured by pools of eligible loans; servicing eligible loans; and issuing LTSPCs for eligible loans.

Featured Stories

Before you consider Federal Agricultural Mortgage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Federal Agricultural Mortgage wasn't on the list.

While Federal Agricultural Mortgage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.