Eagle Asset Management Inc. lowered its stake in shares of Zurn Elkay Water Solutions Co. (NYSE:ZWS - Free Report) by 33.3% during the 3rd quarter, according to its most recent filing with the SEC. The firm owned 686,286 shares of the company's stock after selling 343,033 shares during the period. Eagle Asset Management Inc. owned approximately 0.40% of Zurn Elkay Water Solutions worth $26,882,000 as of its most recent SEC filing.

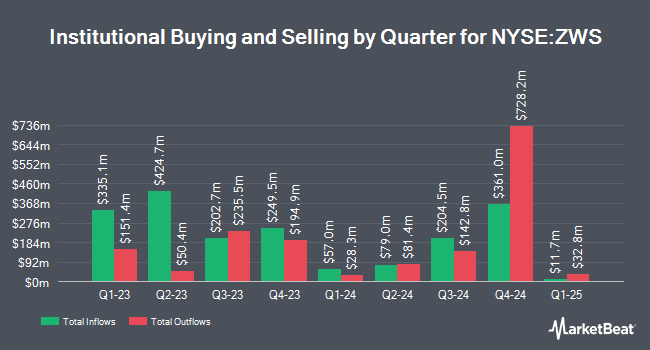

A number of other large investors have also recently made changes to their positions in the stock. Sei Investments Co. increased its position in Zurn Elkay Water Solutions by 11.1% during the second quarter. Sei Investments Co. now owns 211,183 shares of the company's stock valued at $6,209,000 after acquiring an additional 21,081 shares during the last quarter. Global Alpha Capital Management Ltd. increased its position in shares of Zurn Elkay Water Solutions by 23.1% during the 3rd quarter. Global Alpha Capital Management Ltd. now owns 92,448 shares of the company's stock valued at $3,323,000 after purchasing an additional 17,350 shares during the last quarter. Hsbc Holdings PLC lifted its stake in shares of Zurn Elkay Water Solutions by 209.9% in the 2nd quarter. Hsbc Holdings PLC now owns 82,640 shares of the company's stock worth $2,411,000 after purchasing an additional 55,970 shares during the period. Impax Asset Management Group plc boosted its holdings in shares of Zurn Elkay Water Solutions by 4.1% in the third quarter. Impax Asset Management Group plc now owns 8,801,275 shares of the company's stock worth $315,645,000 after buying an additional 346,412 shares during the last quarter. Finally, B. Riley Wealth Advisors Inc. bought a new stake in Zurn Elkay Water Solutions during the second quarter valued at approximately $431,000. 83.33% of the stock is currently owned by institutional investors.

Insider Activity

In other Zurn Elkay Water Solutions news, VP Jeffrey J. Lavalle sold 3,132 shares of the company's stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $39.15, for a total value of $122,617.80. Following the transaction, the vice president now owns 35,422 shares of the company's stock, valued at $1,386,771.30. This represents a 8.12 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CEO Todd A. Adams sold 120,000 shares of the business's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $39.83, for a total transaction of $4,779,600.00. Following the sale, the chief executive officer now directly owns 2,242,867 shares of the company's stock, valued at $89,333,392.61. This represents a 5.08 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 225,688 shares of company stock worth $8,400,151. 3.80% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

ZWS has been the topic of several analyst reports. Robert W. Baird lifted their price target on shares of Zurn Elkay Water Solutions from $37.00 to $39.00 and gave the stock a "neutral" rating in a research note on Thursday, October 31st. Mizuho lifted their target price on Zurn Elkay Water Solutions from $34.00 to $37.00 and gave the company a "neutral" rating in a research report on Thursday, October 31st. Deutsche Bank Aktiengesellschaft upped their price target on Zurn Elkay Water Solutions from $35.00 to $37.00 and gave the stock a "buy" rating in a research report on Thursday, August 1st. Stifel Nicolaus lifted their price objective on Zurn Elkay Water Solutions from $34.00 to $36.00 and gave the company a "hold" rating in a research report on Wednesday, October 16th. Finally, Oppenheimer increased their target price on shares of Zurn Elkay Water Solutions from $37.00 to $40.00 and gave the stock an "outperform" rating in a report on Tuesday, October 22nd. Four investment analysts have rated the stock with a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $38.17.

Get Our Latest Analysis on Zurn Elkay Water Solutions

Zurn Elkay Water Solutions Price Performance

NYSE ZWS traded up $0.58 during trading hours on Friday, reaching $39.93. The company's stock had a trading volume of 837,292 shares, compared to its average volume of 1,038,172. Zurn Elkay Water Solutions Co. has a 1 year low of $27.55 and a 1 year high of $40.64. The company has a quick ratio of 1.71, a current ratio of 2.70 and a debt-to-equity ratio of 0.31. The company has a market capitalization of $6.78 billion, a price-to-earnings ratio of 50.54, a PEG ratio of 1.99 and a beta of 1.14. The firm's 50-day moving average price is $36.85 and its 200-day moving average price is $33.08.

Zurn Elkay Water Solutions (NYSE:ZWS - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The company reported $0.34 earnings per share for the quarter, beating analysts' consensus estimates of $0.32 by $0.02. The firm had revenue of $410.00 million during the quarter, compared to analyst estimates of $406.15 million. Zurn Elkay Water Solutions had a return on equity of 13.30% and a net margin of 8.87%. The business's quarterly revenue was up 2.9% compared to the same quarter last year. During the same quarter last year, the business posted $0.29 earnings per share. On average, equities research analysts predict that Zurn Elkay Water Solutions Co. will post 1.24 EPS for the current fiscal year.

Zurn Elkay Water Solutions Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, December 6th. Stockholders of record on Wednesday, November 20th will be issued a dividend of $0.09 per share. This represents a $0.36 annualized dividend and a dividend yield of 0.90%. This is a boost from Zurn Elkay Water Solutions's previous quarterly dividend of $0.08. The ex-dividend date of this dividend is Wednesday, November 20th. Zurn Elkay Water Solutions's dividend payout ratio is 45.57%.

Zurn Elkay Water Solutions Profile

(

Free Report)

Zurn Elkay Water Solutions Corporation engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally. It offers water safety and control products, such as backflow preventers, fire system valves, pressure reducing valves, thermostatic mixing valves, PEX pipings, fittings, and installation tools under the Zurn and Wilkins brand names.

See Also

Before you consider Zurn Elkay Water Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zurn Elkay Water Solutions wasn't on the list.

While Zurn Elkay Water Solutions currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report