EAM Investors LLC decreased its position in American Superconductor Co. (NASDAQ:AMSC - Free Report) by 85.8% in the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 18,967 shares of the technology company's stock after selling 114,218 shares during the period. EAM Investors LLC's holdings in American Superconductor were worth $467,000 as of its most recent SEC filing.

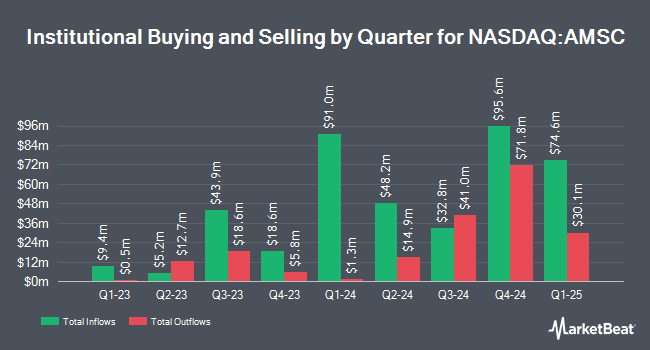

Other hedge funds also recently modified their holdings of the company. Mariner LLC bought a new position in American Superconductor during the fourth quarter worth about $202,000. Barclays PLC lifted its position in shares of American Superconductor by 13.0% during the 4th quarter. Barclays PLC now owns 65,903 shares of the technology company's stock worth $1,623,000 after buying an additional 7,575 shares during the period. Advisory Services Network LLC lifted its position in shares of American Superconductor by 24.9% during the 4th quarter. Advisory Services Network LLC now owns 16,560 shares of the technology company's stock worth $408,000 after buying an additional 3,304 shares during the period. Legal & General Group Plc boosted its stake in American Superconductor by 1.8% in the 4th quarter. Legal & General Group Plc now owns 347,549 shares of the technology company's stock valued at $8,560,000 after buying an additional 6,192 shares in the last quarter. Finally, Wells Fargo & Company MN grew its position in American Superconductor by 68.2% in the fourth quarter. Wells Fargo & Company MN now owns 34,267 shares of the technology company's stock valued at $844,000 after acquiring an additional 13,899 shares during the period. Institutional investors own 52.28% of the company's stock.

American Superconductor Stock Performance

Shares of NASDAQ AMSC traded up $0.47 during mid-day trading on Wednesday, hitting $18.89. 235,564 shares of the stock were exchanged, compared to its average volume of 1,100,244. American Superconductor Co. has a twelve month low of $11.36 and a twelve month high of $38.02. The stock's fifty day simple moving average is $20.50 and its two-hundred day simple moving average is $25.41. The company has a market cap of $745.40 million, a P/E ratio of 269.90 and a beta of 2.58.

American Superconductor (NASDAQ:AMSC - Get Free Report) last released its quarterly earnings results on Wednesday, February 5th. The technology company reported $0.09 EPS for the quarter, topping analysts' consensus estimates of $0.07 by $0.02. American Superconductor had a return on equity of 8.95% and a net margin of 1.64%. As a group, equities research analysts predict that American Superconductor Co. will post 0.41 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Separately, Oppenheimer lifted their price objective on American Superconductor from $33.00 to $39.00 and gave the company an "outperform" rating in a report on Friday, February 7th.

Read Our Latest Stock Analysis on AMSC

About American Superconductor

(

Free Report)

American Superconductor Corporation, together with its subsidiaries, provides megawatt-scale power resiliency solutions worldwide. The company operates through Grid and Wind segments. The Grid segment offers products and services that enable electric utilities, industrial facilities, and renewable energy project developers to connect, transmit, and distribute power under the Gridtec Solutions brand.

See Also

Before you consider American Superconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Superconductor wasn't on the list.

While American Superconductor currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.