EAM Investors LLC lifted its stake in shares of Turning Point Brands, Inc. (NYSE:TPB - Free Report) by 205.8% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 83,847 shares of the company's stock after acquiring an additional 56,429 shares during the quarter. EAM Investors LLC owned approximately 0.47% of Turning Point Brands worth $5,039,000 at the end of the most recent reporting period.

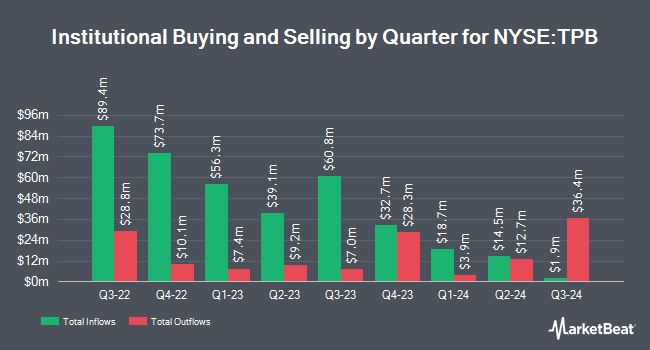

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. USA Financial Formulas purchased a new position in Turning Point Brands during the 4th quarter worth $73,000. Levin Capital Strategies L.P. purchased a new position in shares of Turning Point Brands during the fourth quarter valued at $212,000. Entropy Technologies LP bought a new stake in shares of Turning Point Brands in the fourth quarter valued at about $234,000. AlphaQuest LLC raised its holdings in shares of Turning Point Brands by 56.4% in the fourth quarter. AlphaQuest LLC now owns 4,131 shares of the company's stock valued at $248,000 after acquiring an additional 1,490 shares in the last quarter. Finally, Semanteon Capital Management LP bought a new position in Turning Point Brands during the 4th quarter worth about $271,000. Institutional investors own 96.12% of the company's stock.

Turning Point Brands Stock Performance

NYSE:TPB traded up $0.43 during trading hours on Friday, hitting $57.72. 113,731 shares of the company were exchanged, compared to its average volume of 159,706. The company's 50 day moving average price is $61.56 and its 200-day moving average price is $57.71. The stock has a market capitalization of $1.03 billion, a price-to-earnings ratio of 22.90 and a beta of 0.70. Turning Point Brands, Inc. has a 52-week low of $26.87 and a 52-week high of $72.54. The company has a debt-to-equity ratio of 1.33, a current ratio of 4.21 and a quick ratio of 1.78.

Turning Point Brands Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, April 11th. Investors of record on Friday, March 21st were given a $0.075 dividend. This represents a $0.30 annualized dividend and a dividend yield of 0.52%. This is an increase from Turning Point Brands's previous quarterly dividend of $0.07. The ex-dividend date of this dividend was Friday, March 21st. Turning Point Brands's dividend payout ratio is presently 14.15%.

Wall Street Analysts Forecast Growth

A number of research firms have recently issued reports on TPB. Roth Mkm reiterated a "buy" rating and set a $70.00 price objective on shares of Turning Point Brands in a research note on Friday, January 10th. Alliance Global Partners started coverage on Turning Point Brands in a research note on Monday, March 3rd. They set a "buy" rating and a $80.00 price objective for the company. StockNews.com upgraded shares of Turning Point Brands from a "hold" rating to a "buy" rating in a report on Friday. Finally, Industrial Alliance Securities set a $85.00 price target on shares of Turning Point Brands in a report on Thursday, March 6th. Six analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Buy" and an average target price of $73.33.

Read Our Latest Analysis on Turning Point Brands

About Turning Point Brands

(

Free Report)

Turning Point Brands, Inc, together with its subsidiaries, manufactures, markets, and distributes branded consumer products. The company operates through three segments: Zig-Zag Products, Stoker's Products, and Creative Distribution Solutions. Zig-Zag Products segment markets and distributes rolling papers, tubes, finished cigars, make-your-own cigar wraps, and related products, as well as lighters and other accessories under the Zig-Zag brand.

Featured Articles

Before you consider Turning Point Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Turning Point Brands wasn't on the list.

While Turning Point Brands currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.