Jefferies Financial Group downgraded shares of Eagle Materials (NYSE:EXP - Free Report) from a buy rating to a hold rating in a report released on Monday, Marketbeat.com reports. They currently have $310.00 target price on the construction company's stock, down from their prior target price of $330.00.

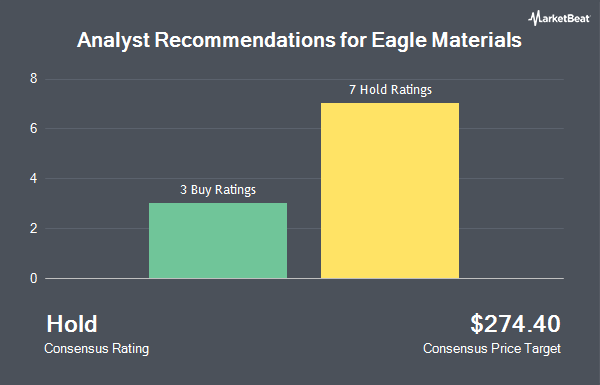

Several other brokerages also recently issued reports on EXP. The Goldman Sachs Group lifted their price objective on Eagle Materials from $277.00 to $317.00 and gave the stock a "buy" rating in a research report on Wednesday, October 30th. Loop Capital cut Eagle Materials from a "buy" rating to a "hold" rating and set a $315.00 price target for the company. in a report on Monday, November 25th. JPMorgan Chase & Co. increased their price objective on Eagle Materials from $290.00 to $310.00 and gave the company a "neutral" rating in a research note on Wednesday, November 27th. Finally, Truist Financial boosted their target price on shares of Eagle Materials from $320.00 to $330.00 and gave the company a "buy" rating in a research note on Monday, November 4th. Five equities research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $304.89.

Check Out Our Latest Stock Report on Eagle Materials

Eagle Materials Price Performance

Shares of EXP stock traded down $5.35 during mid-day trading on Monday, reaching $267.97. The stock had a trading volume of 422,844 shares, compared to its average volume of 304,562. The company has a market cap of $8.99 billion, a P/E ratio of 19.30 and a beta of 1.33. The company has a current ratio of 2.34, a quick ratio of 1.14 and a debt-to-equity ratio of 0.74. Eagle Materials has a 12-month low of $195.93 and a 12-month high of $321.93. The business has a 50-day simple moving average of $297.21 and a 200 day simple moving average of $263.42.

Eagle Materials (NYSE:EXP - Get Free Report) last posted its earnings results on Tuesday, October 29th. The construction company reported $4.31 earnings per share for the quarter, missing the consensus estimate of $4.75 by ($0.44). The business had revenue of $623.62 million for the quarter, compared to analysts' expectations of $651.46 million. Eagle Materials had a net margin of 21.32% and a return on equity of 35.79%. The business's revenue was up .2% compared to the same quarter last year. During the same quarter last year, the business posted $4.28 earnings per share. On average, sell-side analysts anticipate that Eagle Materials will post 15.24 earnings per share for the current year.

Eagle Materials Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, January 13th. Shareholders of record on Monday, December 16th will be paid a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a yield of 0.37%. The ex-dividend date is Monday, December 16th. Eagle Materials's payout ratio is 7.06%.

Insider Buying and Selling at Eagle Materials

In other Eagle Materials news, Director George John Damiris sold 1,000 shares of the business's stock in a transaction dated Tuesday, September 17th. The stock was sold at an average price of $277.62, for a total transaction of $277,620.00. Following the completion of the sale, the director now owns 7,943 shares of the company's stock, valued at approximately $2,205,135.66. The trade was a 11.18 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, SVP Tony Thompson sold 1,401 shares of the firm's stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $314.00, for a total value of $439,914.00. Following the completion of the transaction, the senior vice president now owns 13,212 shares in the company, valued at approximately $4,148,568. This trade represents a 9.59 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 17,866 shares of company stock worth $5,482,931 in the last 90 days. 1.60% of the stock is owned by company insiders.

Institutional Trading of Eagle Materials

A number of institutional investors have recently modified their holdings of the company. Wealth Enhancement Advisory Services LLC increased its holdings in Eagle Materials by 481.5% in the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 8,315 shares of the construction company's stock valued at $1,808,000 after purchasing an additional 6,885 shares in the last quarter. Ausbil Investment Management Ltd boosted its position in shares of Eagle Materials by 400.3% in the third quarter. Ausbil Investment Management Ltd now owns 12,978 shares of the construction company's stock worth $3,733,000 after buying an additional 10,384 shares during the period. Baupost Group LLC MA grew its stake in shares of Eagle Materials by 46.2% in the third quarter. Baupost Group LLC MA now owns 500,273 shares of the construction company's stock valued at $143,904,000 after buying an additional 158,171 shares in the last quarter. Entropy Technologies LP purchased a new stake in shares of Eagle Materials during the 3rd quarter valued at about $920,000. Finally, Natixis Advisors LLC raised its holdings in shares of Eagle Materials by 11.8% during the 3rd quarter. Natixis Advisors LLC now owns 27,265 shares of the construction company's stock valued at $7,843,000 after buying an additional 2,871 shares during the period. Hedge funds and other institutional investors own 96.07% of the company's stock.

About Eagle Materials

(

Get Free Report)

Eagle Materials Inc, through its subsidiaries, manufactures and sells heavy construction materials and light building materials in the United States. It operates in four segments: Cement, Concrete and Aggregates, Gypsum Wallboard, and Recycled Paperboard. The company engages in the mining of limestone for the manufacture, production, distribution, and sale of Portland cement, including Portland limestone cement; grinding and sale of slag; and mining of gypsum for the manufacture and sale of gypsum wallboards used to finish the interior walls and ceilings in residential, commercial, and industrial structures, as well as well as containerboard and lightweight packaging grades; manufacture and sale of recycled paperboard to the gypsum wallboard industry and other paperboard converters; the sale of readymix concrete; and mining and sale of aggregates, such as crushed stone, sand, and gravel.

Featured Articles

Before you consider Eagle Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eagle Materials wasn't on the list.

While Eagle Materials currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.