Easterly Investment Partners LLC reduced its stake in Pilgrim's Pride Co. (NASDAQ:PPC - Free Report) by 16.7% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 234,813 shares of the company's stock after selling 47,238 shares during the quarter. Easterly Investment Partners LLC owned about 0.10% of Pilgrim's Pride worth $10,813,000 at the end of the most recent reporting period.

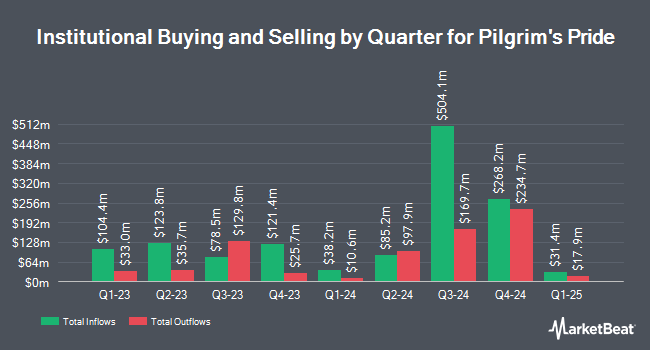

Several other large investors have also recently bought and sold shares of the stock. Norden Group LLC bought a new position in Pilgrim's Pride during the first quarter worth about $308,000. GSA Capital Partners LLP boosted its stake in shares of Pilgrim's Pride by 44.2% in the first quarter. GSA Capital Partners LLP now owns 14,117 shares of the company's stock valued at $484,000 after buying an additional 4,329 shares during the period. Texas Permanent School Fund Corp grew its position in Pilgrim's Pride by 1.3% during the first quarter. Texas Permanent School Fund Corp now owns 35,230 shares of the company's stock worth $1,209,000 after buying an additional 456 shares in the last quarter. Duality Advisers LP bought a new position in Pilgrim's Pride during the 1st quarter worth $303,000. Finally, Quantbot Technologies LP raised its holdings in Pilgrim's Pride by 111.3% in the 1st quarter. Quantbot Technologies LP now owns 27,322 shares of the company's stock valued at $938,000 after acquiring an additional 14,391 shares in the last quarter. 16.64% of the stock is owned by institutional investors.

Pilgrim's Pride Trading Up 2.4 %

Shares of NASDAQ PPC traded up $1.27 during midday trading on Friday, reaching $53.62. The stock had a trading volume of 101,072 shares, compared to its average volume of 903,608. The firm has a market cap of $12.71 billion, a price-to-earnings ratio of 12.64, a price-to-earnings-growth ratio of 0.20 and a beta of 0.81. Pilgrim's Pride Co. has a twelve month low of $25.23 and a twelve month high of $55.50. The company has a debt-to-equity ratio of 0.75, a quick ratio of 1.27 and a current ratio of 1.95. The company's 50 day moving average price is $45.54 and its 200 day moving average price is $41.13.

Pilgrim's Pride (NASDAQ:PPC - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The company reported $1.63 earnings per share for the quarter, beating the consensus estimate of $1.27 by $0.36. The company had revenue of $4.58 billion during the quarter, compared to analyst estimates of $4.69 billion. Pilgrim's Pride had a net margin of 5.46% and a return on equity of 29.92%. Pilgrim's Pride's revenue for the quarter was up 5.2% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.58 EPS. As a group, sell-side analysts expect that Pilgrim's Pride Co. will post 5.21 EPS for the current year.

Wall Street Analysts Forecast Growth

Several analysts recently issued reports on PPC shares. Argus increased their price target on shares of Pilgrim's Pride from $50.00 to $55.00 and gave the stock a "buy" rating in a research report on Wednesday, August 28th. Stephens assumed coverage on Pilgrim's Pride in a research note on Thursday, October 3rd. They issued an "equal weight" rating and a $43.00 price target on the stock. Barclays raised their price objective on Pilgrim's Pride from $45.00 to $49.00 and gave the company an "equal weight" rating in a research note on Friday, November 1st. Bank of America downgraded Pilgrim's Pride from a "buy" rating to a "neutral" rating and set a $47.00 target price for the company. in a research note on Thursday, August 15th. Finally, BMO Capital Markets lifted their price target on shares of Pilgrim's Pride from $42.00 to $43.00 and gave the company a "market perform" rating in a report on Friday, November 1st. Five equities research analysts have rated the stock with a hold rating, one has assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus price target of $45.50.

Get Our Latest Research Report on PPC

Pilgrim's Pride Company Profile

(

Free Report)

Pilgrim's Pride Corporation produces, processes, markets, and distributes fresh, frozen, and value-added chicken and pork products to retailers, distributors, and foodservice operators. The company offers fresh products, including refrigerated whole or cut-up chicken, selected chicken parts that are either marinated or non-marinated, primary pork cuts, added value pork, and pork ribs; and prepared products, which include fully cooked, ready-to-cook and individually frozen chicken parts, strips, nuggets and patties, processed sausages, bacon, smoked meat, gammon joints, pre-packed meats, sandwich and deli counter meats and meat balls.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pilgrim's Pride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pilgrim's Pride wasn't on the list.

While Pilgrim's Pride currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.