Eagle Asset Management Inc. trimmed its position in shares of H.B. Fuller (NYSE:FUL - Free Report) by 22.1% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 51,057 shares of the specialty chemicals company's stock after selling 14,525 shares during the period. Eagle Asset Management Inc. owned approximately 0.09% of H.B. Fuller worth $3,972,000 as of its most recent SEC filing.

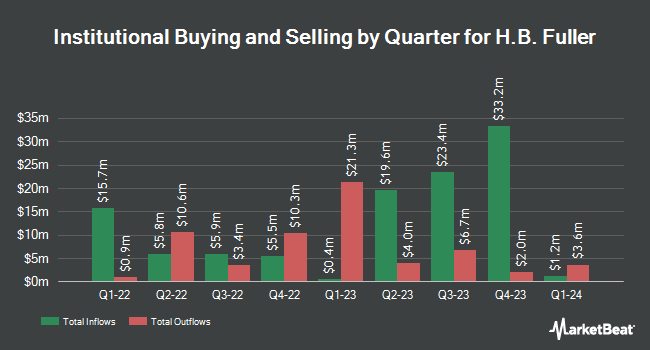

Several other hedge funds and other institutional investors also recently made changes to their positions in FUL. Dorsey & Whitney Trust CO LLC lifted its holdings in shares of H.B. Fuller by 8.1% during the second quarter. Dorsey & Whitney Trust CO LLC now owns 71,354 shares of the specialty chemicals company's stock worth $5,491,000 after buying an additional 5,356 shares during the last quarter. New York State Teachers Retirement System raised its stake in H.B. Fuller by 3.1% during the 2nd quarter. New York State Teachers Retirement System now owns 88,348 shares of the specialty chemicals company's stock valued at $6,799,000 after purchasing an additional 2,694 shares during the last quarter. S&CO Inc. boosted its holdings in H.B. Fuller by 0.3% in the 3rd quarter. S&CO Inc. now owns 267,192 shares of the specialty chemicals company's stock valued at $21,209,000 after purchasing an additional 920 shares during the period. Marshall Wace LLP grew its position in H.B. Fuller by 9.9% in the 2nd quarter. Marshall Wace LLP now owns 290,005 shares of the specialty chemicals company's stock worth $22,319,000 after purchasing an additional 26,239 shares during the last quarter. Finally, Bank of New York Mellon Corp increased its holdings in shares of H.B. Fuller by 1.4% during the 2nd quarter. Bank of New York Mellon Corp now owns 525,731 shares of the specialty chemicals company's stock worth $40,460,000 after purchasing an additional 7,292 shares during the period. 95.93% of the stock is owned by institutional investors and hedge funds.

H.B. Fuller Stock Performance

FUL stock traded up $1.83 during midday trading on Monday, hitting $77.99. The stock had a trading volume of 449,153 shares, compared to its average volume of 302,343. The firm has a market capitalization of $4.26 billion, a price-to-earnings ratio of 23.51, a P/E/G ratio of 1.44 and a beta of 1.42. The company has a current ratio of 1.89, a quick ratio of 1.16 and a debt-to-equity ratio of 1.10. The stock has a 50-day simple moving average of $77.61 and a 200 day simple moving average of $79.28. H.B. Fuller has a 52 week low of $72.60 and a 52 week high of $87.67.

H.B. Fuller (NYSE:FUL - Get Free Report) last issued its earnings results on Wednesday, September 25th. The specialty chemicals company reported $1.13 earnings per share for the quarter, missing the consensus estimate of $1.23 by ($0.10). H.B. Fuller had a net margin of 5.15% and a return on equity of 13.39%. The business had revenue of $917.93 million for the quarter, compared to analyst estimates of $944.04 million. During the same quarter last year, the firm posted $1.06 earnings per share. H.B. Fuller's revenue was up 1.9% on a year-over-year basis. As a group, equities research analysts anticipate that H.B. Fuller will post 4.17 earnings per share for the current year.

H.B. Fuller Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Investors of record on Thursday, October 17th were paid a $0.2225 dividend. This represents a $0.89 annualized dividend and a yield of 1.14%. The ex-dividend date was Thursday, October 17th. H.B. Fuller's dividend payout ratio is 27.47%.

Wall Street Analysts Forecast Growth

Separately, StockNews.com cut shares of H.B. Fuller from a "buy" rating to a "hold" rating in a research note on Wednesday, September 18th.

Get Our Latest Research Report on H.B. Fuller

H.B. Fuller Profile

(

Free Report)

H.B. Fuller Company, together with its subsidiaries, formulates, manufactures, and markets adhesives, sealants, coatings, polymers, tapes, encapsulants, additives, and other specialty chemical products. It operates through three segments: Hygiene, Health and Consumable Adhesives; Engineering Adhesives; and Construction Adhesives.

Read More

Before you consider H.B. Fuller, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H.B. Fuller wasn't on the list.

While H.B. Fuller currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.