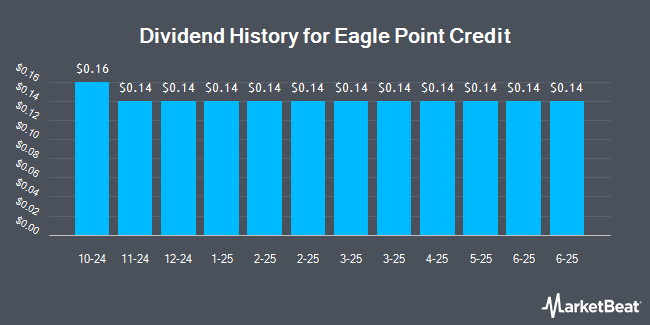

Eagle Point Credit Company Inc. (NYSE:ECC - Get Free Report) declared a monthly dividend on Friday, November 8th,Wall Street Journal reports. Investors of record on Tuesday, March 11th will be paid a dividend of 0.14 per share by the investment management company on Monday, March 31st. This represents a $1.68 dividend on an annualized basis and a yield of 17.32%. The ex-dividend date of this dividend is Tuesday, March 11th.

Eagle Point Credit has increased its dividend payment by an average of 87.7% per year over the last three years. Eagle Point Credit has a payout ratio of 133.3% meaning the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Equities analysts expect Eagle Point Credit to earn $1.29 per share next year, which means the company may not be able to cover its $1.68 annual dividend with an expected future payout ratio of 130.2%.

Eagle Point Credit Price Performance

Shares of Eagle Point Credit stock traded down $0.05 during trading on Friday, reaching $9.70. 1,410,964 shares of the company's stock were exchanged, compared to its average volume of 839,564. Eagle Point Credit has a 1-year low of $9.22 and a 1-year high of $10.49. The company has a debt-to-equity ratio of 0.19, a quick ratio of 2.98 and a current ratio of 2.98. The firm's 50-day moving average price is $9.78 and its 200 day moving average price is $9.96. The company has a market cap of $746.42 million, a P/E ratio of 5.70 and a beta of 0.76.

Eagle Point Credit (NYSE:ECC - Get Free Report) last posted its earnings results on Tuesday, August 6th. The investment management company reported $0.28 earnings per share for the quarter, missing analysts' consensus estimates of $0.36 by ($0.08). Eagle Point Credit had a return on equity of 12.87% and a net margin of 76.61%. The business had revenue of $42.28 million for the quarter, compared to the consensus estimate of $45.67 million. As a group, research analysts anticipate that Eagle Point Credit will post 1.11 earnings per share for the current year.

Analyst Ratings Changes

Separately, Keefe, Bruyette & Woods reduced their price objective on Eagle Point Credit from $10.50 to $10.00 and set a "market perform" rating for the company in a research note on Wednesday, August 7th.

Read Our Latest Stock Report on Eagle Point Credit

Eagle Point Credit Company Profile

(

Get Free Report)

Eagle Point Credit Company Inc is a closed ended fund launched and managed by Eagle Point Credit Management LLC. It invests in fixed income markets of the United States. The fund invests equity and junior debt tranches of collateralized loan obligations consisting primarily of below investment grade U.S.

See Also

Before you consider Eagle Point Credit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eagle Point Credit wasn't on the list.

While Eagle Point Credit currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.